Submitted by Taps Coogan on the 23rd of June 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

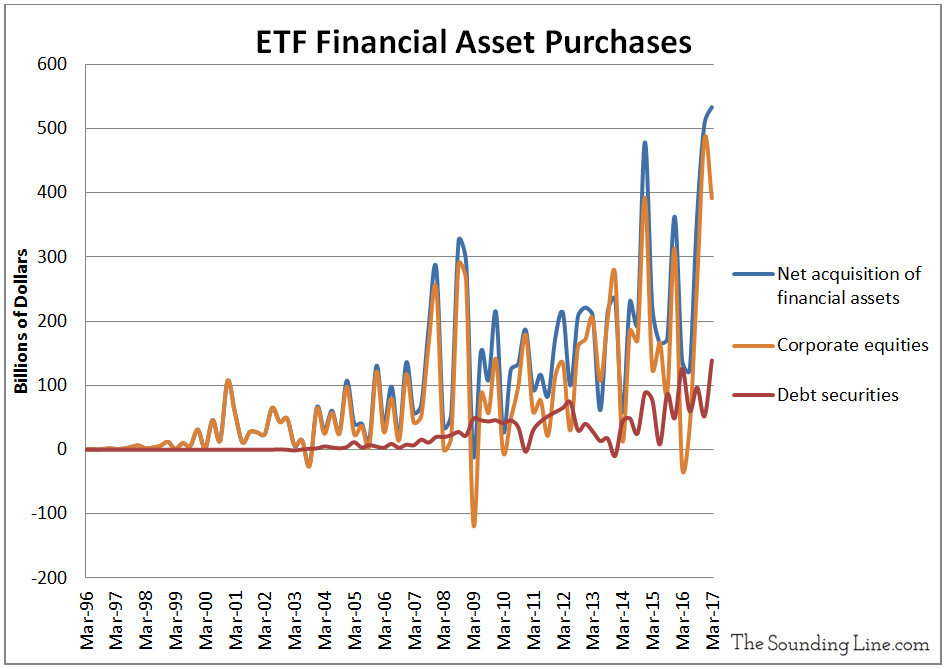

In our recent article, “This is Who Bought Equities in the First Quarter,” we revealed that Electronically Traded Funds (ETFs) were the largest purchasers of US equities in the first quarter of 2017. In fact, as the following chart shows, in the first quarter, ETFs purchased their largest quantity of financial assets ever in the first three months of any year in the US: approximately $533 billion.

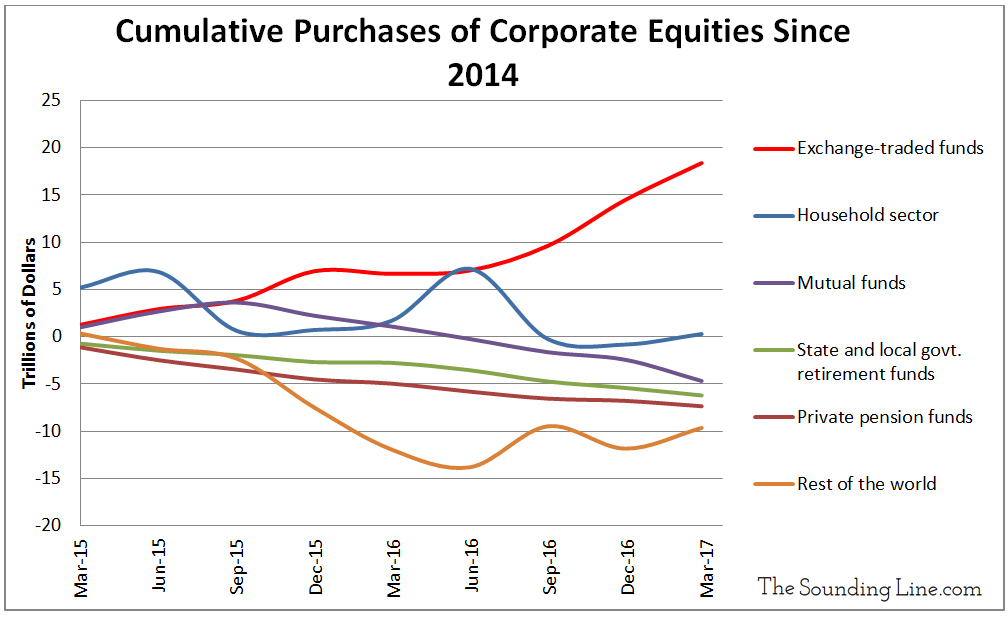

What makes the continued surge in ETF purchases so peculiar is that, according to the Federal Reserves Financial Account of the US, they are the only financial asset buying group to be a significant cumulative net purchaser of corporate equities since 2014. It should be noted that this data set does NOT include corporate stock repurchases, which may also be significant. Mutual funds, pensions, state and local retirement funds, and foreigners have all been net sellers of corporate equities since 2014. Equally concerning: cumulative purchases by US households were flat during the same period.

It is important to remember that these very same groups’ (households, pensions, etc…) exposure to financial assets is not necessarily declining. Instead, their preference appears to be to purchase ETFs as opposed to individual financial assets like stocks or bonds. This raises questions about the broader implications of financial markets dominated by indexed funds like ETFs. Several prominent fund managers and analysts have increasingly voiced concern over the surging popularity of ETFs. These concerns often point to investment and allocation decisions becoming a more abstract process, short on research, and involving opaque instruments whose underlying assets are difficult to analyze and whose liquidity can questionable.

In a series of conversations with Bloomberg, FPA Capital Fund, which manages $789 million dollars, noted:

“When the world decides that there is no need for fundamental research and investors can just blindly purchase index funds and ETFs without any regard to valuation, we say the time to be fearful is now… This new market structure hasn’t been tested,” Bryan said in a telephone interview, noting that the stock market has never gone through a major downturn when passive investors were as important as they are now. “We could get an onslaught of selling.”

In our view, the clearest risk presented by a market dominated by ETFs is linked to what makes ETFs so desirable: indexing. Much like mutual funds, ETFs allow investors convenient exposure to indices, markets, commodities, or really anything, without having to buy individual stocks and bonds. The flip side of this is that when investors choose to sell an ETF, they are not just selling a single stock or bond but often an opaque patchwork of stocks, bonds, and other financial assets. In a serious market downturn, the increasing prevalence of ETFs may lead to increased and unexpected correlations between financial assets. Risks emerging in one sector or with one security may lead to broad based and unexpected selling in another because so many financial assets have now been tied together in unexpected ways by in ETFs. The cascading effects of this could have massive negative impacts for markets whenever the next downturn sets in.

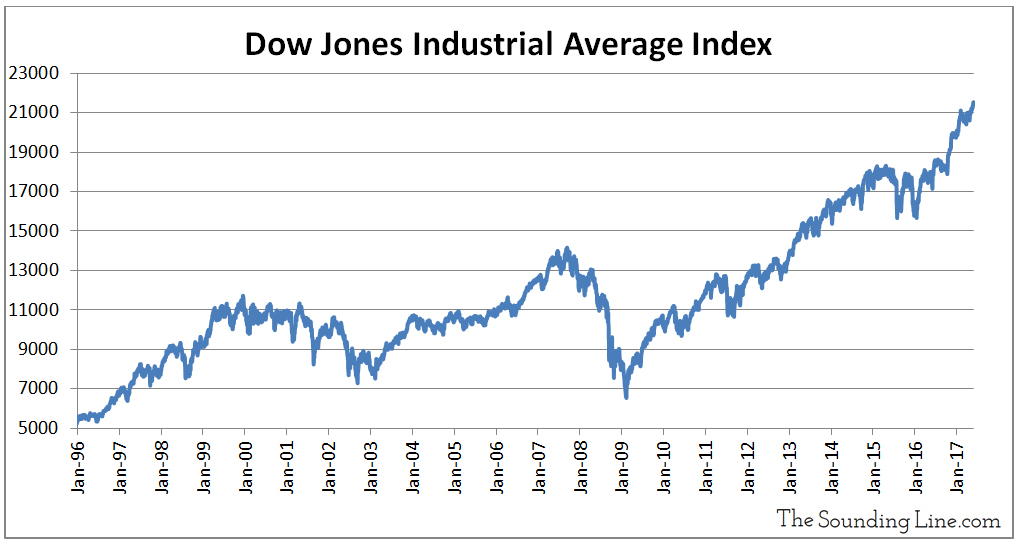

For those who have not looked lately, this is where we are on the advancement of the Dow Jones Industrial Average:

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.