Submitted by Taps Coogan on the 29th of July 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

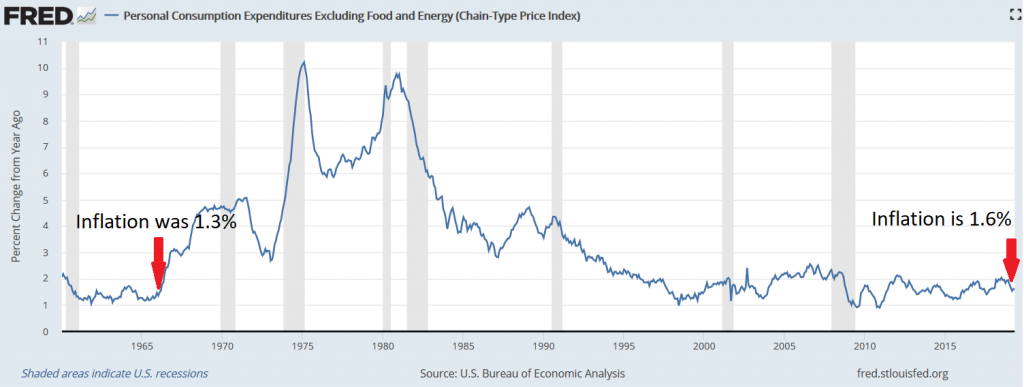

After a modest recession in 1960, PCE core inflation fell from roughly 2% to just 1.05% in November 1961. For several years afterward, inflation would remain persistently low, not rising above 1.73%. By January 1966, inflation was running at just 1.36%. Today, the same inflation measure is running at 1.60%.

The fact that inflation was persistently below 2% in the early and mid 1960s was not viewed by Fed officials of the era as an existential threat to the global economy. The Fed did not have 2%-for-all-conditions inflation targets in the 1960s. It’s a miracle. If the Fed had become as obsessively focused on arbitrary inflation targets then as they are today, they presumably would have pushed interest rates to zero and started printing money like it was going out of fashion right before the most significant inflationary period in modern American history.

Inflation started 1966 at 1.36%. By December 1966, it was over 3%. By the start of 1971, inflation was over 5%. By 1974, inflation was over 10%. After a decade above 5%, it was back to nearly 10% in 1980. It wouldn’t get back to the 2% level until 1996. A slight inflation overshoot for a few months in 1966 ended up as 30 years of painfully high inflation. As Nassim Taleb has noted “the problem with inflation is it’s very non-linear. So, it’s like a ketchup bottle. Nothing comes out and then suddenly things jump out.“

Central banks around the world have become obsessed with stimulating the one thing that would most plausibly destroy the global financial system. They have even started talking about letting inflation run over 2% for an extended period of time to ‘make up’ for past inflation under-shoots. Imagine the loses on the tens of trillions of dollars of negative yielding debt investors are currently pilling into if inflation managed to even modestly overshoot 2% for any extended period… It is the height of lunacy.

In a world where governments and corporations are historically indebted and where trillions of dollars of bonds are pricing essentially no inflation anywhere in the developed world for decades, a little bit too much inflation would be an extinction level event for bond markets.

Precisely because a modest overshoot in inflation would create catastrophic bond loses, inflation cannot remain modestly above 2% for very long. It will go higher rapidly once it overshoots.

Will inflation rear its head tomorrow? Probably not. Will inflation rear its head at some point if central banks keep accelerating monetary policy to ‘sustain the expansion’? Yes, and when it arrives it will be a terminal event.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

The biggest points are missed. We had a gold standard, so inflation targeting is pointless, you simply defend the value of money to gold. Second Vietnam war and deficit spending started, that is what caused inflation. To still spend on war, the gold standard was abandoned and inflation happened through printing more money. That simple, don’t spend what you don’t have.

Indeed those factors explain much of the inflation in the 60s and 70s. We have large and increasing deficits today as well

Good points, but if you assume that wars and printing more money lead to that period’s inflation, why aren’t we seeing inflation during the 21st century, when we’re fighting wars in the middle east and printing the largest quantity of money ever?

IMO: 1.) We do have inflation, it has routinely been at 2% during this expansion, and is not far from 2% right now. The inflation metrics are an average of very divergent underlying categories like TVs and healthcare and probably understate real inflation 2.) We have extreme inflation in financial assets where most of the newly created money has remained. Why would it leave when the real economy is weak and central banks are buying financial assets? 3.) Demographics, technology, and over indebtedness are keeping what inflation we do have from rising higher. Those are not insurmountable hurdles, central banks… Read more »