Submitted by Taps Coogan on the 15th of May 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

We last wrote about margin debt in April of 2017. At that time, NYSE margin debt had surpassed $500 billion for the first time in history, provoking concern about about the risks it posed.

As we noted in 2017, the key to evaluating margin debt is not just the absolute levels, but comparing margin debt growth with underlying stock market performance:

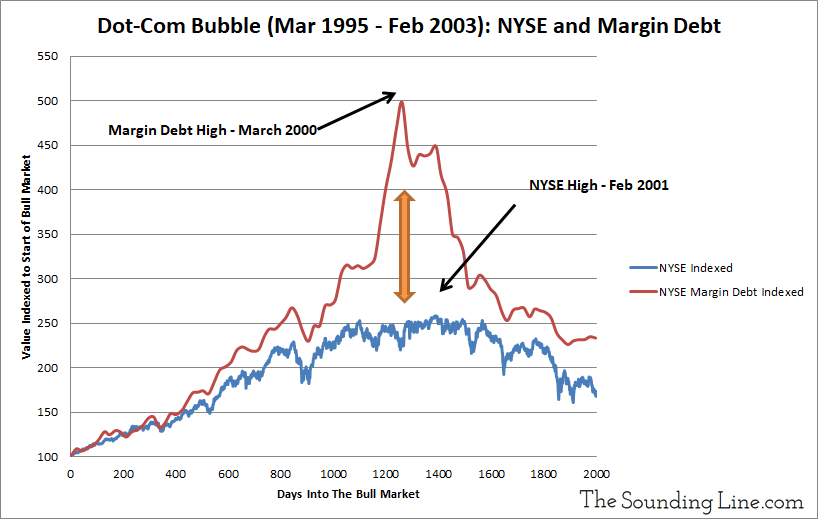

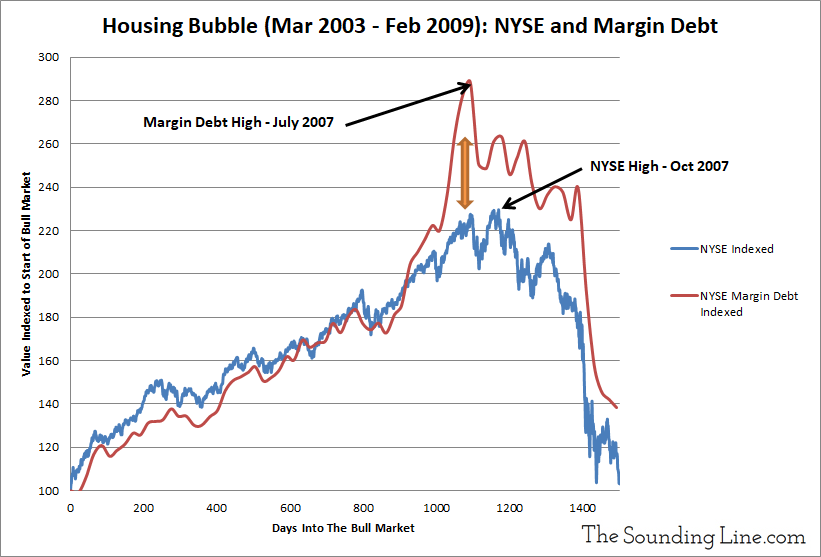

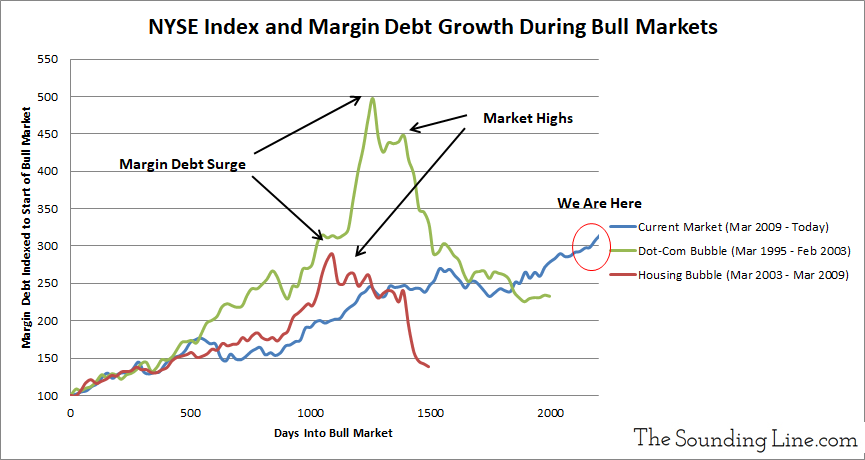

“Margin debt peaked about one year before the high on the NYSE during the dot-com bubble and about four months before the high during the housing bubble. In both cases, margin debt growth closely matched growth on the NYSE for most of the bull market and then, near the highs, margin sharply outgrew the NYSE, peaked, and the market subsequently collapsed… The type of margin debt surge that preceded the 2001 and 2007 market highs has yet to occur. While the current margin debt growth is unsustainable and caution is increasingly warranted, it doesn’t appear from this metric that the market is in its absolute final throws.”

Since 2017, the NYSE has stopped publishing margin debt data and removed their historical data from their website. It is part of an unfortunate trend at the NYSE of publishing less and less critical data. Nonetheless, the Financial Industry Regulatory Authority (FIRMA) continues to publish margin data, though it is delayed by two months and is slightly higher than the NYSE figures (read here for a discussion of why).

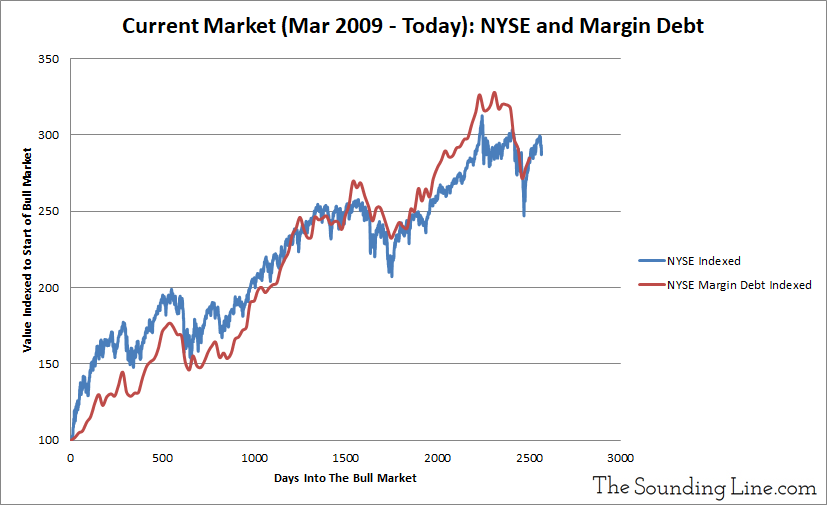

Based on that data, margin debt grew to a high of $669 billion in May 2018 before dropping to $554 billion in December 2018. Margin debt at the end of February, the most recent date for which data is available, stood at $581 billion.

A major margin debt peak?

As the chart below illustrates, despite the recent rise and drop in margin debt, compared to the margin debt surges during the Dot-Com and Housing bubbles, it is not obvious that a similar surge has happened. However, for much of 2018, absolute margin debt levels have remained highly elevated and started to outpace market growth, suggesting a ‘minor’ peak may have occurred and that a major peak may occur in the near future.

Though obvious margin debt peaks were leading indicators of trouble in the last two market cycles, they do not always proceed recessions. As such, the absence of an obvious margin debt peak is not a guarantee of anything, particularly given how high overall debt levels are and how long this cycle has lasted.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.