Taps Coogan – September 28th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

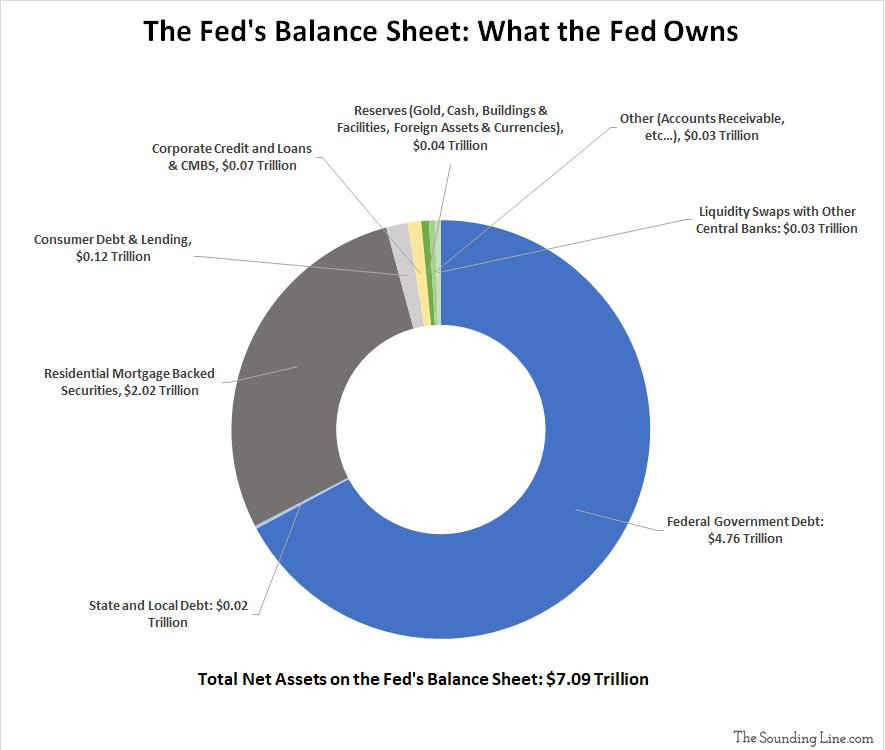

As the Federal Reserve continues its unprecedented ‘money printing’ and asset buying spree, running at roughly $120 billion a month, here is a snapshot of what the Federal Reserve currently owns.

Roughly two thirds of the Fed’s assets are comprised of government debt, virtually all of which is federal Treasury debt. Roughly a quarter of the Fed’s assets are residential mortgage backed securities. Of what remains, the largest slice is credit to consumers followed by credit to corporations.

Many of the assets in the consumer and corporate debt categories have been purchased as part of the Fed’s response to the Covid pandemic. Most are not technically held by the Fed but are instead funded by the Fed through off-balance sheet special purpose vehicles to get around the fact that the Fed does not have the legal authority to be buying them in the first place. Despite these assets totaling over $120 billion and garnering a lot of headlines, they remain a very small portion of the Fed’s overall holdings which are still dominated by massive and fast growing quantities of government debt and mortgaged backed securities.

Despite everything that has happened since the Global Financial Crisis, and more recently the Covid pandemic, the Fed is still overwhelmingly about financing our otherwise unfinanceable federal deficits and propping up the US housing market.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.