Submitted by Taps Coogan on the 12th of November 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

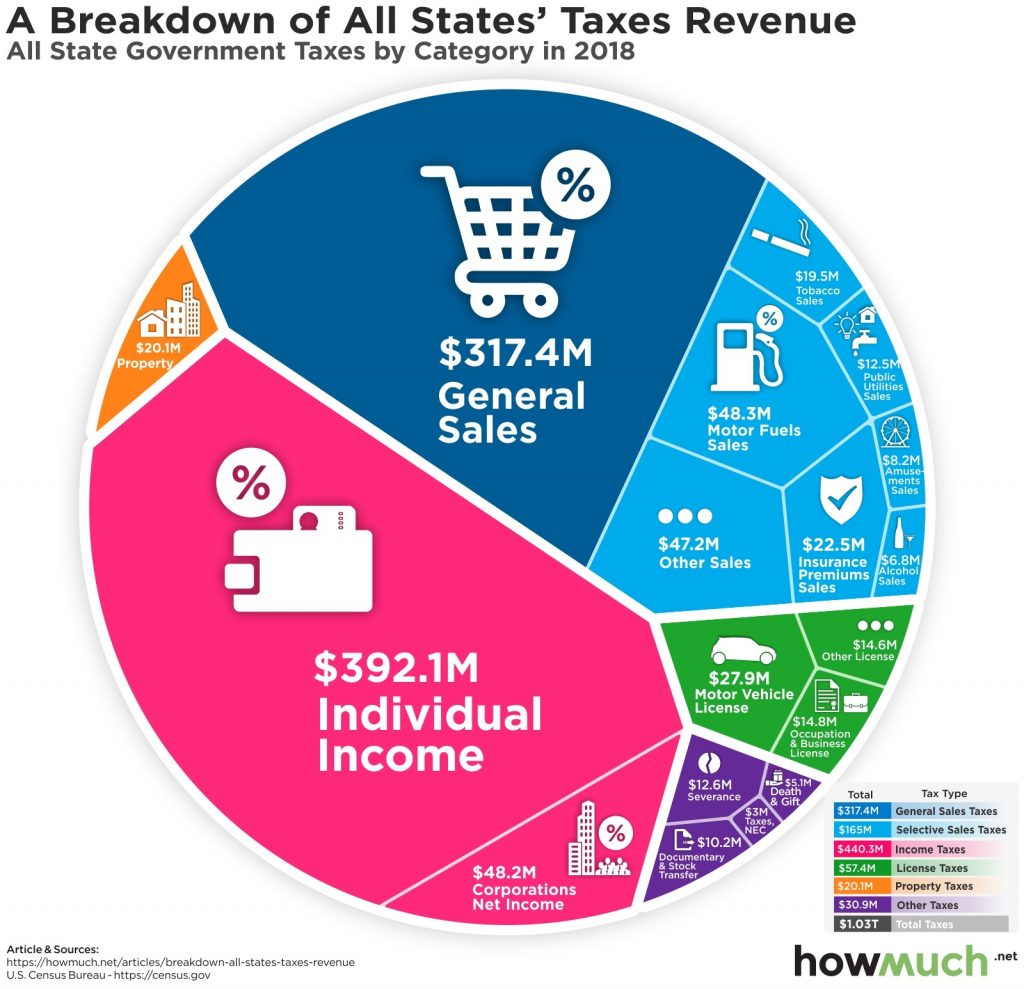

The following chart, from HowMuch.net, shows the various sources of state tax revenue in the US.

Not too surprisingly, the largest source of state tax revenues are income taxes, accounting for just under 40% of all revenues. Income taxes are followed by general sales taxes (32% of revenues), gas taxes (4.8% of revenues), and corporate taxes (4.8% of revenues). In total, states brought in roughly $1 trillion of taxes in 2018, compared to $3.3 trillion for the federal government.

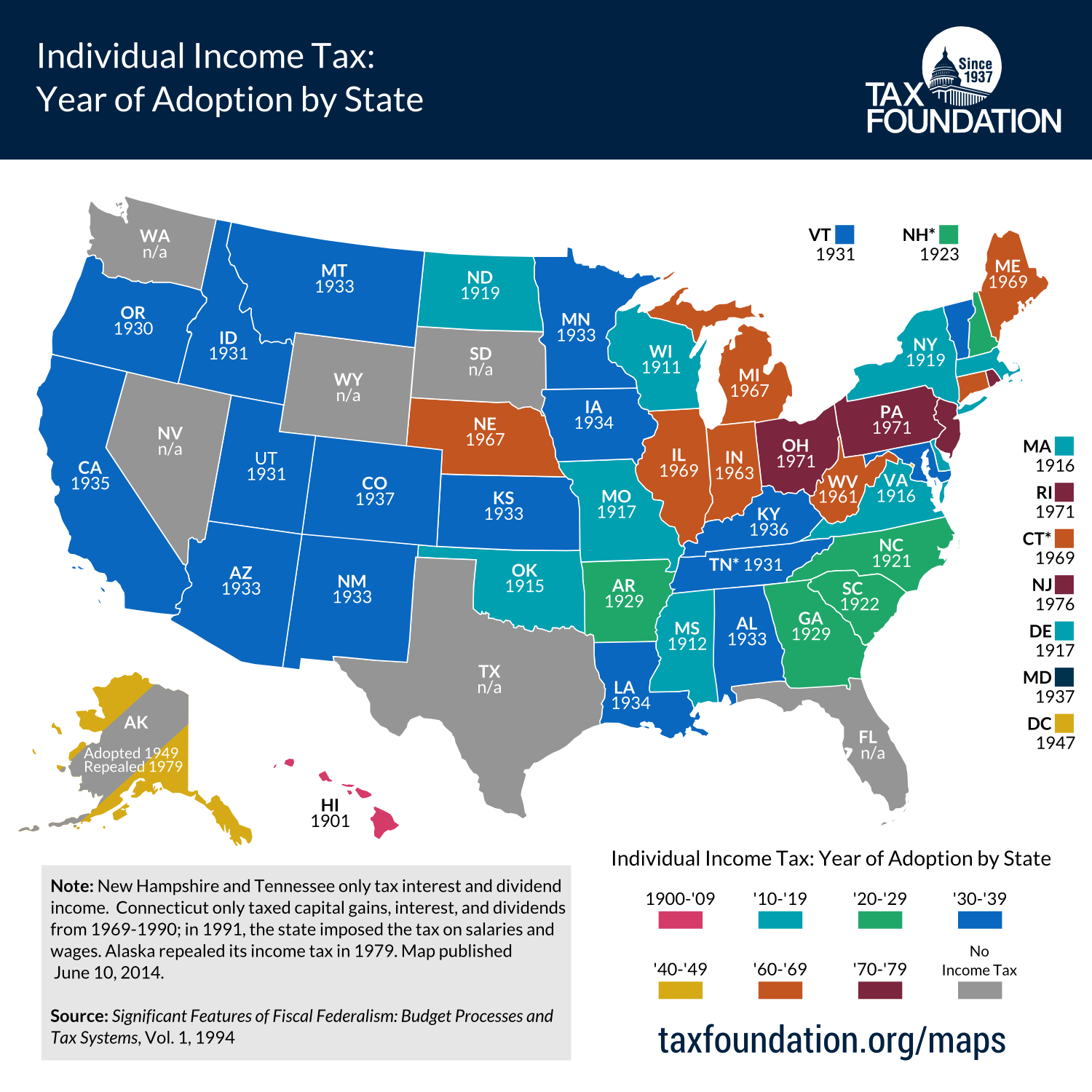

Despite how ubiquitous state income taxes have become, they are actually a relatively new phenomenon. All but Hawaii’s income tax were implemented after the federal government passed the Revenue Act of 1913. Many states didn’t implement incomes taxes until the 1970s, and a few still haven’t (Texas, Florida, Alaska, Wyoming, South Dakota, Washington, and Nevada). It may seem hard to believe given today’s hyper-sensitivity to ‘trade wars’ and tariffs, but prior to 1913, nearly all taxes in the US came from duties, tariffs, and fees.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.