Submitted by Taps Coogan on the 1st of May 2016 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

A well-read peruse of international news reveals growing concerns for the viability of the Japanese economy. In fact, Japan’s economy has experienced depressed growth for decades. In an attempt to break this multi-decade trend of sub 2% GDP growth, the Bank of Japan (BOJ) has undertaken the largest and most extreme monetary measures instituted by any central bank in the world.

A long period void of any inflation, often termed ‘stagflation’, has been touted as the primary reason for Japan’s persistently slow economic growth. While there may be a correlation between slow growth and very low inflation or deflation, I would strongly contend that Japan’s lack of inflation is simply a symptom of one of the world’s oldest and fastest shrinking populations and poor economic policies, not the cause of it.

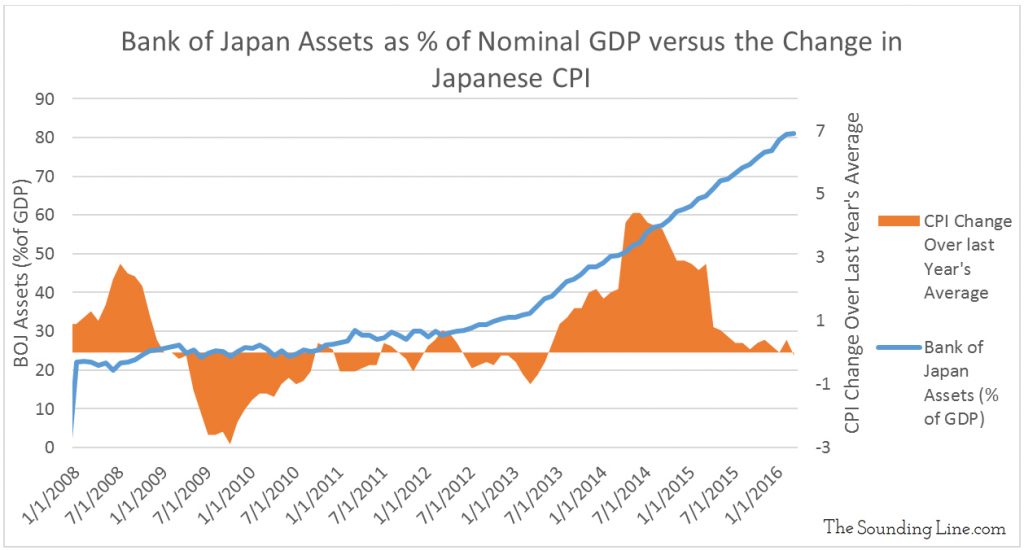

Nonetheless, since Prime Minister Shinzō Abe’s election in 2012, the BOJ has printed money to purchase assets, known as quantitative easing (QE) and lowered interest rates to try to stimulate inflation. Unlike most central banks, which have restricted their quantitative easing (QE) programs to purchasing government bonds, the BOJ has aggressively expanded its quantitative easing purchases to include corporate bonds and even publically traded Japanese stocks. In the process, the BOJ has become a top 10 shareholder in 90% of companies listed in the Nikkei 225 stock index and is on pace to be the top equity holder in 40% of Japan’s Nikkei companies by 2017 (link here). All told, the BOJ has purchased assets worth over 80% of Japan’s entire GDP! Even this hasn’t been sufficient and, at the start of 2016, Japan went one step further and became one of the first to implement negative interest rates.

As the chart below shows, while these policies resulted in some modest inflation when first begun in 2012, inflation (change in Consumer Price Index – CPI) has been declining since 2014 and actually posted a negative 0.1% value in March 2016. Remarkably, it appears that when confronted by the failure of BOJ’s current inflation stimulus programs to create inflation after 2014, their best idea has been to accelerate these very same failed policies.

On the heels of the negative CPI print for March 2016, analysts and economists were certain that the BOJ would expand its QE programs and lower rates further when it recently met in late April 2016.

To most people’s surprise, the BOJ did neither and they went as far as to dismiss the idea of printing money and giving it directly to citizens, Japan’s own version of “helicopter money,” an extreme policy they had been contemplating.

The decision not to expand its easy money policies may finally signify recognition by the BOJ that their strategy has not only failed to produce the desired results but may be acting counter to it. As we discussed here, record amounts of cash are being withdrawn from Japanese banks as people are losing confidence in the increasingly unstable Japanese financial system.

While it is encouraging to think that the BOJ may have finally realized the folly of its policies, it will be nearly impossible to unwind them without causing massive negative effects. One only has to imagine what would happen if the largest buyer of Japanese government bonds, stocks, and corporate debt stopped buying. It certainly would not help the situation.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.