Submitted by Taps Coogan on the 15th of January 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

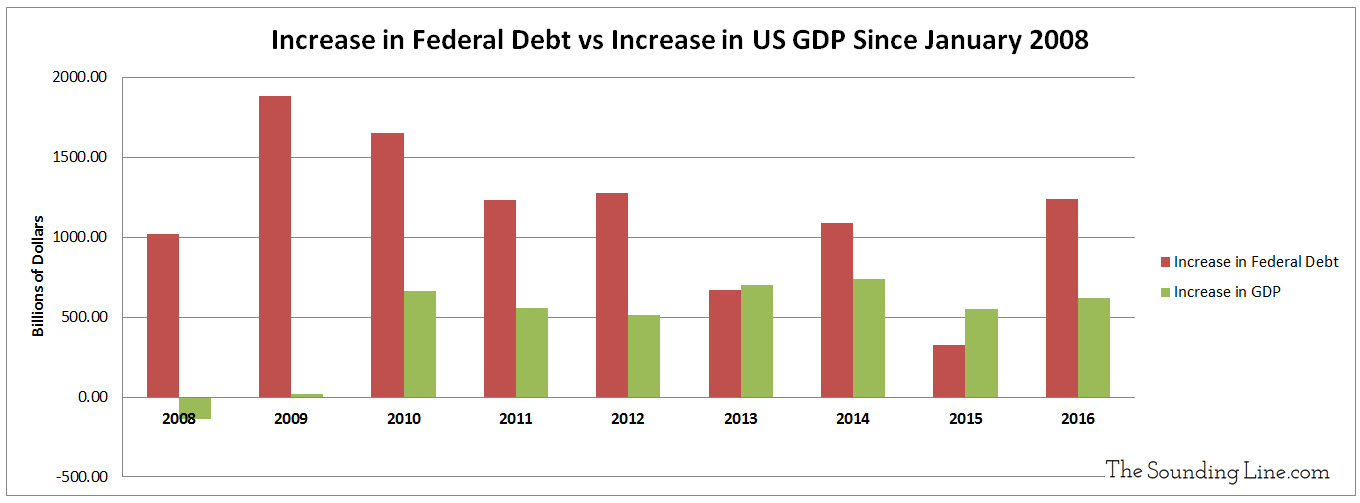

Every year since the 2008 recession, with the exception of 2013 and 2015, the growth in the annual output of the US economy, the US GDP, was less than the growth in the US national debt.

It is important to point out that government spending contributes to the calculation of GDP in two ways. First, government spending on final goods and services (civilian and military equipment, government salaries, infrastructure investments, etc…) counts directly towards GDP. One dollar spent on these goods and service directly adds one dollar to the US GDP calculation. The second way that government spending adds to GDP is via welfare and transfer payments. While these do not directly count towards towards GDP, when the recipients of welfare and transfer payments spend their benefits, that spending counts directly towards GDP. Nearly all government spending is spent on final goods and services or welfare and transfer payments, thus, directly or indirectly, government spending adds to substantially to GDP. When government deficit spending is larger than the increase in GDP year after year, it suggests that nearly all economic growth is attributable to government borrowing.

Based on these figures, one wonders whether the US economy would have grown at all since 2008, if not for huge increases in government borrowing enabled by artificially low interest rates and multi-trillion dollar purchases of US government debt by the Federal Reserve. As interest rates rise and the Fed whittles down its balance sheet of government debt, it will be increasingly costly for the federal government to run perpetual deficits. For now, tax and regulatory reforms and continued liquidity injections from the Fed and other central banks are keeping debts and the economy growing. However, it is all too easy to forget just how much of the current economic expansion is the direct result of the largest increase in government borrowing in history, a trend which cannot continue forever.

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.