In an attempt to calm growing concern that Italian banks are on the brink of collapse, Bank of Italy Governor, Dr. Ignazio Visco recently spoke with CNBC.

Enjoy The Sounding Line? Click here to subscribe for free.

In an attempt to downplay the impact of large amounts of non-performing loans (NPLs) already on the books at several Italian banks, Dr. Visco emphasized that it’s only ‘a few’ Italian banks that are in trouble, that most of the 360 million Euro in bad loans on their books will actually end up getting paid, and much has been written off already. Dr. Visco insisted that “It takes time to reduce, to get rid of the non-performing loans. You have to go to court, you have to somehow realize the collateral of these loans… but (this) is not the concern. Profitability is the concern. Profitability has to do with growth, so the issue is how quickly, how fast, the Italian economy will be able to go back to a sustained growth track.”

Certainly the profitability, and for that matter the earnings, of the Italian banking system is critical to its survival. While we can sympathize with Dr. Visco’s desire (and obligation) to allay fears, it’s precisely the issue of profitability that has everyone worried about Italian banks’ stability in the first place.

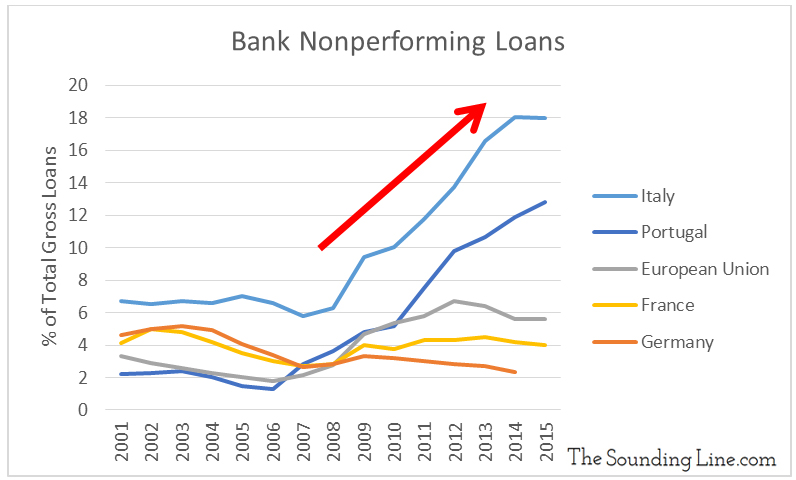

Far from getting NPLs off of their books and contained, NPLs have been surging for years, rising to 18% of all loaned money at Italian banks by 2015.

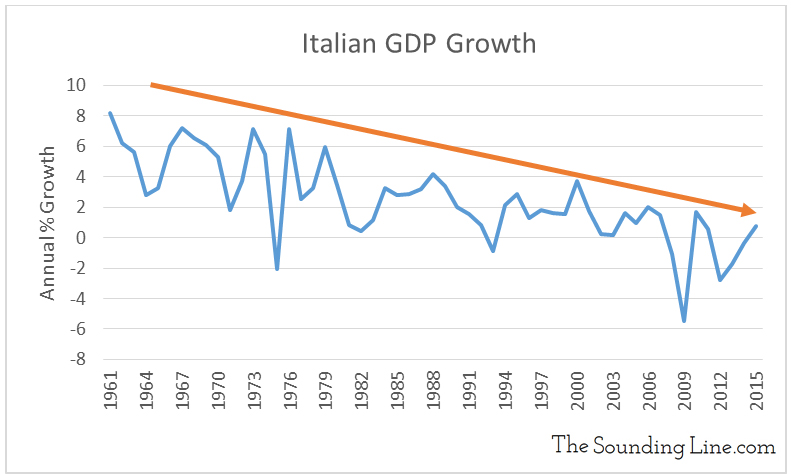

Before one can expect a turn to economic growth to save Italy, it should be noted that Italy has seen an unrelenting deceleration of growth since 1961!

Add low interest rates that compress loan profit margins, imploding share prices, and the geopolitical risk precipitated by the UK’s departure from the EU and there is quite good reason to question the viability of the Italian banking system.

While investors are told to believe that their fears are overblown, the EU and the Italian banks say that there is the need to establish the facility for ‘precautionary public intervention’, in case the ‘market solutions’ don’t work. For readers who aren’t sure what a ‘precautionary public intervention’ is, it’s a highly word crafted way of saying taxpayer funded bailout. Dr. Visco insists it’s very unlikely that this precautionary public intervention will be needed.

If it so unlikely to be used, why then break the EU rules on ‘bail-ins before bail-outs’ before they are even tried out? It certainly seems like the EU taxpayer is being played for a fool. Approve a pre-emptive bailout for the crisis that really isn’t that bad, that we definitely won’t need to use? Just in case…

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.