Taps Coogan – January 20th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The US national debt-to-GDP ratio is currently in the ballpark of 133%. By the end of fiscal year 2021 it will likely be in the ballpark of 150% and still rising.

The argument that the US can continue to increase the debt-to-GDP by 10%-20% per year without economic and social consequences seems to hinge on the fact that the three other developed economies with higher debt-to-GDP ratios than the US still exist (Greece, Italy, and Japan).

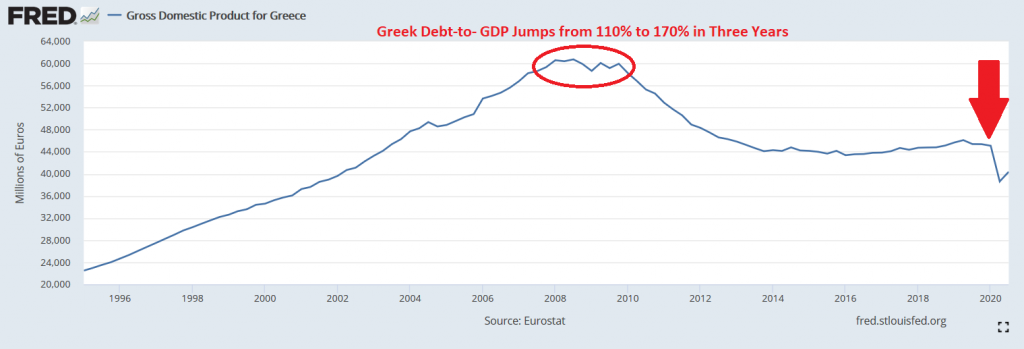

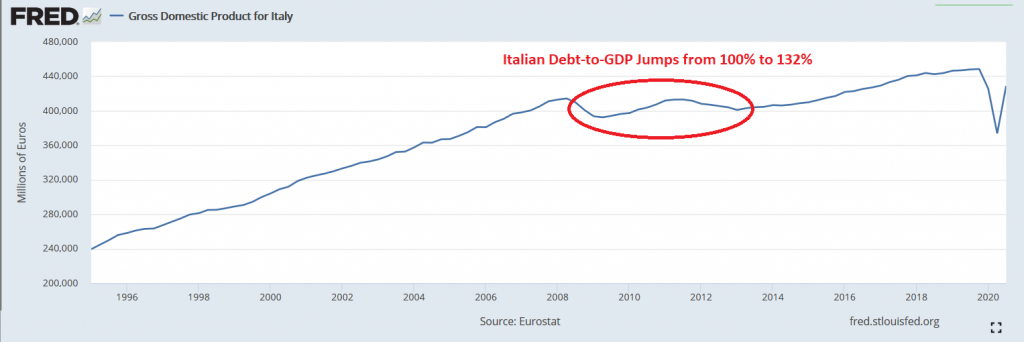

A detail that always seems to get forgotten in that comparison is that all three have witnessed zero/negative GDP growth ever since exploding their national debts meaningfully beyond 100%.

Greece GDP

Italy GDP

Japan GDP

Those are the only developed-market examples of countries with higher national debt-to-GDP than the US today. The only thing to celebrate about the economic performance in those countries is that Italy and Japan have avoided an outright economic contraction over the past 15 years, a period that witnessed roughly 45% economic growth in the US.

Presumably, the US economy is going to rebound strongly for the next year or two. That almost always happens in the wake of recessions. Nonetheless, the examples above are what await us in the long run. The only possible ‘fix’ would be an ‘everything including the kitchen sink’ pro-growth/pro-productivity economic reform agenda. It is as unlikely as ever.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.