Taps Coogan – July 16th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe

With Chinese state media making a not-so-subtle front page endorsement of engineering a state-backed bull market in Chinese equities last week, Peter Fisher, Dartmouth Tuck School of Business Senior Fellow, recently spoke with Bloomberg Markets about his concerns that it is time to “start worrying” about a bubble in Chinese stocks.

Evoking the 2015 bubble and crash in Chinese equities, Mr. Fisher warns:

“Yes, I think it is time to start having those thoughts (referring to the 2015 bubble and crash). The Chinese economy, for a long time, one of the only places that uncertainty about the future can get expressed is in the equity market. The credit slice of the capital structure has been kind of fixed. The government doesn’t let a lot of corporates default. They have a way higher corporate debt-to-GDP than the United States has, but the government kind of anchors that. And therefore, more of the volatility is going to show through in equities markets because that’s where it can be expressed…”

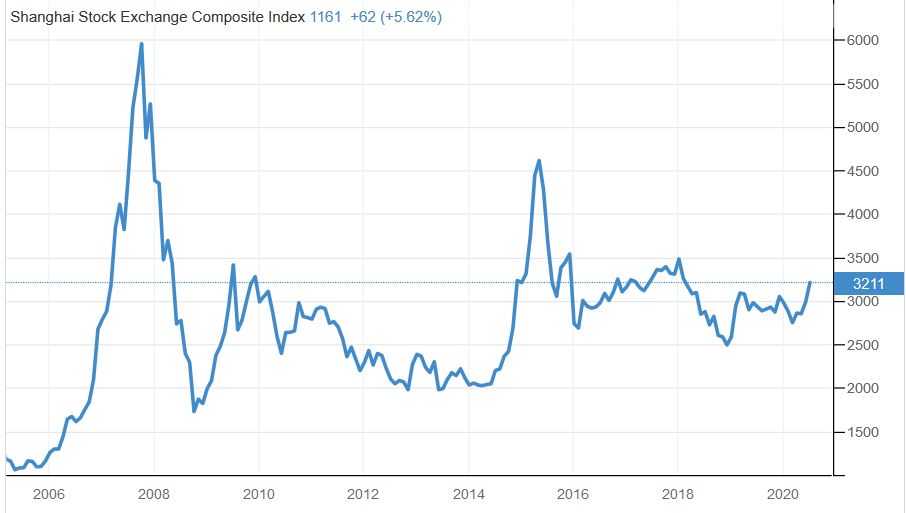

One of the oddities of China’s economic rise over recent decades has been the dismal relative performance of its equity markets. The benchmark Shanghai Composite has taken a volatile trip to nowhere over the last 13 years and remains below levels first achieved in 2007.

As Mr. Fisher notes, Chinese economic planners have, until now, left the equity markets to fend for itself (for the most part), preferring to fudge their economic numbers through bubbles in real-estate, infrastructure, and corporate/local government debt.

Now, amid unprecedented economic and geopolitical turmoil, massive flooding, spiking food inflation, and with its preferred bubbles long past the point of diminishing returns, it appears that China is pivoting to the last bubble left unblown: stocks.

With 600 million Chinese citizens living on less than $5 a day (yes, you read that correctly), here is some friendly advice informed by decades of experience with Fed blown stock bubbles: they don’t help one bit.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.