Submitted by Taps Coogan on the 2nd of April 2016 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Under Prime Minister Shinzo Abe, Japan has taken accommodative monetary policy to an extreme unmatched anywhere in the world. As a result of massive public spending, massive asset purchases by the Bank of Japan, and negative interest rates on Japanese sovereign debt, Japan has amassed a public debt that is 229% the size of its GDP. Interest payments on its public debt are estimated to be as high as 43% of tax receipts in 2015 (link here). Even Prime Minster Abe has implicitly acknowledged the unsustainability of Japan’s monetary policy by pledging to balance the budget by 2020. A key element of the plan to balance the budget? Raise the national sales tax rate from 8% to 10% in 2017. In addition to raising revenues, the Japan’s finance ministry is hoping that the tax increase will pull forward consumption, particularly of big ticket items like automobiles, providing a short term economic boost this year.

While that sounds nice in theory, it should not be a surprise to discerning readers that the threat of higher taxes in the near future hasn’t revived the ailing Japanese economy. In fact, the rate of car registration in February has fallen 11.9% month-over-month and 7.7% year-over-year, falling to the lowest levels since July 2011. As one might imagine, stimulating auto sales in a weakening global environment takes simulative, not punitive actions.

Prime Minister’s Abe’s administration has bet the house that unprecedented radical monetary policy like negative interest rates would deliver so much economic growth that Japanese tax payers could somehow support a debt more than twice the size of their annual economic output. Not only has rapid economic growth not materialized, but we now add falling car registration rates to a growing list of indicators of economic deceleration.

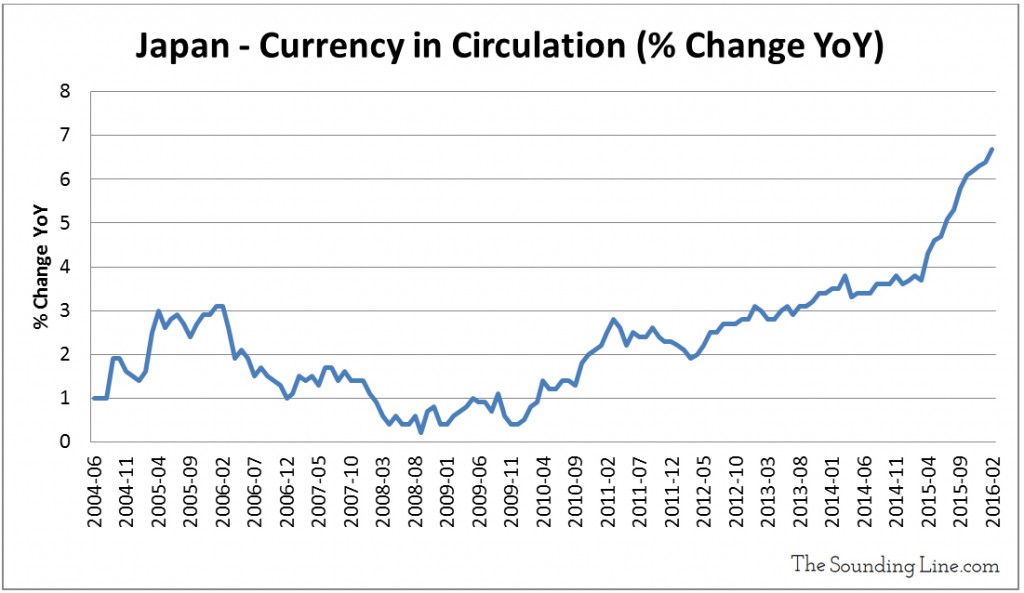

Japan has made international news with its shortages of personal security safes which are being purchased by individuals to stockpile cash. The chart below shows the accelerating growth of currency in circulation in Japan. This a result of people withdrawing their savings from banks and holding cash instead. Japan has now reached the point where all paths lead to the same outcome. Raising interest rates at this point could quite literally bankrupt Japan. Lowering interest rates further would simply serve to accelerate the flow of capital out of Japan’s financial system, undermining any simulative effect that further negative interest rates might theoretically produce.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.