Submitted by Taps Coogan on the 29th of May 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

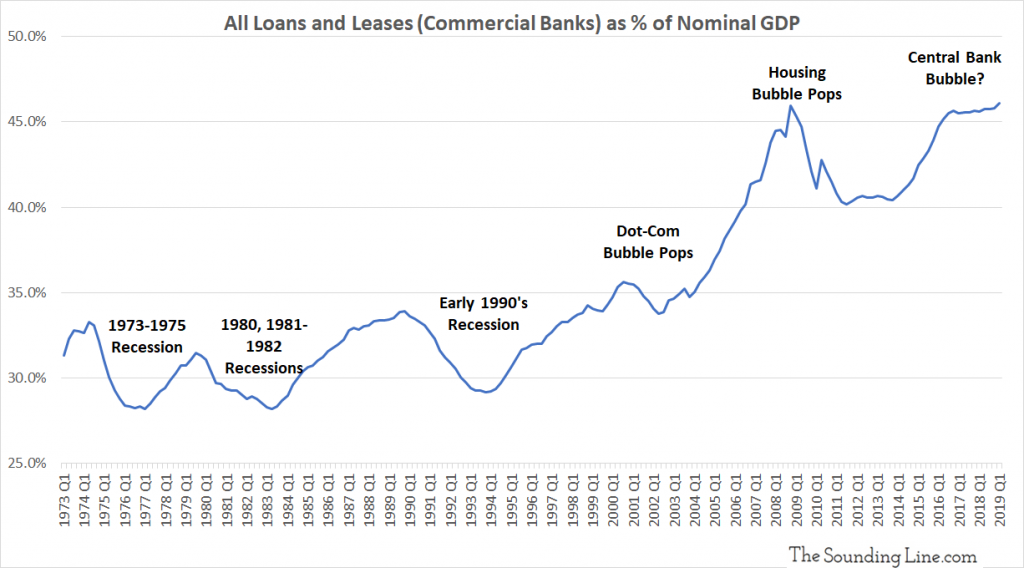

As obvious as it sounds, the simplest way to tell where we are in the credit cycle is to look at the credit cycle itself. One way to do that is to look at total loans and leases relative to GDP.

In the first quarter of 2019, total loans and leases made by commercial banks in the US hit 46.1% of nominal GDP, exceeding the previous high of 45.9% set during the Financial Crisis (Q4 2008) for the first time ever.

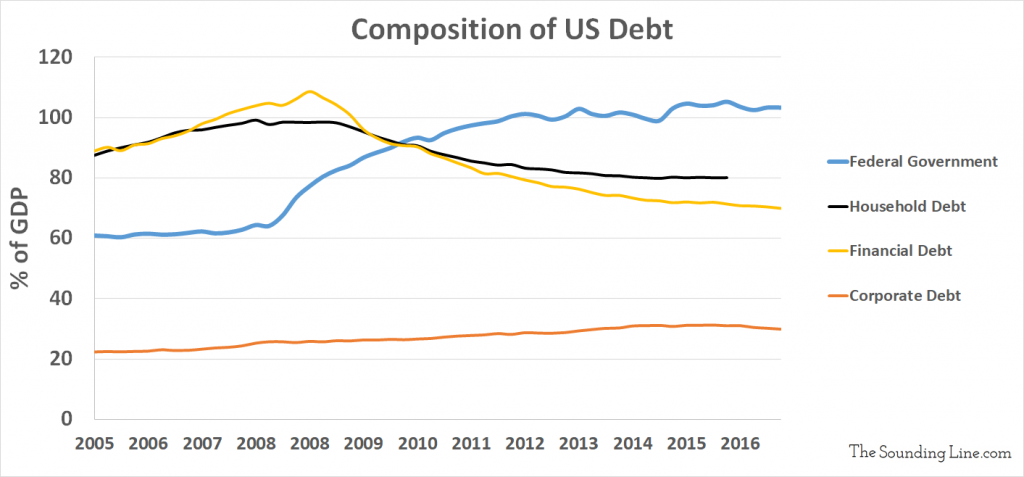

Loans and leases by commercial banks are just one type of debt in the US economy. There is also the debt owed by financial institutions themselves, as well as the bond and treasury markets.

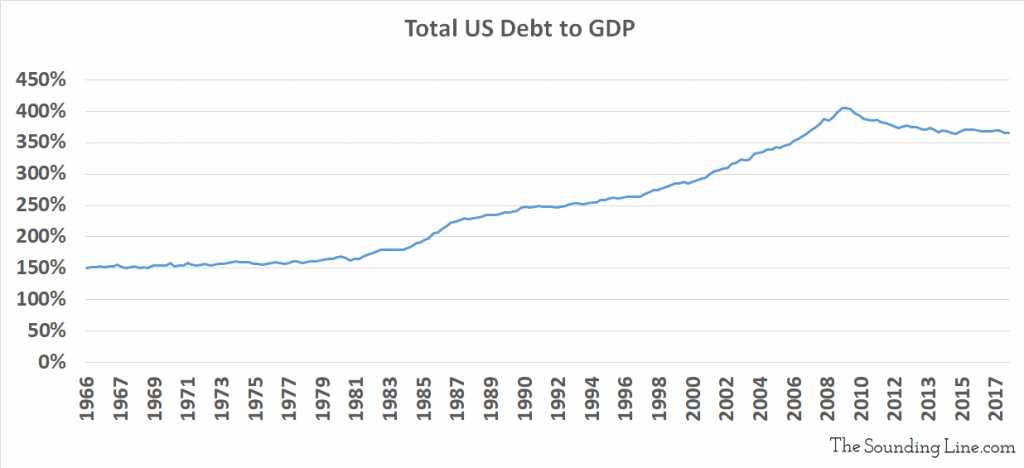

As we have discussed before, the ‘total’ debt in the US economy has actually been declining relative to GDP since the Financial crisis, though it remains at historically elevated levels.

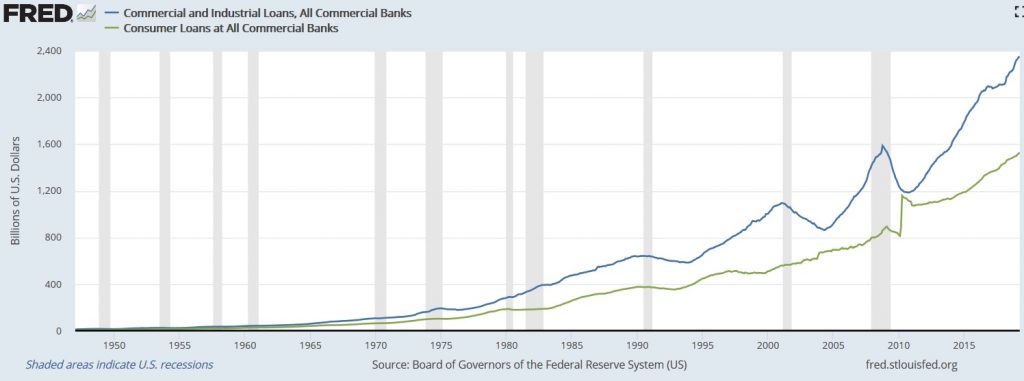

The most glaring increase in debt in the economy during this cycle has been government debt. Corporate debt, while significantly smaller than government debt, has also grown rapidly and is near record highs. The largest single cause of the rise in total loans and leases has been corporate and industrial borrowing.

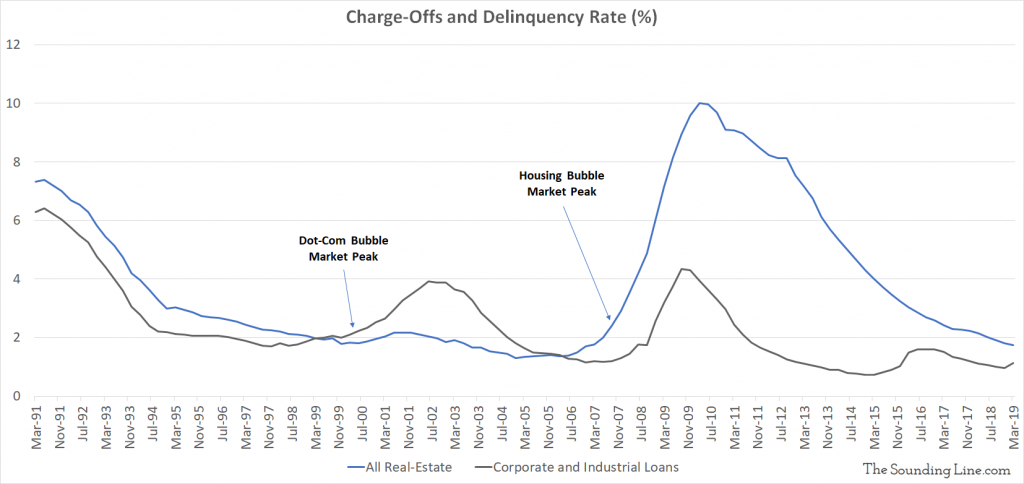

Before a credit bubble pops, there is typically a modest rise in delinquencies in the types of credit that have grown most aggressively.

During the Dot-Com bubble, delinquencies on corporate and industrial debt started to edge up slightly in the late stages of the bull market. During the Financial Crisis, delinquencies on real estate started to edge up in the late stages of the bull market. When debt levels are very high, even a small rise in delinquencies quickly becomes toxic.

Where Are we Today?

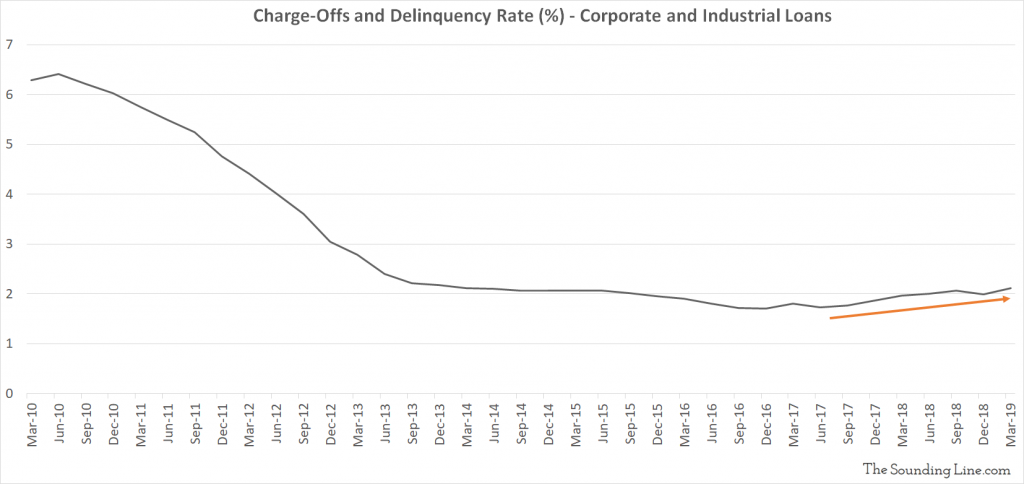

Government debt doesn’t have a delinquency rate. The US federal government is either paying its debt or it isn’t. For now, it is paying its debt and is likely to continue to do so for some time, especially with treasury yields remaining very low. Speculating when the government debt issue will become acute is a tricky task. Corporate delinquencies, on the other hand, have already started to edge up, ever so slightly. Given the rapid growth in corporate debt, even such a slight increase in the delinquency rate should be taken seriously.

In a few weeks, the current US expansion will be the longest in American history. The US stock market is already on its longest streak in history without a 20% decline on a closing basis. The global economy is slowing and geopolitical risks are not going the way markets had hoped. While total debt levels in the US tell a mixed story, corporate debt is far above the levels seen in during the Dot-Com Bubble and the Housing Bubble. Though delinquency rates remain very low, they are starting to edge higher. If central banks don’t soon deliver the dovish policy the market has already priced in, we are in for a rough ride.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.