Submitted by Taps Coogan to The Sounding Line on the 2nd of February 2016.

Enjoy The Sounding Line? Click here to subscribe for free.

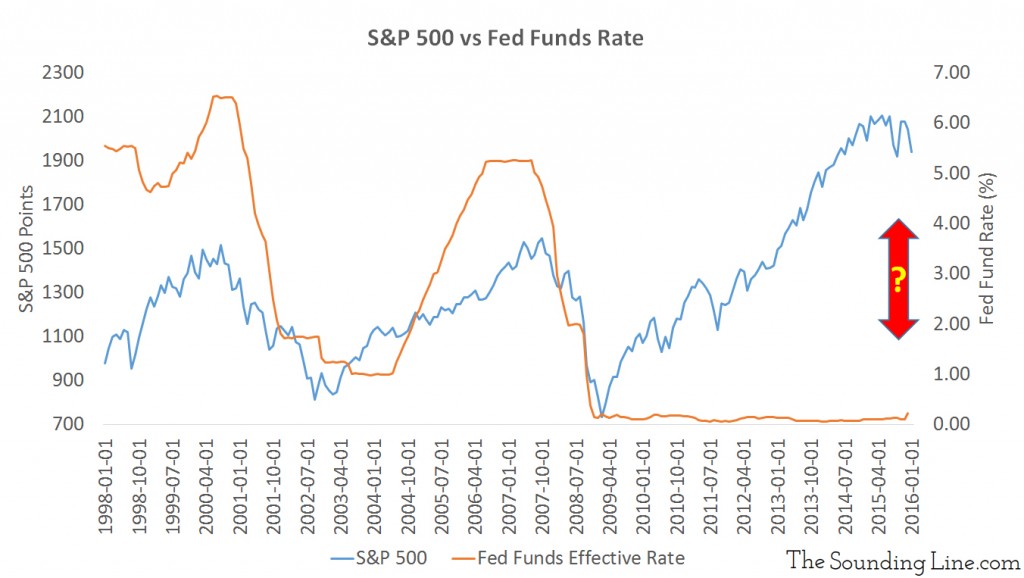

When people talk about the Federal Reserve (Fed) increasing or decreasing interest rates, in actuality, it is the ‘Fed funds rate’ that the Fed is directly targeting. The Fed funds rate is the rate that depository institutions, i.e. banks, pay when they loan reserves between each other. Due to constant fluctuations in loan creation and reserves, banks loan these reserves between each other in order to meet reserve requirements at the end of the day.

Increasing or decreasing the Fed funds rate is a key tool that the Fed uses to effect the economy. Raising rates above their free market value constrains increases the banks’ cost of loan creation and constricts ‘over exuberant’ lending. Lowering the rates below their free market value encourages reduces the banks’ cost of loan creation, making loans possible that would otherwise be uneconomical for banks and thus encourages credit growth. This is all part of an attempt to constrain markets when they get bubbly and support them when they are weak. At least that’s how the theory goes.

As you might expect the Fed funds rate normally follows economy and market growth higher and then follows them lower. That’s why the chart below is so concerning. After all, it would hardly be surprising if we were at the end of the current bull market. It has been the third longest in history (link here). This could be a case of central bank malpractice of epic proportions.

In the market crashes of 2001 and 2008 the Fed lowered rates by about 5%. With rate currently at 0.25% perhaps it’s time to get familiar with the idea of very negative interests rates …?

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

[…] discussed in ‘The Fed – Missing the Curve’ (link here), the decision by the Federal Reserve (Fed) to keep the Fed funds rate between 0% and 0.25% for […]

[…] been the focus of an ongoing series of articles from ‘The Fed- Missing the Curve’ (link here) to ‘Negative Interest Rates – The Excess Reserve Overhang’ (link here). This […]