Submitted by Taps Coogan on the 9th of January 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

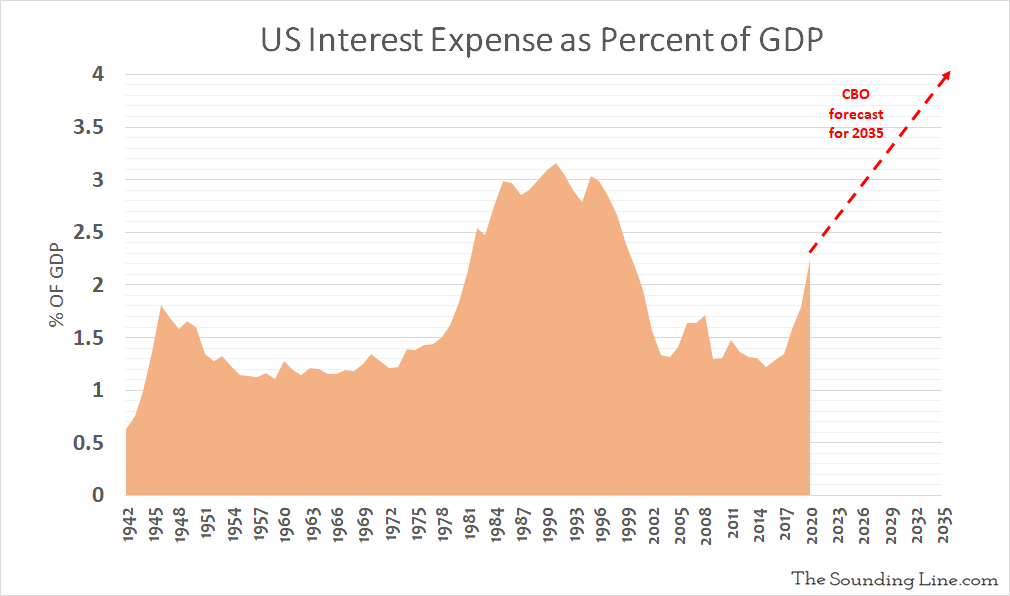

Until now, the largest increase in the interest on the US national debt, relative to GDP, occurred in 1981 when it rose from 1.83% of GDP to 2.14% of GDP in a single year, a 0.39% increase relative to GDP. At the time, inflation in the US was soaring at over 10% and concerns about large deficits (for the era) were widespread.

Assuming that the US economy grows by roughly 2% in 2020, the interest expense will rocket from 1.79% in 2019 to 2.25%, a 0.46% increase, the largest increase on record for a single year.

The US federal government paid over $375 billion of interest on the national debt in 2019 and will pay roughly $479 billion in 2020. The CBO forecasts that the interest expense will reach roughly 4% by 2035, at which point it will be the largest non-entitlement spending item in the US.

The national debt was barely 30% of GDP in the early 1980s and the US ran a budget deficit in excess of 5% of GDP just once during the decade. Today, the national debt is over 106% of GDP and the deficit is likely to remain at least 5% of GDP every year for the foreseeable future. The fact that the interest on the national debt isn’t already radically higher is a ‘miracle’ of low interest rates and inflation. It is something to keep in mind as the Federal Reserve constantly bemoans a ‘persistent and worrying lack of inflation.’

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.