Submitted by Taps Coogan on the 2nd of August 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Current financial asset valuations and the popular ‘bull’ case for markets hinge on persistently ‘low’ inflation providing the Federal Reserve with room to continue to suppress interest rates and accommodate financial markets.

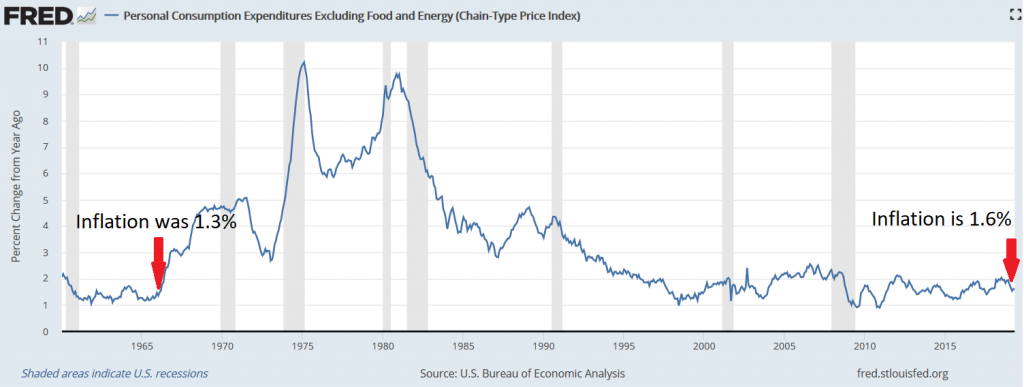

However, the Fed’s preferred inflation measure, PCE core inflation, is really not that exceptionally low. Year-over-year PCE core inflation is 1.6% and has been rising modestly in its most recent data releases. From a historic perspective, 1.6% is actually quite close to the Federal Reserve’s 2% inflation target. In fact, PCE core inflation has been lower than it is today no less than 24% of the time since 1960 and 43% of the time since 1997. What would have been an entirely unimportant rounding-error-undershoot in an imperfect metric at any point from 1960 to 2008 has transformed into just-cause for an ever deeper dive into the most accomodative global monetary policy in history.

Enter More China Tariffs

Starting on September 1st, the Trump Administration will be applying 10% tariffs to the remaining $300 billion of Chinese imports to the US. The products in this $300 billion category are predominantly consumer goods: smartphones, toys, apparel, etc… Until now, tariffing these consumer oriented goods has largely been avoided in order to shield US consumers from directly feeling the effects of the trade war. With nothing left to tariff but these consumer goods, that prudence is apparently going to be set aside.

10% tariffs on $300 billion of imports represents $30 billion a year or roughly 0.14% of US GDP. Consumers will not see 100% of that $30 billion show up in their prices, but they may see a good deal of it. Before dismissing the economic impact of these additional tariffs, remember that PCE Core inflation is only slightly below target. A 0.14%-of-GDP inflation push that is piggybacking on an admittedly preemptive Fed rate cut is nothing to scoff at when persistently low inflation is the entire rational for historically high financial asset prices.

While the window of opportunity for additional rate cuts from the Fed certainly has not yet closed, one can increasingly visualize how inflationary pressures from increasing tariffs on consumer goods begin to restrict the Fed’s ability to provide the stimulus that everyone is hoping for.

In other words, while most ‘bad news’ is now good news for financial markets, bad news that leads to price inflation is just old fashioned bad news.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.