Allianz chief economic advisor Mohamed El-Erian recently discussed what he believes to be ‘building systemic risk’ in the financial system in an interview (posted below) with Bloomberg’s Jonathan Ferro.

Enjoy The Sounding Line? Click here to subscribe for free.

El-Erian pointed to several concerning developments within the bond market to explain why he believes we are returning to an era of volatility. El-Erian and Ferro first note that investors, pushed out of government bonds in search for higher yield, have led to tightening spreads between US high yield bonds and treasuries. El-Erian warns that “people are being pushed out of low yielding government bonds into higher risk assets hoping for yield and at some point, like in 2006 and 2007, this will go to far.” Highlighting the issue, Ferro points out that, for the first time ever, non-financial companies are issuing negative yielding corporate bonds.

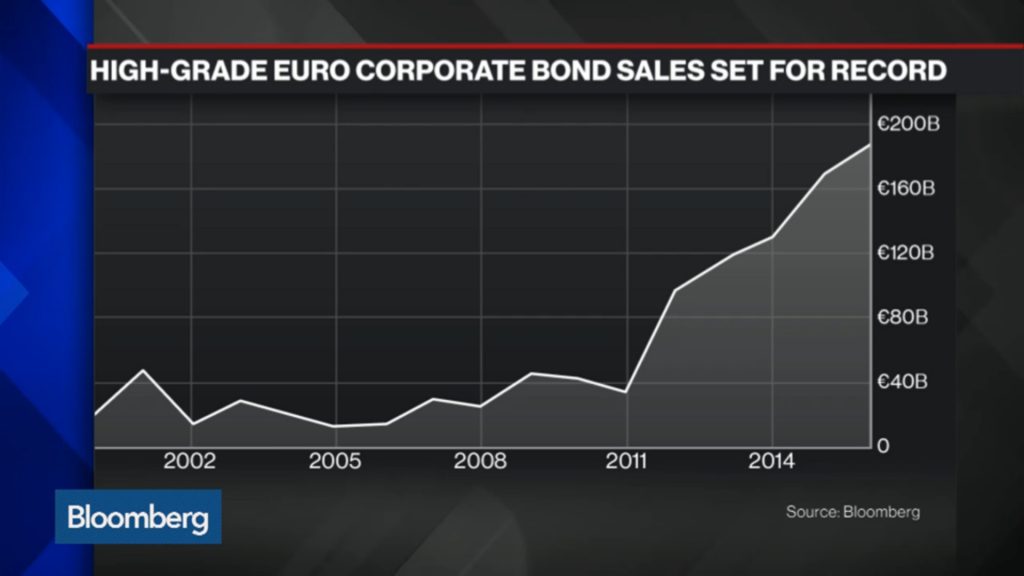

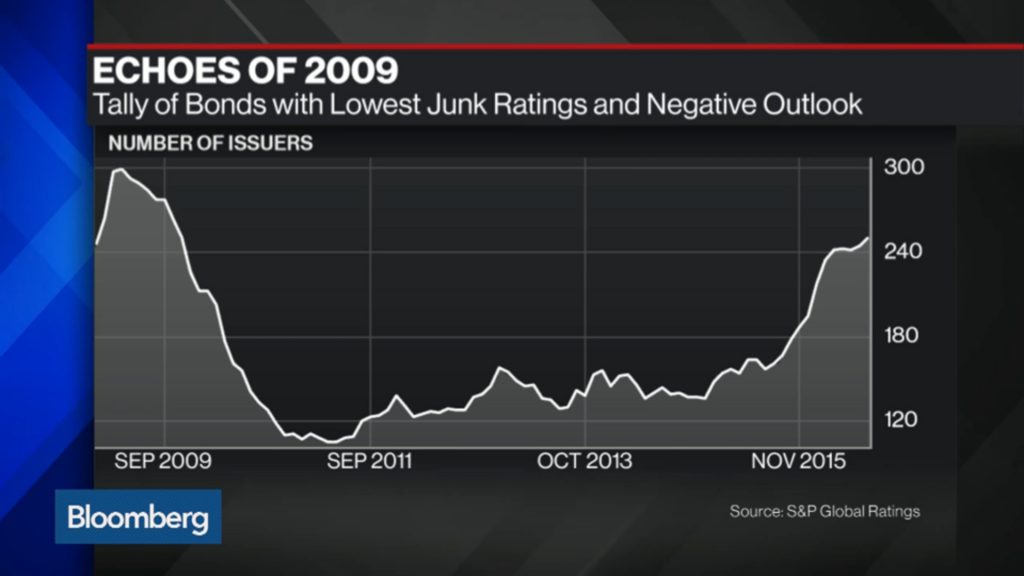

Simultaneous with the continued decline of corporate bond yields into the negative realm has been the largest issuance of high grade Euro bond since the creation of the Euro and an explosion in bonds with the lowest junk rating and a negative outlook, approaching financial crisis 2009 levels.

With a trifecta of increased issuance of bonds, decreased yields (into the negative realm in some cases), and surging junk ratings and negative outlooks, El-Erian offers ample caution to investors saying “this is the time to take some cash, reduce risk exposure to public instruments in general, and wait.”

See the full interview below:

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.