Submitted by Taps Coogan on the 25th of July 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

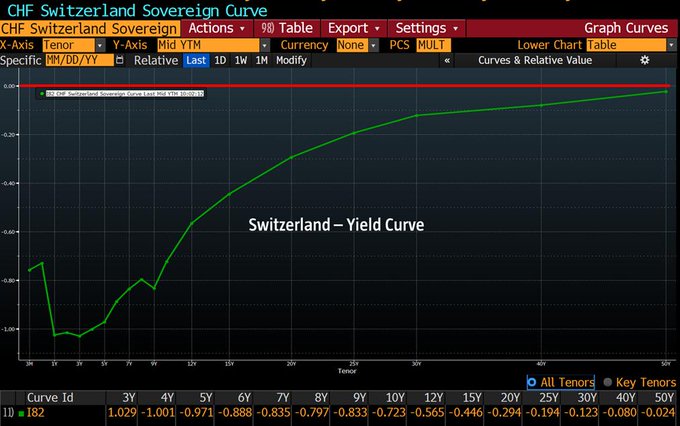

In yet another eerie sign of just how extreme this moment in financial history is, consider this: the entire sovereign yield curve in Switzerland is now negative. That includes 50-year bonds.

In principal, Swiss benchmark rates are now pricing in zero inflation and zero credit risk in Switzerland for at least the next 50 years. The only way to make money on Swiss government debt is if rates go even more negative and you pass on these hot-potato bonds to someone else at even lower rates. That may work for a while longer, but to what end?

If all benchmark rates are already negative, what difference does it really make to the economy if central banks re-stimulate from here? Credit isn’t just free, it already pays to borrow. If you are not borrowing by now, chances are that you never will. If a decade of this sort of policy hasn’t achieved ‘escape velocity,’ why on Earth would it start working now?

Franky. this latest round of re-accelerating monetary accommodation reeks of desperation.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.