Taps Coogan – June 16th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

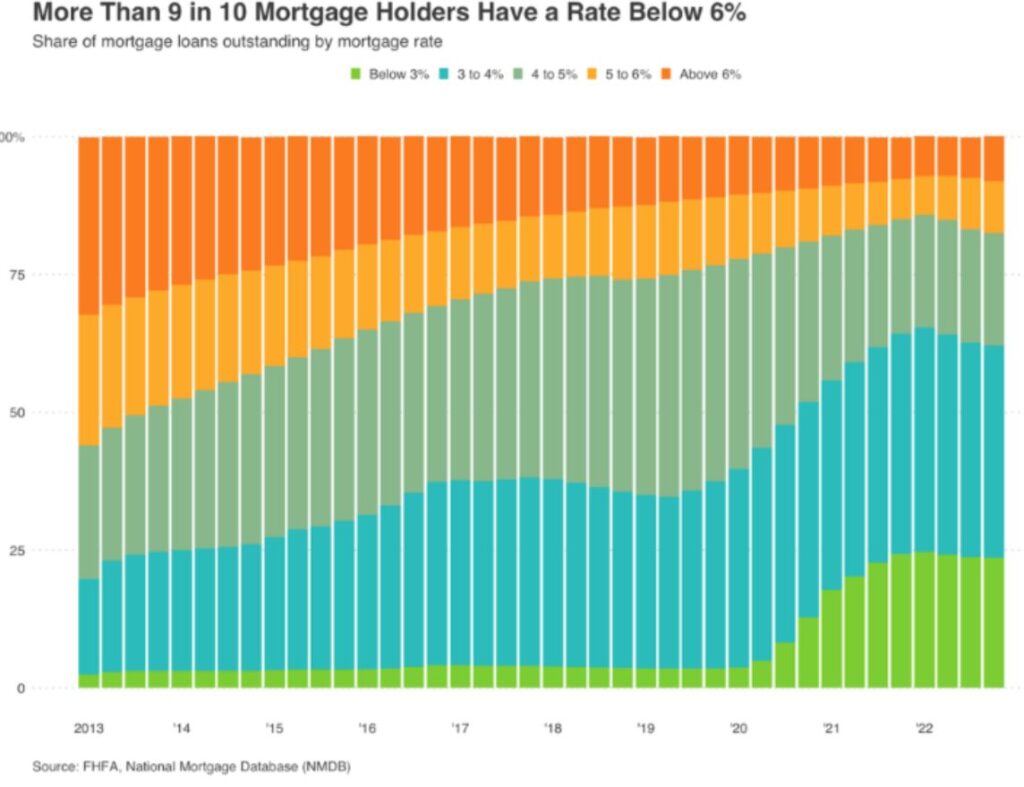

As we’ve noted before, thanks to a decade of low interest rates and huge churn in the real-estate market at ultra-low rates immediately after Covid, the overwhelming majority of existing mortgages remain at fairly low APRs. Via Charlie Bilello:

Despite the average APR on a new mortgage being nearly 7%, so few mortgages have been written at those high rates that they still aren’t a meaningfully part of the market. The implication of this, as we’ve noted before, is that existing home owners are heavily incentivized not to sell their homes and take on a new mortgage. While 7% mortgage APRs are likely to pull down homes prices, the lack of sellers is likely to slow down and drag that processes out.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Out here in Kalifornia we have Janitors selling houses they could afford to buy 35 years ago to brain surgeons that can barley afford to buy