Submitted by Taps Coogan on the 19th of March 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The spending bills are flying out of Washington at break-neck speed. First there was a $8.3 billion emergency bill to cover expenses associated with the federal medical response. Last night, a $104 billion aid bill was signed into law that provides expanded sick leave, enhanced unemployment insurance, increased funds for Medicaid, and other items. Now a $1.3 trillion stimulus bill is under development to provide direct financial assistance to nearly all Americans, loan provisions to small and medium sized businesses, as well as loans for wide swaths of corporate America and Wall Street (including companies that have engaged in out-sized buyback schemes in recent years). A separate $850 billion stimulus bill aimed at providing payroll tax relief and other measures is also working its way through Washington. Once we get through the inevitable political wrangling, these bills, or something like them, are likely to be passed.

If there was ever a time to use federal stimulus spending to help Americans bridge a sharp interruption in the economy, this is probably it. If there was ever a time for the federal government to get its finances in order so that it could provide that stimulus without taking the national debt to outlandish levels, the last decade of economic expansion was it. We are going to do the former. Unfortunately, we didn’t do the later.

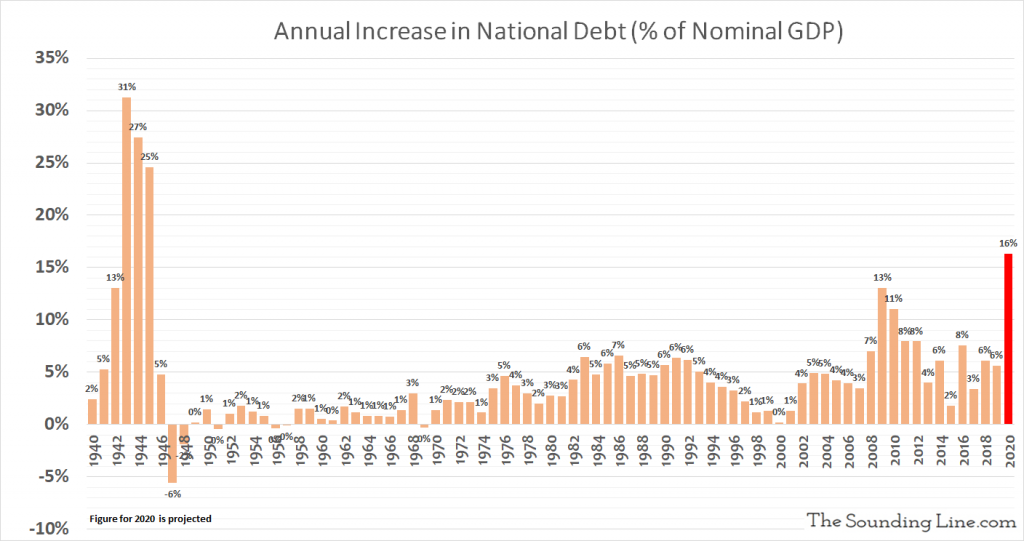

Last year, the increase in the national debt was $1.2 trillion or nearly 6% of GDP. Prior to the Coronavirus outbreak, the national debt was forecast to rise by a similar amount this year. Now the increase will be much higher.

In addition to the $112 billion in emergency spending that has already been signed into law, the stimulus and tax cut proposals currently under discussion amount to $2.15 trillion in further expenses to the federal government. Considering that tax revenues will fall as the economy slows, and that unemployment claims will rise, it is virtually guaranteed that the increase in unfunded federal spending this year will be greatly higher than $3.6 trillion ($1.3 trillion base increase plus passed and proposed spending). Assuming that US GDP doesn’t shrink this year, that works out to an increase in the national debt of over 16% of GDP.

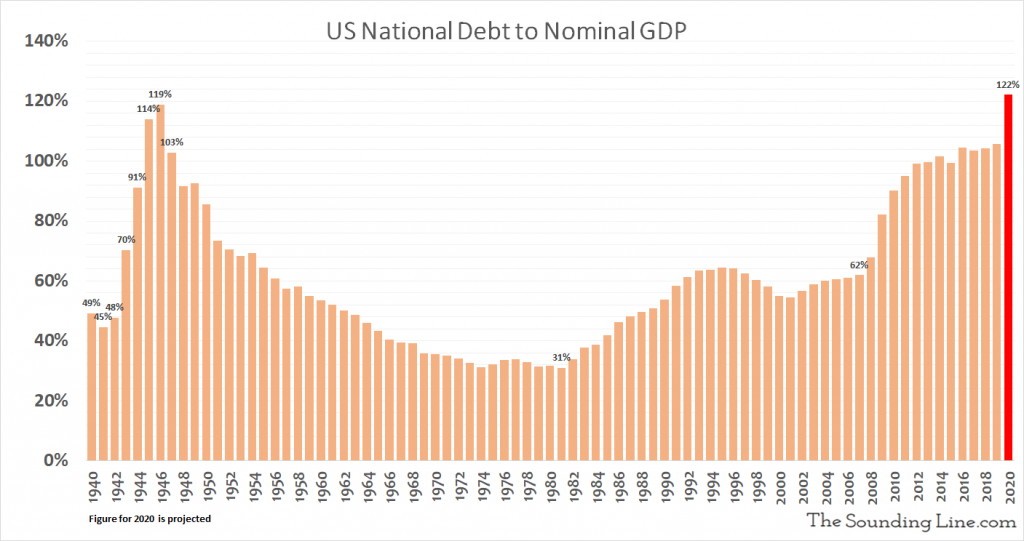

To put 16% of GDP in perspective, the stimulus packages rolled out in 2009, when the US was already a year into a deep recession, increased the national debt by ‘just’ 13% of GDP. For only three years during the height of World War II did the US expand the national debt by over 16% per year.

The difference between then and now was that before WWII, the US debt-to-GDP was just 40%. When the Financial Crisis stimulus was unveiled, US debt-to-GDP was barely 60% of GDP. Today it is 107%. By the end of the year, it will likely be over 122%, the highest level in American history.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Can you say, Weimar?

Lots of uncomfortable historical analogues to this period