Submitted by Taps Coogan on the 19th of August 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The global economy is slowing for a raft of reasons: increasing trade tensions, a decade of capital misallocation due to artificially low interest rates, historic over-indebtedness, aging demographics, economic de-liberalization in China, the normal ebbs and flows of the business cycle, and many other factors.

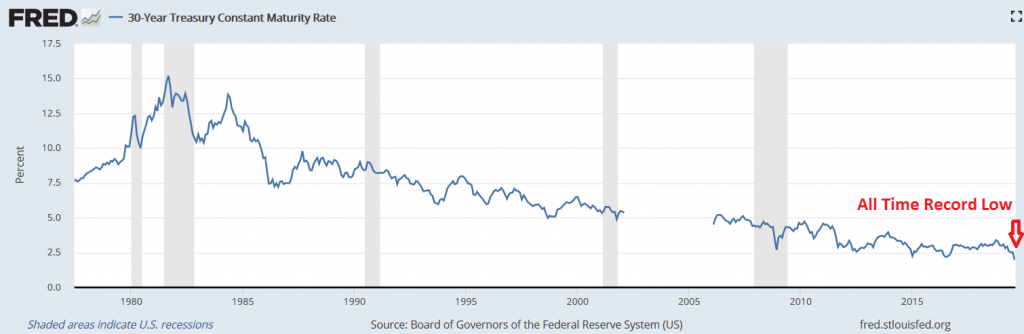

However, given that interest rates have not been lower at any point in recorded human history, it is fair to say that high borrowing costs are not among even the proximate causes of the ongoing global slowdown. That reality won’t stop central banks from cutting interest rates. It may prove to be history’s most expensive example of a hammer in search of a nail.

What Will Lowering Interest Rates Do?

Lowering interest rates further will not address the causes of today’s global economic malaise. It may, however, prevent the rise in borrowing costs and bankruptcies that often tips a slowing economy into a recession. In other words, preemptively suppressing interest rates before a recession actually manifests, may succeed in delaying the recession. In doing so, it would deprive the economy of an intense but brief recession that purges overcapacity and unproductive elements. Instead, the economy becomes ever more ‘zombified,’ denied of a badly needed cathartic event.

Beyond the poisoned chalice of preventing a recession without addressing any of its causes, lowering rates will presumably keep pushing financial asset prices higher. Central banks think that this is a desirable effect because they believe in the ‘wealth effect.’

In reality, the wealth effect is a prescription for capital misallocation and wealth inequality. In an environment with low economic growth, chronic overcapacity, high trade uncertainty, yet rapidly rising financial asset prices, where does one invest capital? One invests in financial markets, not the real economy.

What Next?

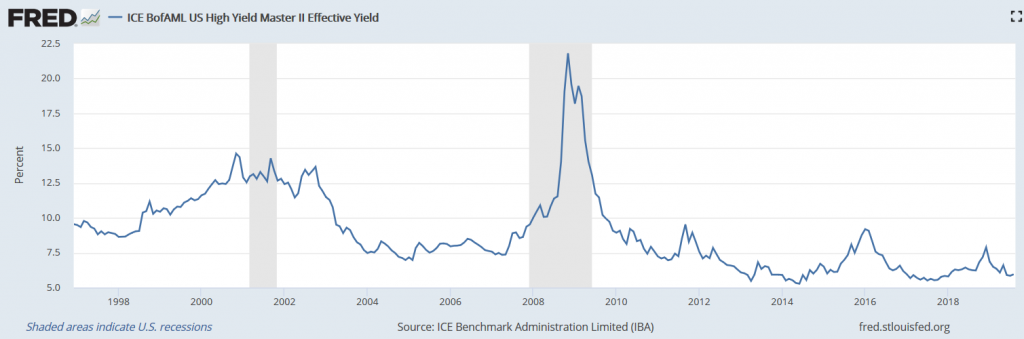

Many, many people are warning of a looming recession and/or financial crisis. While certainly possible, it’s not common to see a wave of bankruptcies, layoffs, and financial panics unfolding as interest rates on junk bonds are manipulated to record lows.

US Junk Bond Yields

Many people have also commented on the apparent contradiction between the price signals being sent by bond and stock markets. Falling treasury rates and inverting yield curves are interpreted as a sign of an imminent recession, while high and rising stock and junk bond prices signal relatively little concern.

What seems like a contradiction may not be. Perhaps financial markets are simply pricing in the preemptive deployment of highly stimulative monetary policy which prevents a recession, but worsens the long term growth outlook. After all, isn’t that exactly what central banks are proposing to do?

Someday soon, central banks will run out of space to keep stimulating. Until then, I don’t see why global growth cannot continue to weaken while certain financial assets continue to make skittish, volatile, and dangerous new highs.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Many thanks for your insights Taps.. The ancillary reading excellent too.

PF

Thanks for the kind words