Taps Coogan – July 16th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

Before the June FOMC meeting, we argued that the Fed was poised to make a major policy mistake by signaling an increase in the anticipated pace of rate hikes from 50 basis points per month to 75 basis points per month.

By the time that year-over-year inflation metrics like CPI or PCE signal that inflation is rolling over, actual inflation will have already peaked two or three months prior. That is due to the one-month lag in reporting inflation and the six to 12 month lag in housing inflation that represents one-third of CPI, along with the time it takes for items to move through the supply chain. On top of that, the full effect of monetary policy acts with long lags – generally believed to be at least six months to a year.

With regards to using the labor market’s strength as justification that the economy can withstand more tightening, one of the first articles we ever published here at The Sounding Line was an attempt to show the folly of using the labor market as a forecasting tool. As we noted then:

“Since 1950, without exception, any significant worsening of unemployment… has happened after a recession has been declared, never before… The average time between the maximum low in unemployment and the next declaration of recession is 3.8 months, the maximum is 10 months, less than a year. Three times since 1950 (’57, ’73, ’90) a low in unemployment has been followed by recession and an explosion in unemployment in less than one month.”

The text book recession is one caused by the Fed waiting too long to tighten while the times are good and then tightening too aggressively as inflation overshoots and the economy slows. Every single time, the Fed points to strength in the labor market as justification for its policy mistake.

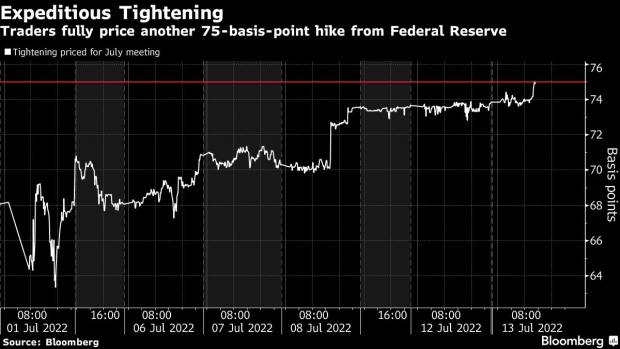

Right now, money markets are pricing in a virtual certainty of a 75 basis point rate hike in July and one-in-three odds of a full 100 basis points.

Meanwhile, there is little doubt that the economy is slowing quickly. The Atlanta Fed’s admittedly inaccurate real GDP forecast is currently negative -1.5%. That comes after -1.4% real GDP contraction in the first quarter. The yield curve has reinverted since the last Fed funds meeting and the S&P 500 is still down roughly 19% year-to-date, both portending a recession. Core PCE inflation has declined for three months running.

Aggressively accelerating the pace of tightening as the economy tips towards recession is no less foolish than the Fed’s decision to keep printing $1.5 trillion and holding rates at zero as real GDP hit 12% last year and inflation tripled the Fed’s target.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Um, actually, they really should be doing a 900 basis point raise. There is a lot of rot that needs to be cleared out.

It’s already started clearing out. If the Fed hiked 900 they’d be doing QE by the next meeting. It’s about preserving the longevity of the tightening cycle

Right on. I laid out here that I think they should do 50bps and wait to see how inflation moves. They want normalization and the best way to do that is keep rates high in the next recession, and the best way to do that is don’t push them so high that cuts become necessary. If they hike 50bps to 2.25% they could sit there at least until CPI falls below 2%.

Couldn’t agree more. I love your site btw

Read your site and I will stipulate that your understanding of economics is way deeper than mine. Enjoyed it.

But stopping a market decline is not a Fed mandate. “Full employment” would perhaps necessitate a rate reduction in your scenario. But we need fundamental reform of our deficit spending habits….the Fed has enabled this ruinous path.