Submitted by Taps Coogan on the 1st of May 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

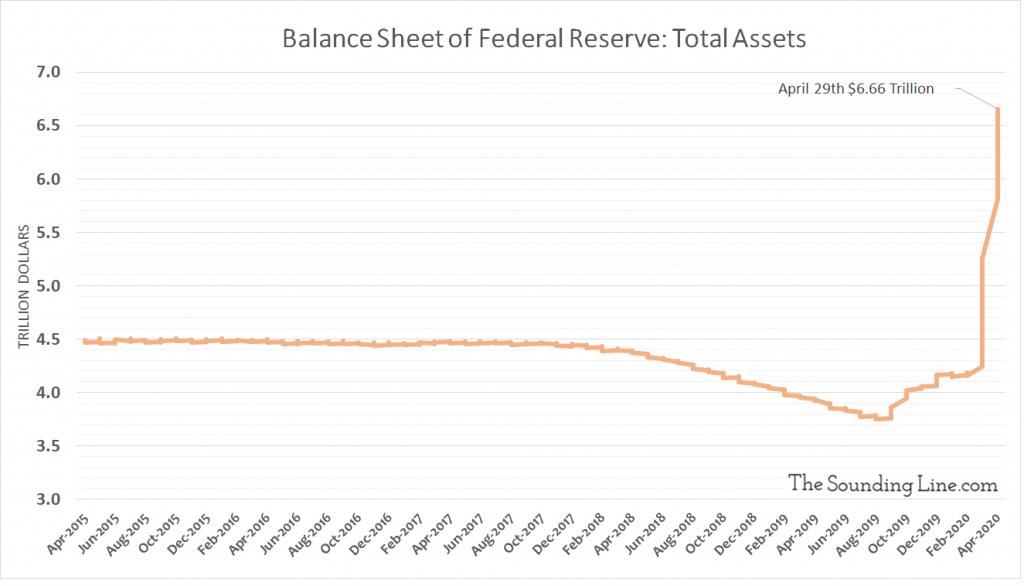

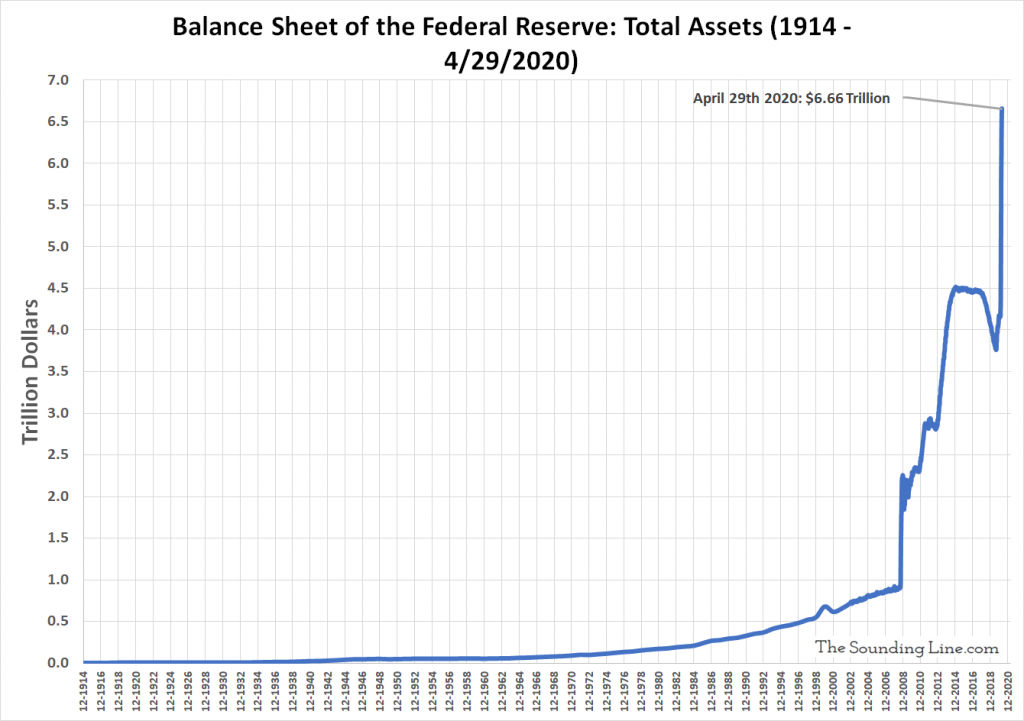

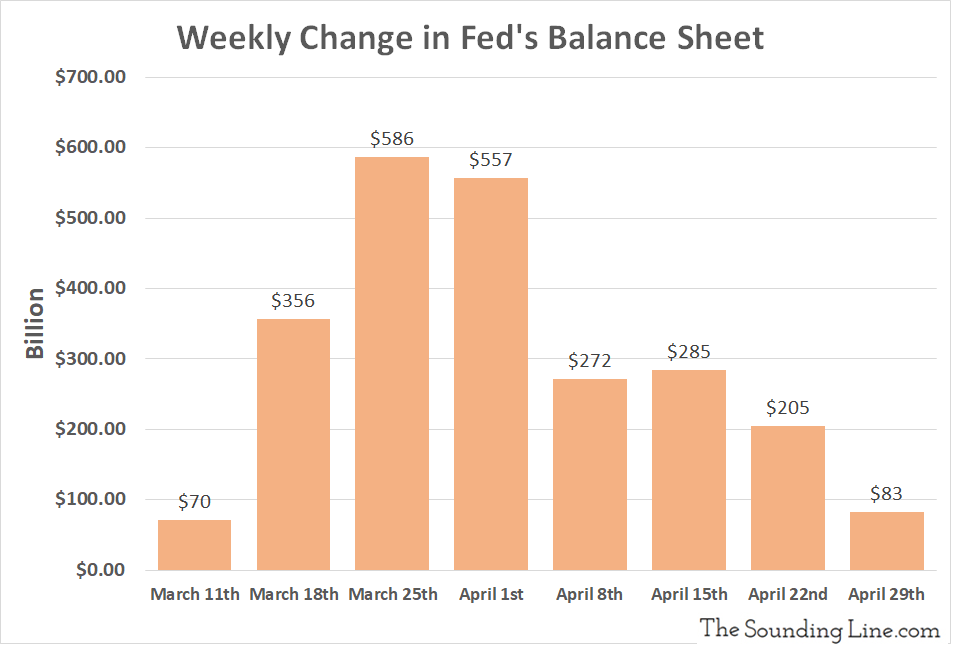

Data released last night (April 30th) reveals that the Fed’s balance sheet grew by another $83 billion over the past seven days, a considerable slowdown compared to recent weeks, although still a blindingly fast pace compared to pre-Coronavirus times.

The past seven days’ $83 billion of ‘printing’ by the Fed compares to $205 billion the week prior and a peak of $586 billion for the seven day period ending March 25th.

Most of the growth in the Fed’s balance sheet over the past week consisted of $62 billion of treasury securities. The Fed also slightly increased its repos (+$702 million), made an additional billion dollars of loans to its alphabet soup of special purpose vehicles, and did another $29 billion in central bank currency swaps. Surprisingly, it shed $17.7 billion in mortgage backed securities. compared to a nearly $30 billion increase the week prior.

The trillion dollar question for markets remains how big the Fed’s balance sheet will get before growth reverts to its longer run growth rate. Even getting back to the $60 billion-a-month pace it was growing at before the Coronavirus outbreak started remains a distant dream.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.