Submitted by Taps Coogan on the 13th of July 2018 to The Sounding Line. Updated on September 15, 2018.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The current bull market in US equities is now officially the longest in American history. A number of factors have contributed to this exceptionally long expansion, the most prominent being the multi-trillion dollar quantitative easing programs that central banks have gone on since 2008. However, one important factor that gets much less attention is the significant decline in the number of publicly traded companies and outstanding shares in the US stock market.

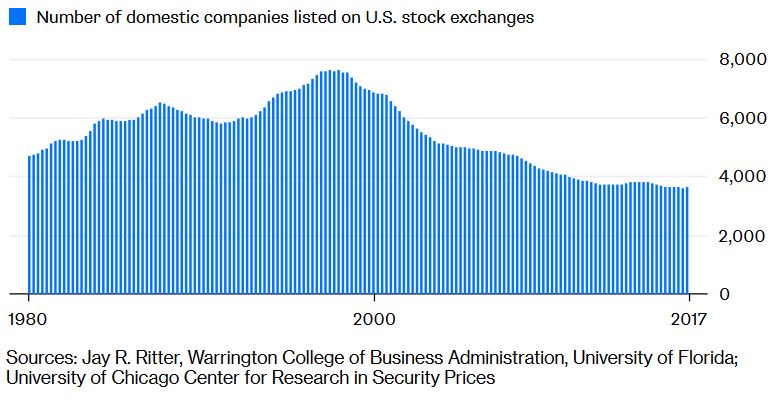

As the following chart from Bloomberg details, the number of publicly traded companies in the US has fallen over 50% from a high of 7,600 in 1997 to 3,618 at the end of 2017. As Bloomberg notes:

“The universe of (publicly traded) companies has been shrinking in the U.S. New businesses have been offering shares to the public at less than half the rate of the 1980s and 1990s. Mergers and acquisitions have eliminated hundreds more.”

“Why has this happened? Some blame regulation — notably, the 2002 Sarbanes-Oxley legislation, designed to counteract the accounting frauds of the 1990s, which added to the reporting and liability burdens imposed on public-company managers. (The U.S. Chamber of Commerce, an industry lobbying group, has made rolling back regulation a priority for this year.) Yet that can’t be the whole story: The decline began in the late 1990s, well before Sarbanes-Oxley. Much of the earlier shift was probably payback for the abundance of poorly conceived companies that came to market in that exuberant decade.”

Bloomberg further adds:

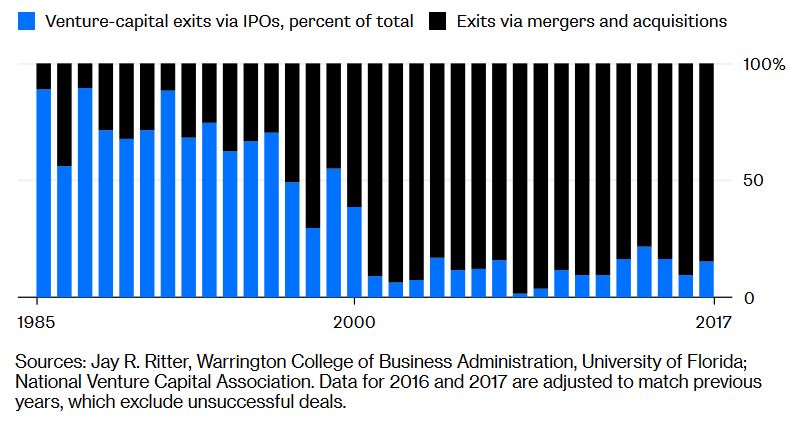

“Once upon a time, selling shares to the public was an important way for companies to raise money — and for early investors to cash out. That’s no longer the case. Companies such as Uber and Airbnb can attract tens of billions of dollars while remaining private. And venture-capital firms increasingly sell their holdings directly to existing public companies, which have the global reach needed to expand young businesses quickly (think Facebook buying WhatsApp). As of 2017, just 15 percent of venture-capital exits involved initial public offerings.”

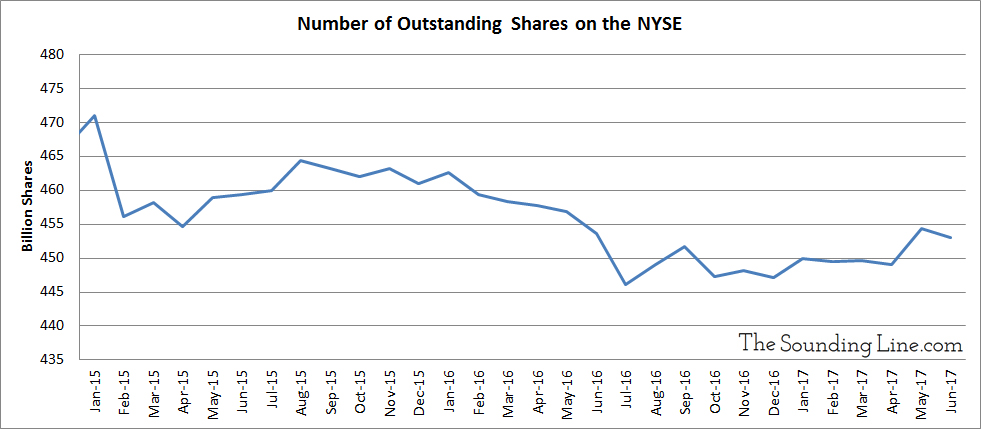

The problem isn’t just limited to the number of publicly traded companies. According to one study, 449 of the 500 companies in the S&P 500 have engaged in share buyback programs since 2012, eliminating billions of shares from public trading. Combined, the declining number of publicly traded companies and the accelerating pace of stock buybacks, has now overcome the effects of stock-splits. Accordingly, the number of outstanding shares on the New York Stock Exchange (NYSE) has fallen from an all time high of roughly 470 billion shares in January 2015 to 453 billion shares in June 2017, the latest date for which data is available.

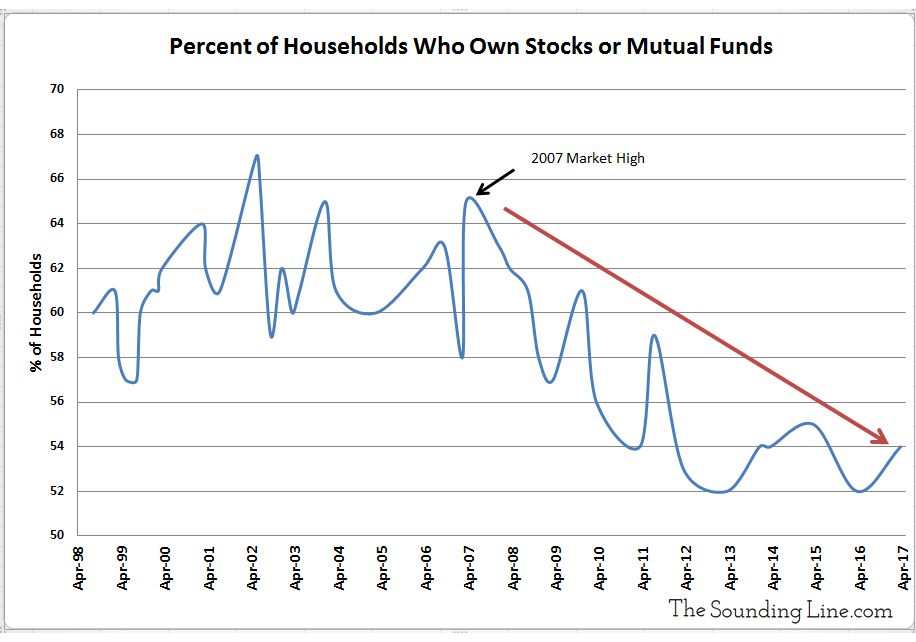

The result of fewer companies and fewer outstanding shares is an increasing scarcity in stocks that inflates their value. Meanwhile, the Fed induced financial asset driven economic expansion has exacerbated the wealth divide in the US. As the chart below shows, the percentage of American who actually own stocks, and benefit from their appreciation, is falling. The end result is fewer companies controlled by fewer shares owned by fewer increasingly wealthy people, none of which seems symptomatic of a healthy underlying economy.

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any spam.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.