Submitted by Taps Coogan on the 18th of December 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

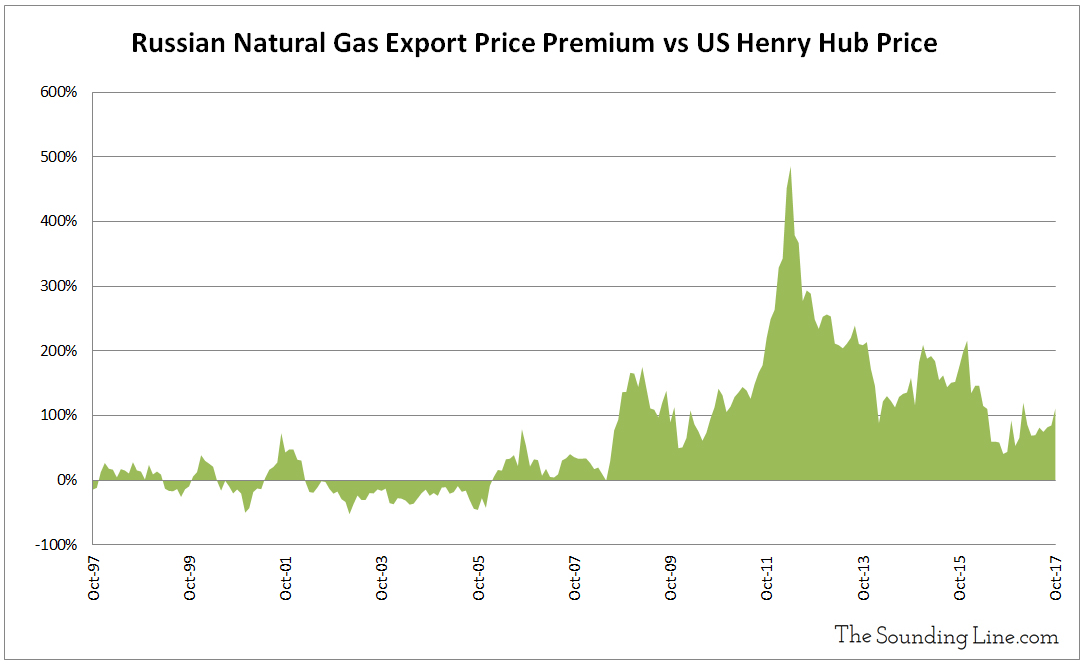

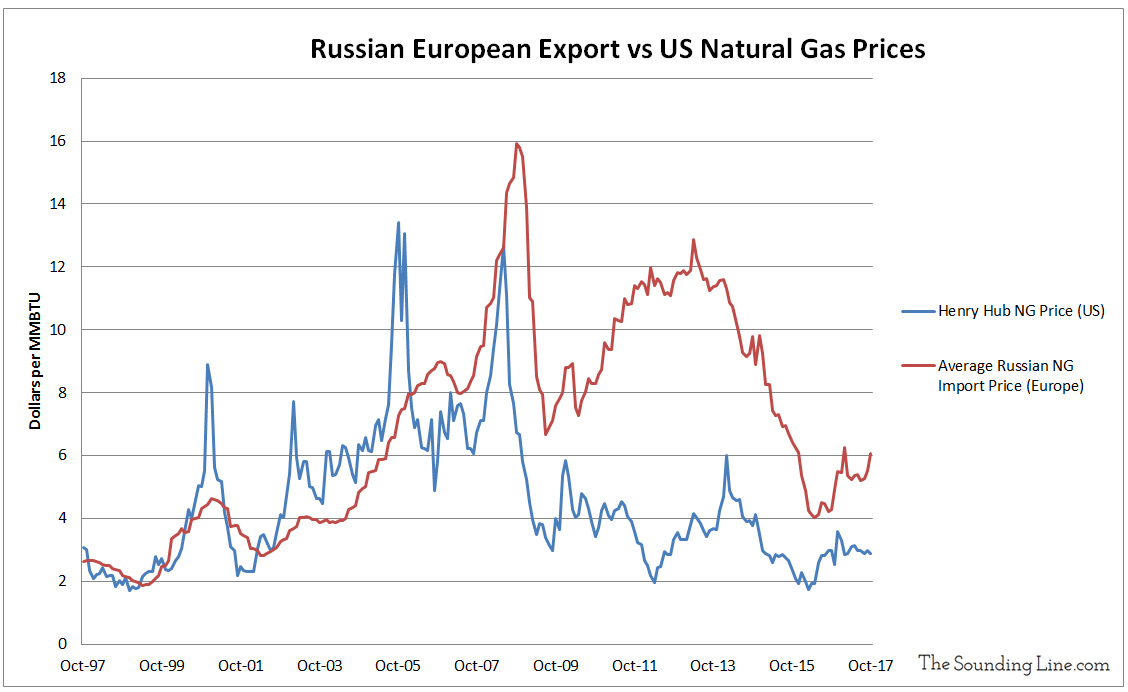

Russia is the world’s largest natural gas exporter with the largest portion of its exports being piped to Europe. However, as the following charts show, Russian natural gas exports to Europe are currently more than twice as expensive as natural gas produced and sold in the United States, the world’s top natural producer (but not exporter). At times, the Russian price premium has been even higher. In the spring of 2012 for example, Russian gas was nearly 500% more expensive than US gas.

Russia’s large price premium results from the fact that Europe has failed for decades to find sufficiently plentiful alternative sources to compete with Russian imports. The resulting Russian semi-monopoly in Europe has been a boon to Russia and a consistent drain on Europe’s economy.

Now that Russian dominance may be changing, at least marginally. Surging US natural gas production has led to the opening of the first Liquid Natural Gas (LNG) export facility in the US in February 2016 with a second terminal expected to come on line imminently in Maryland and at least three more to follow in the coming years. However, the process of liquefying natural gas for export is significantly more expensive than transporting it via pipeline resulting in US LNG export prices being about double that of US domestic pipeline prices. Consequently, US LNG export prices are roughly in line with Russian export prices. While US exports will not completely out-compete Russian exports, they can put a price ceiling on Russian gas. If Russian prices rise much higher than US LNG, European’s will have an incentive to buy US gas instead. That’s good news for Europe and the US and potentially marks the end of Russia’s most exorbitant price premiums.

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

funny.

Balts say, that the LNG from US is double as expensive, as the russian piped gas.

So who is moron now? Author of the article, or the Balts themselves?

Thank you for that example of a useless comment.

Baltic gas prices are trading for about 20 Eur/MWH ($7/MMBtu) which is over twice the current US Henry Hub price.

https://www.getbaltic.com/

If you are going to write about a topic you should know at least the most basic, elementary facts about it. Which you clearly don’t. If you want to compare apples to apples, compare the Henry Hub price to the wellhead price in Siberia. Believe it or not, transportation is a quite large factor in energy costs. Also GetBaltic quote prices for delivery, which includes taxes and the like, whilst the Henry Hub price does not. I suggest you put your money where your mouth is. Invest in an LNG liquefaction plant. I’ll be the first to enter into a… Read more »

Why would I ever compare Henry Hub prices to well head prices in Siberia? Henry Hub prices are not well-head prices they are spot prices for delivery just like GetBaltic. I talk about transportation costs in the article. You literally have no idea what you are talking about you just don’t like the idea that Russian gas might be expensive. I wonder why

“Why would I ever compare Henry Hub prices to well head prices in Siberia?” Because they are much more equivalent. Henry Hub prices are a commodity price at the center of gas production area, not a delivery price. So yeah, bananas are cheaper in Costa Rica than in Fargo, N.D. “Henry Hub prices are not well-head prices they are spot prices for delivery just like GetBaltic.” No, Henry Hub prices are not priced for delivery in Latvia, they are spot prices for delivery at … Henry Hub. You might consider that the US may impose an export tax and Latvia… Read more »