Submitted by Taps Coogan on the 10th of July 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

As the following chart from Statista.com shows, China manufactured 40% more cement in 2017 than every other country in the world combined.

You will find more infographics at Statista

You will find more infographics at Statista

China’s decades long construction blitz is unprecedented in human history. As Statista notes:

“An incredible statistic from Bill Gates’ blog shows that between 2011 and 2013, China consumed more concrete than the U.S. did in the entire 20th century. The Three Gorges Dam alone required 16 million tons of cement. The country’s insatiable thirst for the stuff hasn’t been quenched and it comfortably remains the world’s king of concrete. In 2017, China produced more cement than the rest of the world combined, according to the U.S. Geological Survey.

In total, Chinese cement factories produced 2.4 billion metric tons and the rest of the world churned out 1.7 billion metric tons. India was “the best of the rest” with 270 million metric tons, far ahead of the U.S. where production amounted to 86.3 million. China blitzes that every single month. Take July 2017 as an example: that month, China produced 221 million metric tons, over twice U.S. annual output.”

While China’s massive construction boom is awe inspiring, it has been accompanied by one of the fastest credit expansions in history and, critics assert, it has been more of an instrument to inflate GDP numbers than a reflection of productive economic growth. Despite representing 18% of the world’s population, roughly 15% of world GDP, and 6% of the world’s landmass, China produces and consumes nearly 60% of the world’s cement. Something just doesn’t add up.

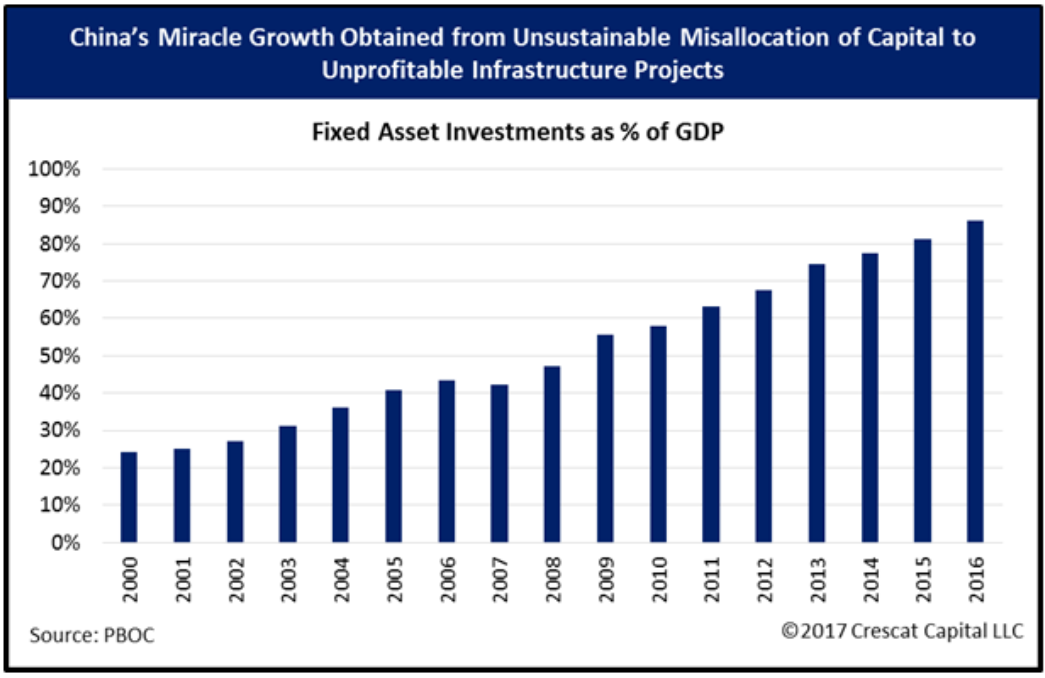

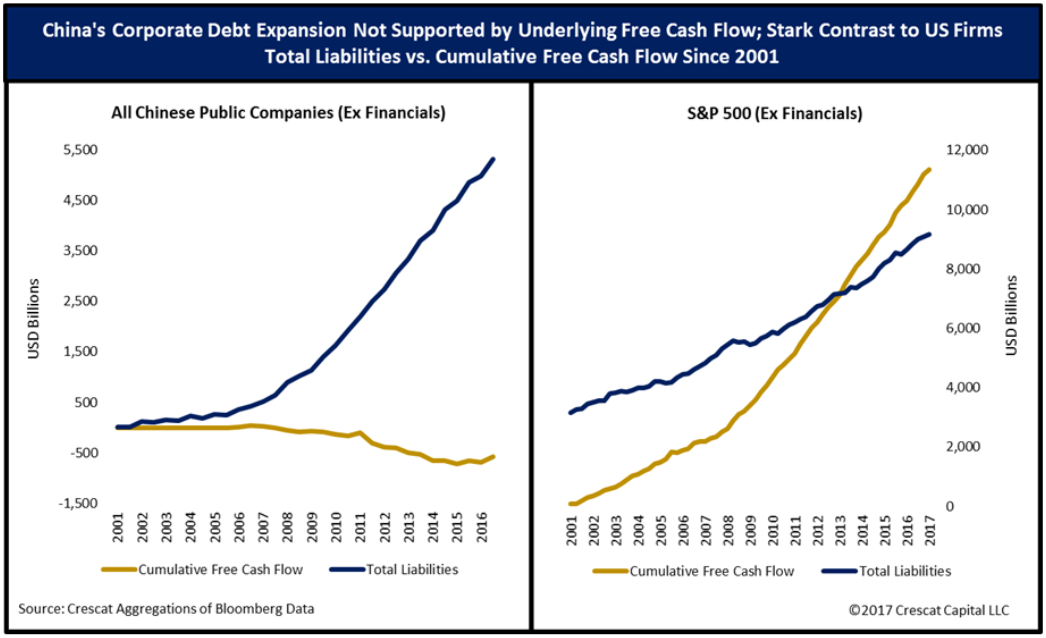

As we first discussed here, China has been spending ever greater amounts on fixed capital investment relative to the size of its economy. Meanwhile, Chinese corporations are cumulative free cash flow negative going all the was back to 2000 yet their debts have been piling up.

While the US government is oft criticized (especially here) for running unsustainable deficits, as we recently pointed out, the various layers of Chinese government are now running a larger deficit than all the layers of US government, despite China having a smaller economy and a smaller tax base.

While China’s world beating economic expansion may continue for a long time to come, it is showing many of the characteristics that have led to economic collapses in virtually ever other economy in history: massive miss-allocation of capital, exponential debt growth, aging demographics, and a looming trade war.

As legendary financial observer James Grant noted in a recent discussion about financial fraud:

“China is the most extraordinary living laboratory in credit formation and credit abuse the world has ever seen and that is a long history of credit formation and credit abuse, but China I think takes the cake… I should preface this by saying ‘concerning China, nobody knows nothing.’ Insofar as there are data and insofar as they are credible, China, to put it very succinctly, has been creating credit at twice the rate of its economic growth, sometimes more than that, and now what China is trying to do is pull that back… and Chinese bank credit as a percentage of its GDP is far greater than anyone else’s. It’s bank credit is far greater than ours with an economy much smaller… So if there are no consequences to this, the world has truly been remade. Imagine all this credit financing all these state supported projects… in a society where information is manipulated and suppressed… We are running our of adjectives to express our dire concern.”

P.S. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.