Submitted by Taps Coogan on the 20th of March 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click hereto subscribe.

The question is no longer whether central banks will allow markets to fall, but whether they will allow them to run.

On October 3rd, 2018, when the S&P 500 made its last all-time high, I wrote an article titled ‘Out with BTFD, In with BTFR.’ Amid tightening monetary policy and signs of a global economic slowdown, I warned that the era of buying run-of-the-mill market dips was likely over. Paradoxically, it would take a bona-fide market ‘panic’ or recession to restart the monetary accommodation necessary to justify continued advancement of already elevated asset prices.

Who knew that just such a market panic would start the next day? Within two months US markets had fallen 20%. It was essentially the worst sell-off outside a recession or multi-year bear market in over 30 years.

In face of the huge sell-off, central banks abandoned their tightening policies. The Fed went from planning three rate hikes this year to maybe one next year. They went from balance sheet reductions on ‘autopilot’ to planning an end of balance sheet reductions this fall. They even discussed using QE as a regular policy tool outside of recessions. In Europe, the ECB pledged to not raise their negative benchmark interest rates until next year at the earliest and started a fresh program of subsidized loans to their banking system. Chinese regulators have thrown everything but the kitchen sink at their markets to forestall their day of reckoning.

Markets have embraced the dovish pivots and some now stand within striking distance of their old highs, completely shrugging off a recession in Italy, the worst industrial output numbers on record in China, and a brisk moderation in the US.

For those who worry about the slowdown in the real economy, please recall the period from 2009 until roughly 2017 when virtually all financial asset prices surged despite the weakest post-war economic expansion on record, swelling debt levels, plateauing earnings, and a sovereign debt crisis that set much of Europe’s economy back by a decade. In this perverse central bank driven expansion, the real economy only matters to financial markets to the degree to which it justifies continued monetary stimulus.

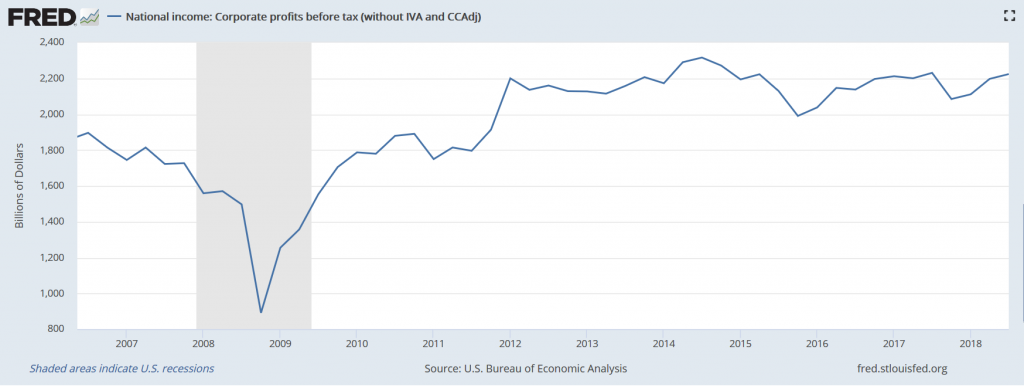

Just as a reminder, the S&P 500 is up somewhere around 125% since 2012 despite a whopping 0.01% pre-tax corporate profit growth since then:

Is the market’s assumption of renewed central bank dovishness really such a sure thing?

It is probably a safe assumption with the ECB. The sort of economic improvement in the Eurozone that would justify tightening policy seems terminally unlikely. Yet, perhaps some greater skepticism is warranted with the Fed. The Fed has been significantly more willing to tighten policy over the last few years and, despite capitulating on those policies in the past few months, has yet to actually loosen policy. It simply stopped tightening quite so quickly.

It is clear that central banks will not tolerate big market sell-offs. The question now is how much room will the Fed give markets before it reverts to tightening. Time will tell and a bit more skepticism is probably warranted with the Fed, but make no mistake, central banks are back in the market supporting game. It didn’t take long.

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.