Submitted by Taps Coogan on 2nd of August 2016 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

In a recent interview (here) Dr. Alan Greenspan, former Federal Reserve Chairman, revealed his belief that the US is finally seeing the very early signs of an uptick in inflation. Dr. Greenspan noted that the US and other developed economies have been struggling with slow, turgid inflation, and, at times, deflation, since the 1990s in Japan and, more recently, in the US and Europe.

Though he alleged that we are seeing only the earliest signs, Dr. Greenspan pointed to recent growth in M2 money supply as the primary telltale sign that something is changing with regard to inflation. Here at The Sounding Line we discussed the importance of the money supply and its velocity (here). To provide a brief recap, M2 money supply includes M1 money supply (notes and coins in circulation, travelers’ checks, demand deposits, and checkable deposits) as well as saving deposits, certificates of deposit (less than $100,000), and money market deposits for individuals. Changes in M2 money supply can glean a sense of how much consumers are spending and/or saving.

Dr. Greenspan said that the growth of M2 money supply in the last eight weeks has been above trend and therefore it’s reasonable to believe that changes may be coming.

Let’s take a look at the available data.

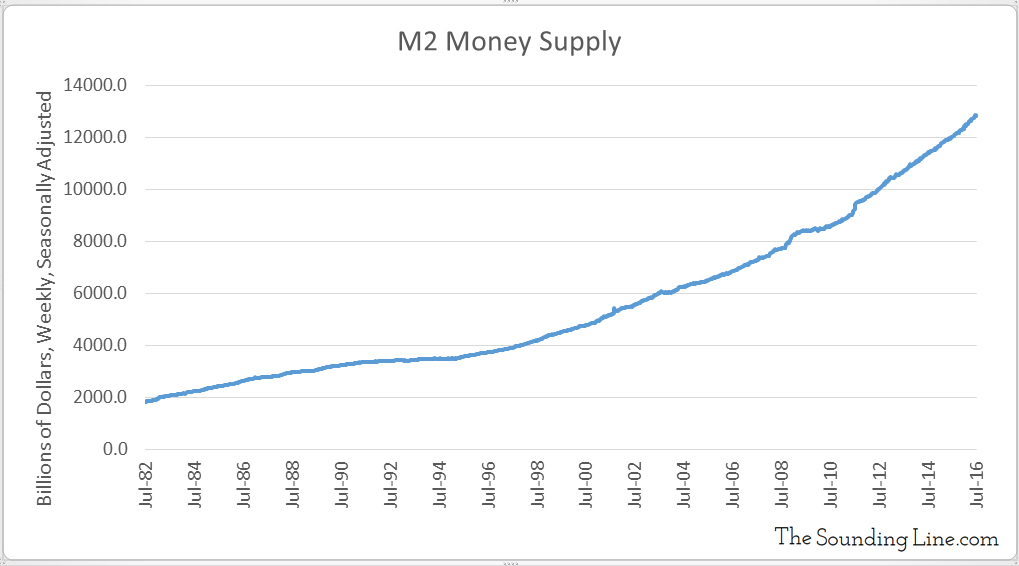

Below is a chart of M2 money supply going back to 1982. This long term perspective doesn’t show a noticeable change in the recent money supply.

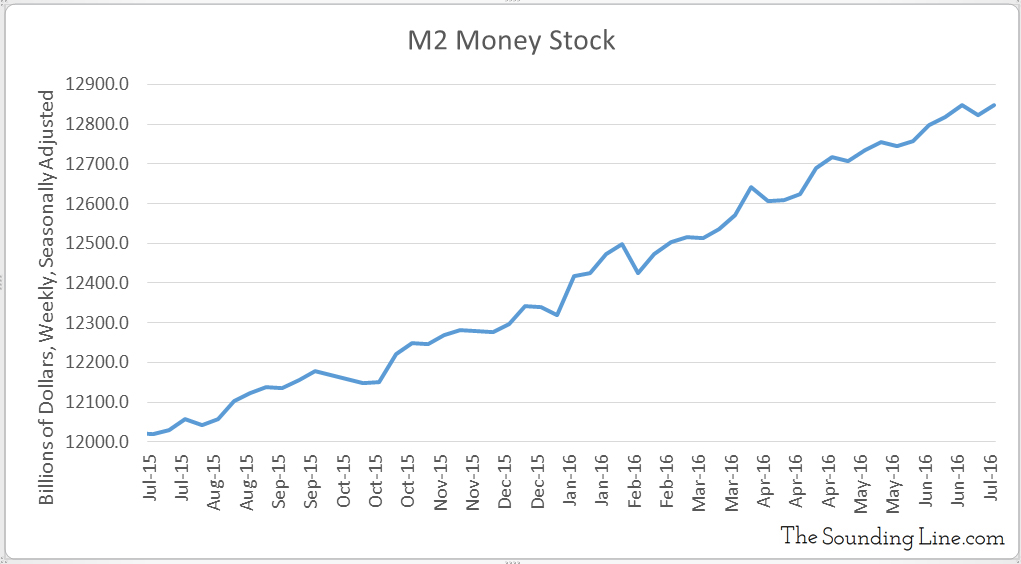

Similarly, if we zoom into the last couple years, there doesn’t appear to be a noticeable pick up in money supply.

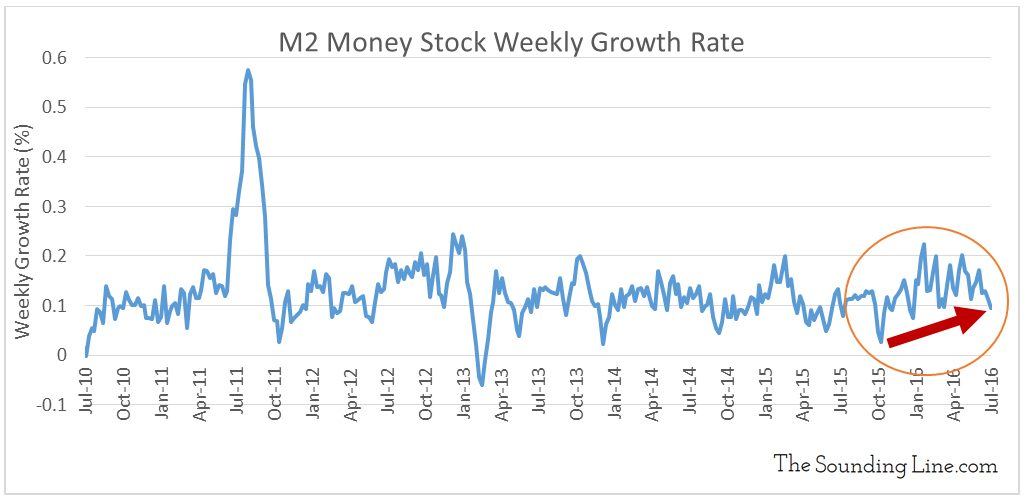

Looking at the eight week moving average of the weekly change in M2 supply we can see that there is perhaps a very modest uptick in M2 money supply.

Dr. Greenspan emphasized that there hasn’t been a breakout yet and, from these charts, that’s clearly true. Yet, to Dr. Greenspan’s credit, there does appear to be a very modest uptick in the M2 money supply growth rate in the last few months, though this is within the historic trend.

It is likely that Dr. Greenspan has access to data beyond that which is made available to the public by the Fed and perhaps that is behind his sentiments. We can only speculate. Regardless, Dr. Greenspan was notably not optimistic about the renewed inflation, noting that the deflationary fear would be replaced by inflationary fear in a matter of weeks.

Whether Dr. Greenspan is right in calling this point the begging of a change or not, given the enormous liquidity that has been created by central banks around the world, given the enormous public and private debt that has accumulated, and given the negative interest rates of some many (do you mean so many, some, many or some of the many?) public bonds, any meaningful increase in inflation would have monumental implications.

Let’s watch it closely.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.