Submitted by Taps Coogan on the 4th of August 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

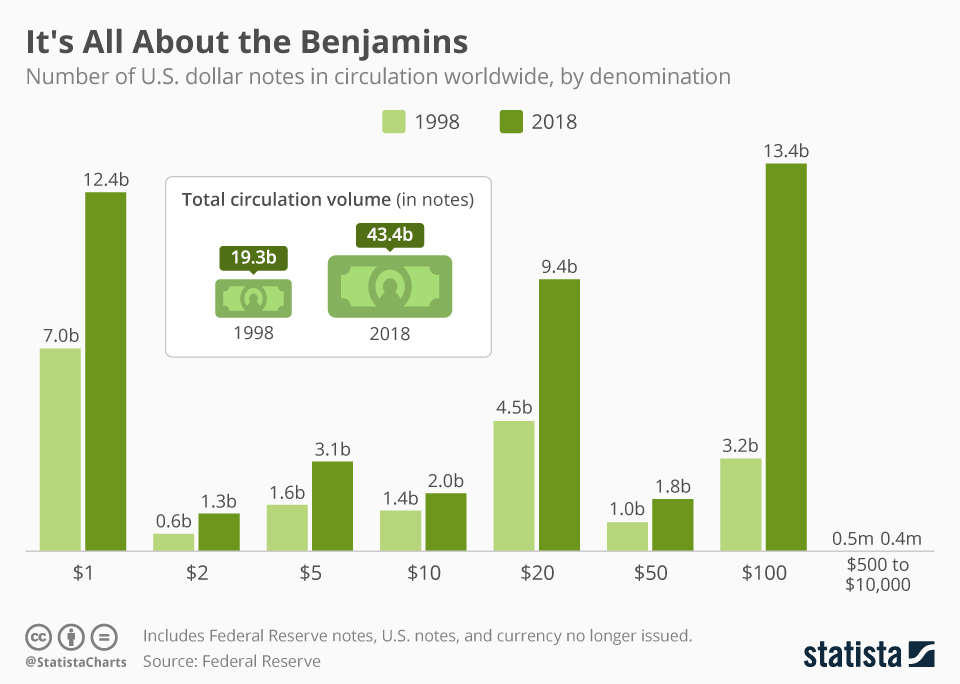

The global crackdown on banking privacy, cash transactions, and large denomination bills is having a conspicuous albeit predictable effect. As the following graphic from Statista shows, the quantity of $100 bills in circulation is surging and has eclipsed even $1 bills for the first time in history. With 13.4 billion notes in circulation ($1.34 trillion worth), the $100 bill is now the most popular bill in the world. According to the IMF, over 80% of those bills are in circulation outside the US.

With negative interest rates and punitive taxes on the top of policy makers’ minds, cash has become public enemy number one. You just can’t push deposit rates significantly negative and expect people to keep their money in the bank when cash is an easy alternative. You also can’t push taxes and regulations beyond a certain point if people can simply take their money out of the financial system.

Hence, countries around the world have been busy outlawing bank privacy, eliminating large currency bills, and banning large cash transactions. The result: more large denomination bills than ever. It is a bit like how massive monetary stimulus programs aimed at pushing investors out of low-risk government bonds and pushing savers to spend has led to the largest government bond bubble in history and higher saving rates.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.