Submitted by Taps Coogan on the 8th of February 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

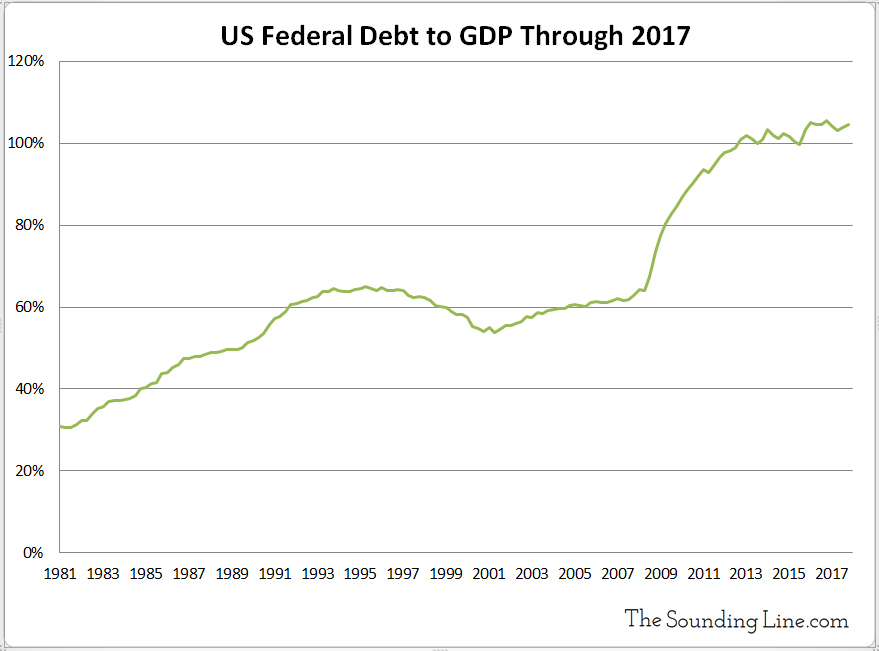

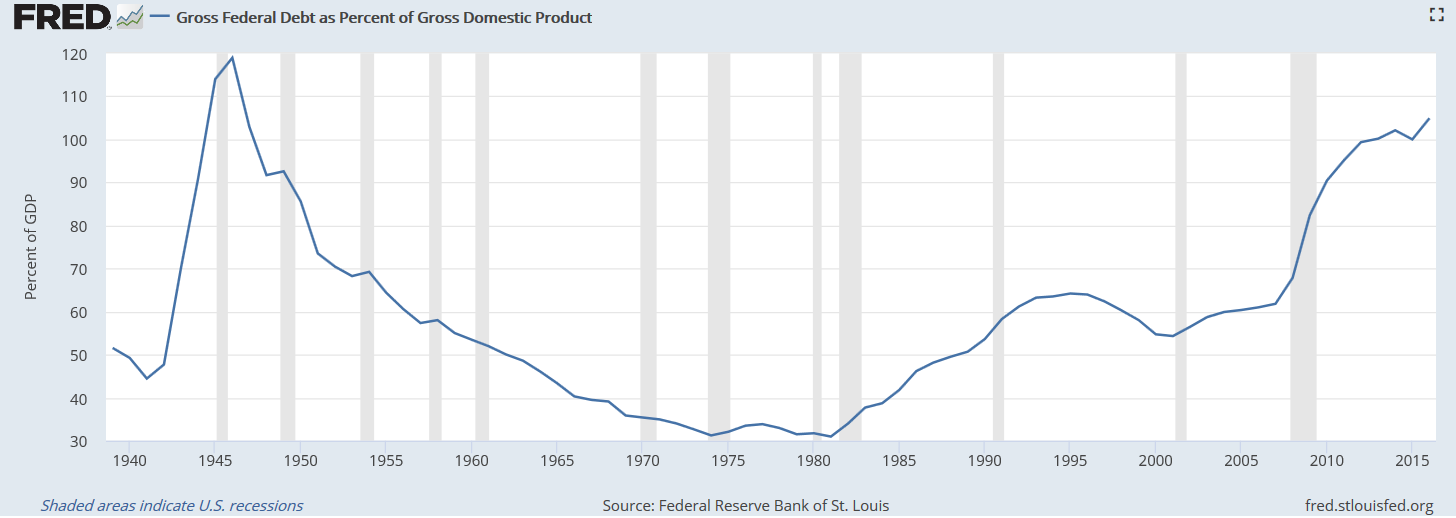

The US ended 2017 with a GDP of roughly $19.386 trillion, a federal (national) debt estimated at $20.625 trillion, and a debt-to-GDP of 104%, a slight reduction from the recent high of 106% at the end of 2016.

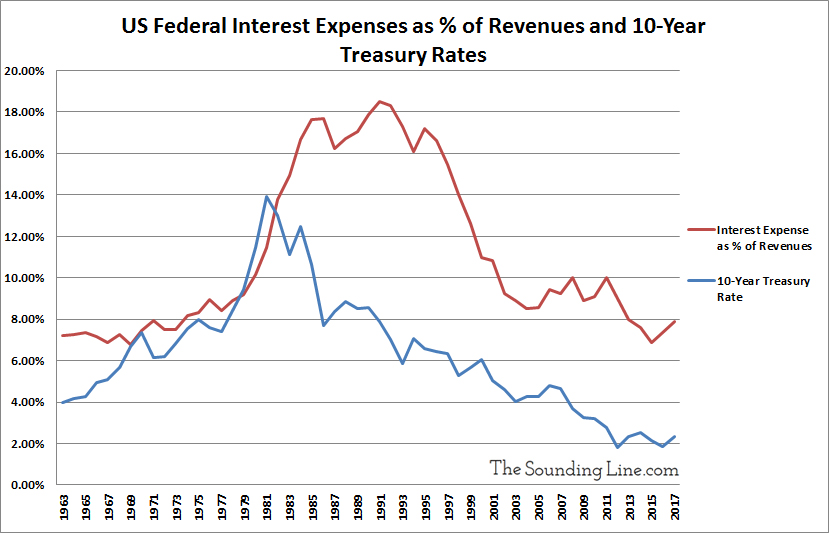

The US federal government spent roughly 8% of its revenues in 2017 on interest payments on the federal debt, quite a low amount from a historical perspective. In the 1980s and early 1990s, the federal government was frequently paying over 15% of its revenues on debt interest payments.

Current interest expenses are low despite the very large federal debt because interest rates have fallen to near all time lows. Today’s exceptionally low interest rates have shielded the federal budget from the enormous magnitude of the federal debt. The federal debt has only been higher for a brief period during World War II.

Why now is the time to eliminate federal deficit spending:

There is increasing belief among investors that the long term trend of declining interest rates may have ended. We discussed some of the reasons to believe that interest rates are headed higher here. In the past several days, it has been noted that 10-year treasury rates broke above their 30 year downtrend. This could mean the end of the multi-decade bond bull market and the beginning of a new market reality which has not been experienced since the late 1970s, long before most of today’s investors got into the business: a long term bond bear market.

The implications are enormous. The long term trend of declining interest rates meant that even if rates were low now, they were likely to go even lower in the future, increasing the resale value of bonds and making even negative yielding bonds potentially profitable. Aided by their perceived security, low inflation, and enormous bond purchases by central banks around the world, demand for very low and negative yielding bonds has remained strong despite swelling debt loads.

All this may be changing. With the specter of inflation rising, with the long term trend in interest rates having potentially reversed, and with central banks expressing a desire to reduce their bond purchases, many of the factors that have maintained demand for low and negative interest rate bonds are in peril. Arguments can be made for buying low yielding bonds when rates are still falling. There are far fewer arguments for buying low yielding bonds when rates and inflation are rising.

This creates the possibility of a shortfall in demand for bonds while interest rates are still low but rising, creating the possibility of a rapid rise in interest rates.

A significant rise in interest rates could greatly increase the interest expense of future federal government borrowing. When interest expenses were consuming over 15% of federal revenues in the 1980s, the debt-to-GDP was barely over 30%. Today the debt-to-GDP is 104%. The current pace of ever expanding deficit spending and borrowing becomes far more destructive in a rising interest rate environment with today’s debt loads.

Because debt levels are already at historic highs, so called fiscal conservatives control both chambers of Congress, the economy is the healthiest it has been in years, and interest expenses are still manageable, there may never be a better time for Washington to balance its budget.

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.