Submitted by Taps Coogan on the 9th of April 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The traditional role of markets is to allow for the efficient allocation of capital throughout the economy based on the real-world price-discovery of risk.

In our modern world, central banks have inverted the function of markets to instead reflect the intentional mispricing of risk in a misguided effort to perpetually stimulate economic growth.

The inversion all comes down to the mythical ‘wealth effect.’ At its simplest, the wealth effect is the belief that if central banks make interest rates go down and financial asset prices up, people will get richer and the economy will improve. Under such a belief, markets become little more than a transmission mechanism for monetary policy.

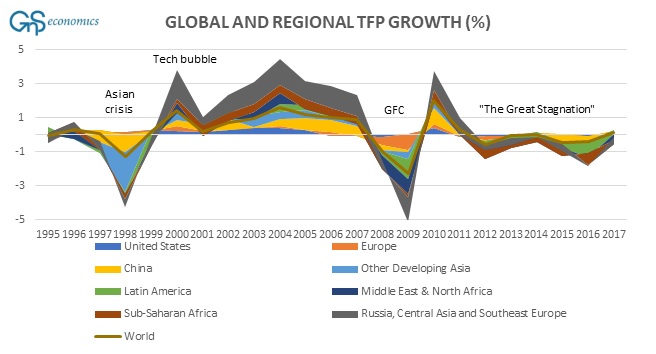

Of course, the transmission mechanism has never really worked. Despite years of the most accomodative monetary policy in modern history, economic and productivity growth has been exceptionally weak across the world.

Total Factor Productivity Growth

The problem is that the wealth effect incentives much of the liquidity it creates to stay within the financial sector. Why would someone with wealth created by Fed policy forego further asset appreciation in order to invest into a real economy that is weak by the very fact that the Fed needs to stimulate? Accordingly, very little of the ‘wealth’ created by the ‘wealth effect’ ever makes it out of the financial system.

Any increase in lending that is stimulated by artificially lower interest rates go to activities that would not be productive enough to justify the lending based on actual economic fundamentals. Perpetual artificially low interest rates create an economy that is not productive enough to survive without artificial stimulus.

Meanwhile, in order to force interest rates lower, the Fed must deprive average Americans, most of whom do not own significant financial assets, of the interest income they would otherwise get on their modest savings. The people who are paying for the appreciation of financial markets, by forging interest income on their modest savings, are the very people who would be most likely to spend any increase in income in the communities that need it most.

Perhaps most importantly, the wealth effect obscures the need for real structural economic reform. It gives the illusion that there are easy monetary alternatives to the tough task of making an economy more competitive and productive. There aren’t.

Unfortunately for central banks, trying to turn the markets into a perpetual monetary policy transmission mechanism works in both directions. The S&P 500 peaked the very same month as global central bank balance sheets in 2018 and immediately started plunging when central bank money dried up. Only when central banks fully reversed their policy path from ‘hawkish’ back to dovish did markets recover and, as if the farce wasn’t obvious enough, they recovered in one of the sharpest rallies in decades despite a deterioration in economic data in every major economy in the world. The Fed’s attempt to normalize policy in 2018 failed.

Can policy ever normalize?

At its most basic, the unwillingness of central banks to ‘permit’ markets to accurately reflect even modest slowdowns in the real economy defines this period of abnormal monetary policy. Only when central banks are willing to allow, or become otherwise incapable of preventing, markets from accurately reflecting a slowdown in the real economy can ‘policy normalcy’ ever be re-established. Given how deeply dependent the economy’s entire structure has become on stimulative monetary policy and risk-mispricing, normalization will almost certainly entail a recession. In other words, monetary policy won’t normalize until there is a slowdown and central banks risk allowing it to become a recession for the sake of normalization.

Don’t hold your breath.

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.