Submitted by Taps Coogan on the 23rd of March 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The following post is courtesy of Visual Capitalist:

Today’s visuals come to us from Engaging Data, and they use Sankey diagrams to display data from the Bureau of Labor Statistics (BLS) that helps to paint a picture of how different household income groups make and spend their money.

We’ll show you three charts below for the following income groups:

- The Average American

- The Lowest Income Quintile (Bottom 20%)

- The Highest Income Quintile (Highest 20%)

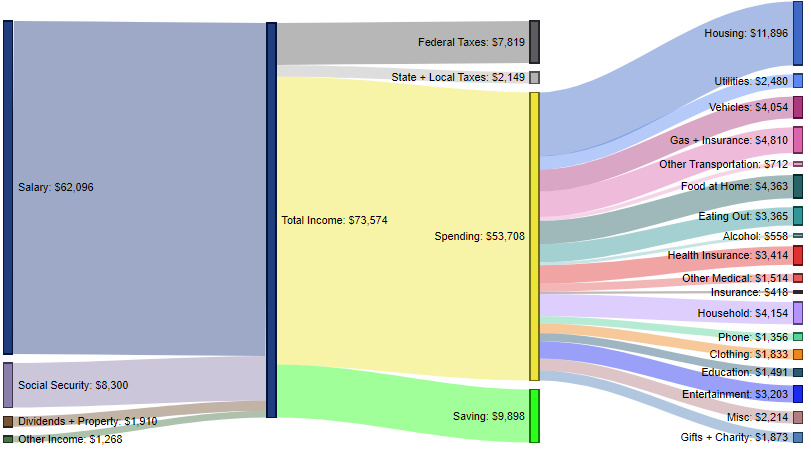

Let’s start by taking a look at the flows of the average American household:

The Average American Household – $53,708 in spending (73% of total income)

The average U.S. household has 2.5 people (1.3 income earners, 0.6 children, and 0.4 seniors)

As you can see above the average household generates $73,574 of total inflows, with 84.4% of that coming from salary, and smaller portions coming from social security (11.3%), dividends and property (2.6%), and other income (1.7%).

In terms of money going out, the highest allocation goes to housing (22.1% of spending), while gas and insurance (9.0%), household (7.7%), and vehicles (7.5%) make up the next largest categories.

Interestingly, the average U.S. household also says it is saving just short of $10,000 per year.

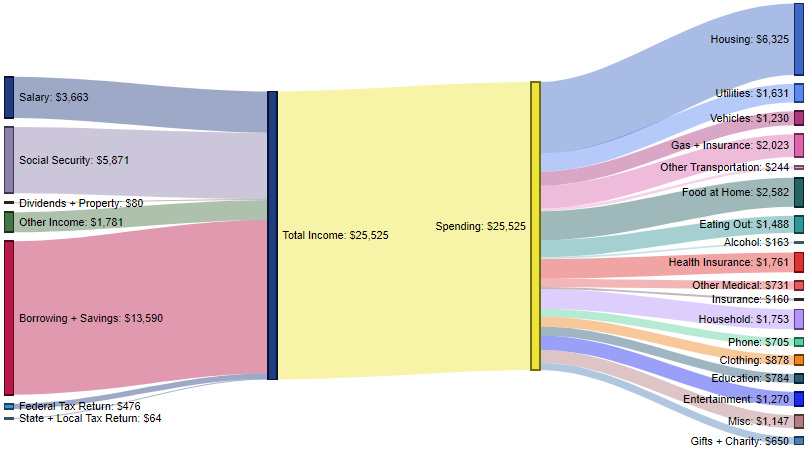

The Bottom 20% – $25,525 in spending (100% of total income)

These contain an average of 1.6 people (0.5 income earners, 0.3 children, and 0.4 seniors)

How do the inflows and outflows of the average American household compare to the lowest income quintile?

Here, the top-level statistic tells much of the story, as the poorest income group in America must spend 100% of money coming in to make ends meet. Further, cash comes in from many different sources, showing that there are fewer dependable sources of income for families to rely on.

For expenditures, this group spends the most on housing (24.8% of spending), while other top costs of living include food at home (10.1%), gas and insurance (7.9%), health insurance (6.9%), and household costs (6.9%).

The Highest 20% – $99,639 in spending (53% of total income)

These contain an average of 3.1 people (2.1 income earners, 0.8 children, and 0.2 seniors)

The wealthiest household segment brings in $188,102 in total income on average, with salaries (92.1%) being the top source of inflows.

This group spends just over half of its income, with top expenses being housing (21.6%), vehicles (8.3%), household costs (8.2%), gas and insurance (8.2%), and entertainment (6.9%).

The highest quintile pays just short of $40,000 in federal, state, and local taxes per year, and is also able to contribute roughly $50,000 to savings each year.

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.