Submitted by Taps Coogan on the 12th of February 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Update 2: The Fed released the following comment about the interbank dataset:

Dear user,

There have been some structural changes to that data in addition to the corrections.

More information can be found at https://www.federalreserve.gov/feeds/h8.html

The Interbank Loans have been discontinued and we are confirming the validity of the last value in that series.

Sincerely,

FRED Team

Update: Reader ‘YYZ’ points out that the Fed issued a notice with respect to bank assets and liabilities (https://www.federalreserve.gov/feeds/h8.html). Perhaps the following is the result of a data error on the part of the Fed.

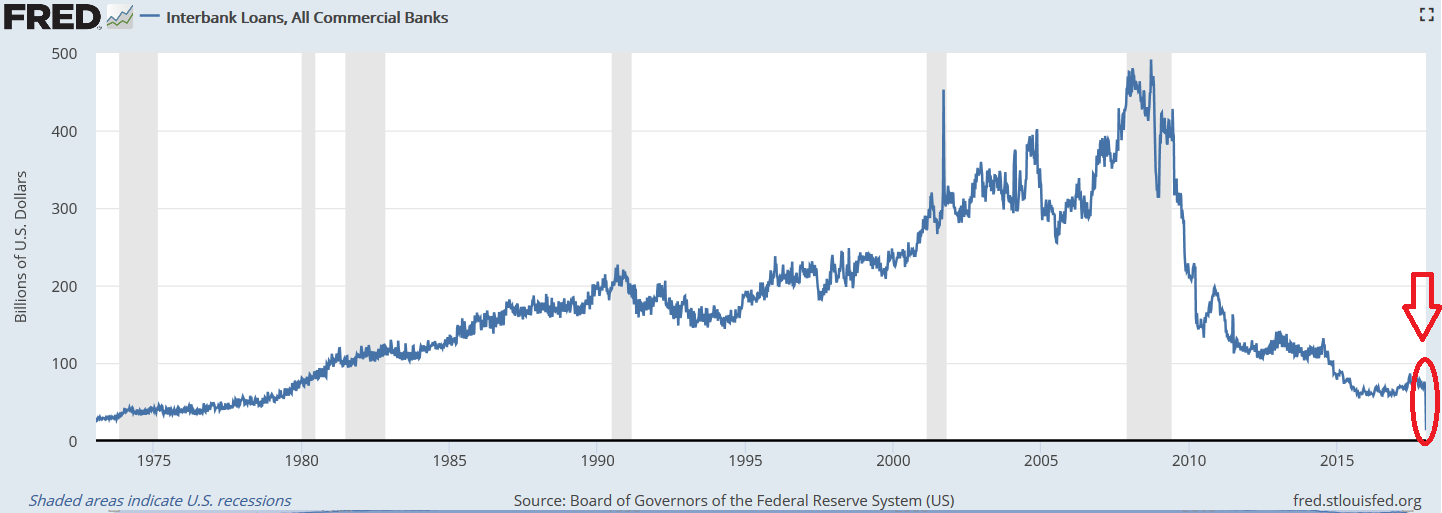

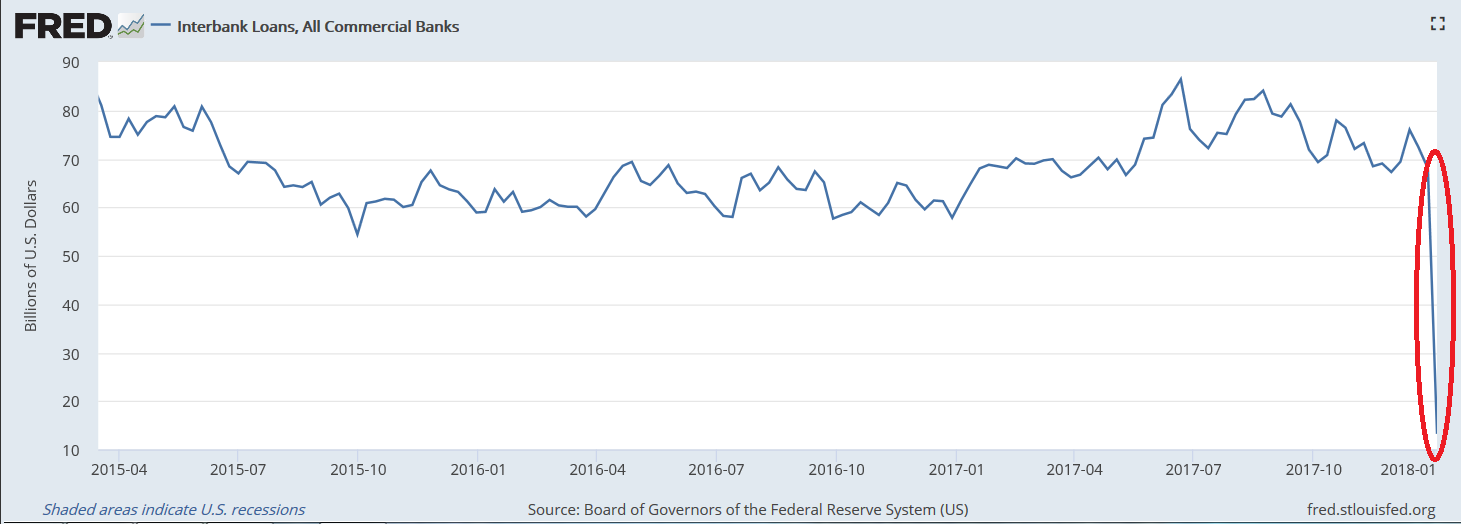

Something unprecedented has occurred in the US financial system and few seem to have noticed. In the first week of 2018, the most recent date for which data is available, US interbank lending collapsed by roughly $55 billion, a decline of over 80%. It was the largest weekly percentage decline in interbank lending on record and brings interbank lending to its lowest absolute level on record.

As we have discussed on several occasions (here), interbank lending has been in long term decline as a result of the Federal Reserve’s policy response to the 2008 financial crisis. Since 2008, the Fed’s QE programs have injected banks with trillions of dollars of reserves and the Fed began a policy of paying banks interest on those reserves. Both of those measures greatly enhanced the level of the banks’ reserves and reduced their need to borrow reserves from each-other via interbank lending. Nonetheless, the magnitude and timing of the recent decline in interbank lending is anomalous.

This begs the question of why interbank lending is now imploding so rapidly. As of now, there does not appear to be an official explanation and little in the way of insightful discussion of event.

In search of an explanation:

Assuming that the data is accurate, one possible explanation could be a deterioration in interbank trust. As Capitalist Exploits aptly described back in 2014:

“The interbank lending market is an integral part of any country’s banking system as it is where banks maintain their short-term liquidity requirements. Often a bank will have a mismatch between between short-term assets and obligations and as such they will have to enter the interbank lending market to maintain optimal liquidity. If a bank has excess short-term reserves they may want to lend these out to other banks who have a shortfall in short-term reserves. The opposite also occurs where a bank, with a short-term funding deficit, will enter the market to borrow funds to match short-term liabilities.”

“The behavior of the interbank lending market can provide one with a good appreciation for the liquidity of the banking system as a whole. If there is a lot of liquidity in the system (more short term assets than liabilities) the interbank rate will fall, if there is scarcity of short term assets relative to liabilities then rates will rise. So a rising interbank rate is generally associated with contracting liquidity conditions. Rapid rises in interbank lending rates are often associated with banking or credit crisis. This happened in the lead up to the GFC (Taps Coogan: Global Financial Crisis). What happened was that as banks began to fear the ability of other banks, who are their counter-parties, to make good on their obligations they demanded higher rates especially from banks already facing liquidity problems which only compounded their original the situation.”

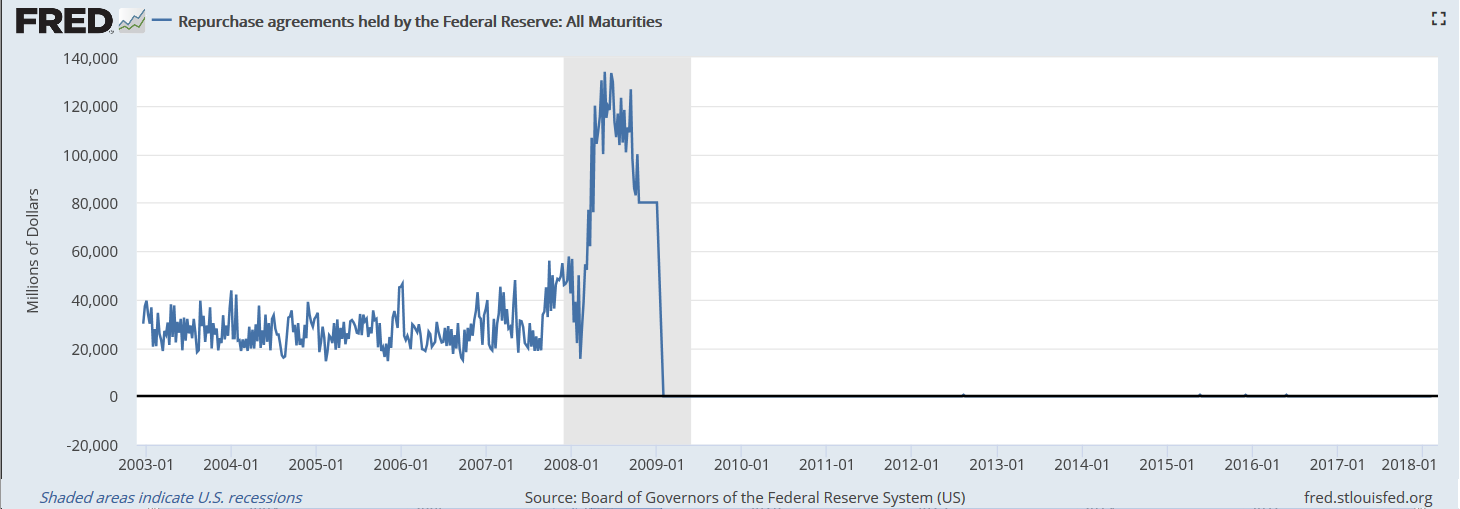

However, the current situation does not fit perfectly into the above scenario. Interbank lending rates have not experienced a corresponding sudden increase, nor does it appear that Fed repo or reverse repo lending has experienced the sort of surge one might expect during a period of liquidity problems. In fact, Fed repo agreements remain virtually non-existent, a fact which is inconsistent with a broad based liquidity crisis.

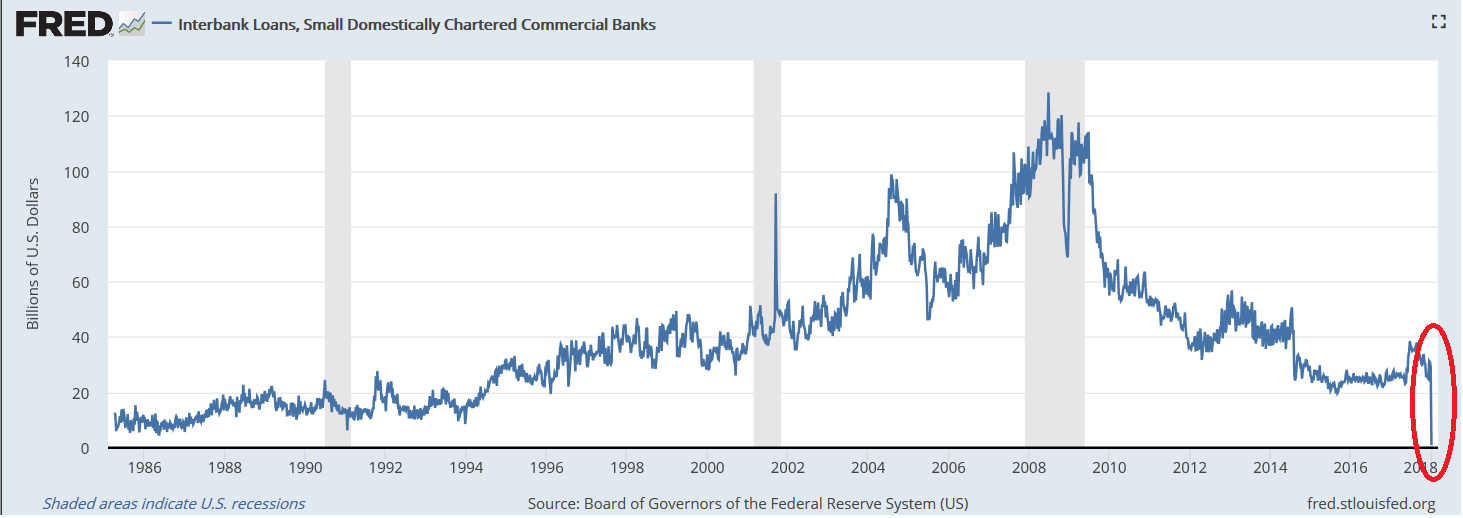

It is worth noting that the majority of the decrease in interbank lending can be attributed to small domestically chartered commercial banks. Their interbank lending plunged from just under $30 billion to under $1 billion at the start of 2018.

It remains unclear what is causing this drop in interbank lending. It is a mystery to me how, suddenly, virtually no small US bank needs to borrow on the interbank market. Any data after the first week of January has yet to be released. It will be very interesting to see what the data for the recent period of high volatility in the stock market looks like.

What do you think?

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

The data your posting stopped January 3rd., respectively, on the charts. Best to send email to the FED for an explanation.

The January 3rd data point is the most recent

Fed site gave warning 1/12 but no explanation why – still a concern to me.

https://www.federalreserve.gov/feeds/h8.html

Thanks so much for pointing that out. I added an updated to the header of the article

Maybe I’m misunderstanding something but if the information posted in your article + update above is combined with this from their site on January 12, 2018 (https://www.federalreserve.gov/feeds/h8.html): “1. Previous line item 26, Fed funds and reverse RPs with nonbanks, and previous line item 32, Fed funds and reverse RPs with banks, have been combined as new line item 30, Total federal funds sold and reverse RPs. Note that line item 1, Bank credit, and line item 9, Loans and leases in bank credit, no longer include Fed funds and reverse RPs with nonbanks and the category Interbank loans (former line… Read more »

Great info and question. Looking into the answer

maybe people are pulling out of the stock market so banks can use depositors cash instead