Taps Coogan – September 13th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

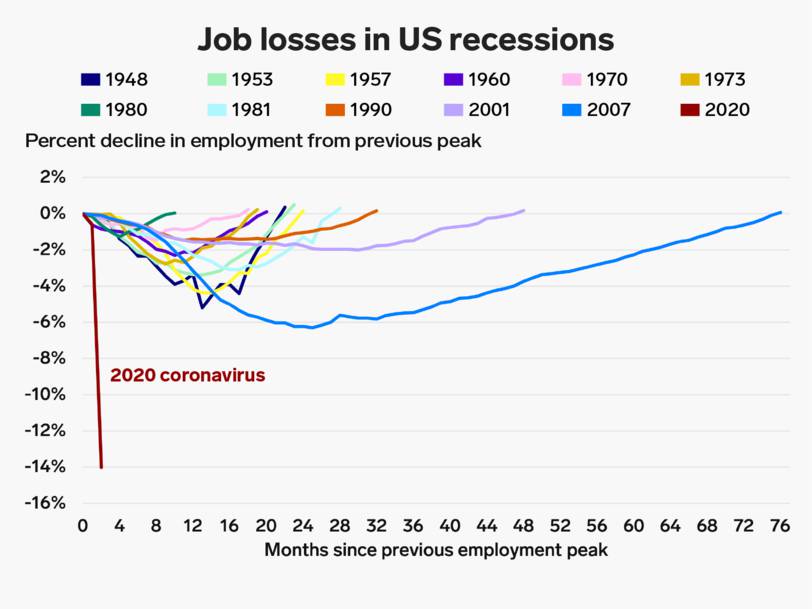

Daniel Lacalle, Chief Economist at Tressis Gestión and author of several books including ‘Escape from the Central Bank Trap‘ and ‘Freedom or Equality,’ recently spoke with NTD News about the worrying trend whereby every recession sees deeper job losses and a slower recovery than the prior, as illustrated in the following chart.

As Mr. Lacalle notes, the cause of this phenomenon is the over reliance on “monster” print-and-spend stimulus as opposed to implementing badly needed structural economic reforms.

Some excerpts from Daniel Lacalle:

“The reason why we get out of every crisis in a completely weaker way, particularly for job creation…, is fundamentally because injecting monster amounts of liquidity and increasing government spending delivers… a much weaker result in terms of job creation and real wages for most workers”

“Every time the stimulus is not only larger but more incentivized towards… protecting bloated government spending… it is a transfer of wealth from workers and savers to the government and its crony sectors… When you inject massive amounts of liquidity very early on in a crisis and you increase government spending… who benefits? The public sector and those who have access to debt and those who have access to assets…”

“Money creation is never neutral… It always benefits the first recipients of the money created and the ones that pay for it are the last recipients of that money. So who are the first recipients of that newly created money…? Government and financial markets. Who are the last recipients? Workers, salaries, and small business”

Of course, none of that will stop the Fed gravy train.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

This article is spot on!