Taps Coogan – March 11th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

We started pointing this out a few months ago and we are going to point it out again: the Fed needs to double its QE program.

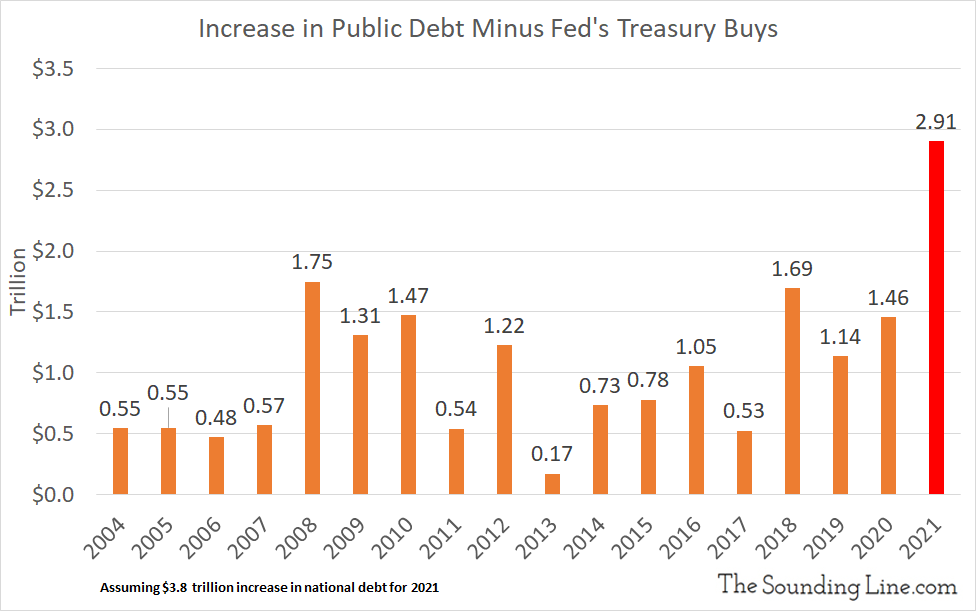

The reason is simple and is highlighted in the chart below.

In calendar year 2020, the national debt surged by an unprecedented $3.8 trillion. However, the Fed bought $2.36 trillion worth of treasury securities in 2020. That left public markets with just $1.46 trillion to absorb, within the typical yearly range seen since the Global Financial Crisis.

This year is very different. The Fed is currently running QE-Infinity at $120 billion a month, of which $80 billion a month is treasury purchases. That equates to ‘only’ $960 billion of treasury buying this year, down from $2.36 trillion last year.

Our guesstimate for the increase in the national debt this calendar year comes in at around $3.8 trillion. That is roughly inline with the CBO estimate when updated for the most recent stimulus bill (the CBO forecast is for the fiscal year not the calendar year). The exact increase in debt will depend on the timing and phasing of any infrastructure bill, student debt transfer, further stimulus checks, etc…

Unless the Fed increases its QE program dramatically, markets are going to have to absorb something like $1.3 trillion more treasury debt this year than last year and by far a new record. Put differently, the difference between the amount of treasury debt likely to hit public markets this year and last year is 30% more than all of China’s treasury holdings, holdings that took China a generation to accumulate. Considering that foreign treasury holdings have actually been stagnating for years, if the Fed doesn’t step in, the job of funding America’s reckless runaway deficits are likely to fall on the domestic private sector.

If you are wondering why long term rates keep inching higher, it’s because the private sector isn’t going to fund the government at a negative real rate to the tune of trillions of dollars for very long.

Good luck to the Fed if it tries to double its QE program later this year when inflation is pushing 3%. As we’ve been stating over and over, the good old days of endless inflation-free monetization are over.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.