Taps Coogan – March 15th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The mantra of fiscal policy for the last decade has been that the government should take advantage of low interest rates to borrow enormous sums of money and spend it on various political schemes because doing so is ‘cheap.’

In the simplest sense, this is true. Each incremental trillion dollars of government borrowing done today costs less to service than it did 20 years ago. In the long run however, that dynamic quickly becomes irrelevant.

The national debt has increased every year since 1957. Even during the late 1990s when Congress briefly ran a ‘budget surplus,’ off-budget spending and intragovernmental debt kept pushing the total national debt higher every year.

For all intents and purposes, the US government never pays off its debt. It adds new debt to its pile every year and rolls any maturing debt forward at the prevailing interest rates of the day. Debts incurred in 1957 weren’t paid back at the interest rates of 1957. They were rolled over at the interest rates of the 1960s, 1970s, 1980s, 1990s, 2000s, 2010, and are still owed today.

Now, if we magically balanced the budget this problem would go away in time, but we aren’t going to balance the budget. Balancing the budget is, for all practical purposes, impossible. As we note every year, mandatory entitlement spending and the interest on the national debt exceeds all federal tax revenue. All functions of the federal government other than entitlements and the interest on the national debt are payed for with debt.

Recognizing these realities, the only way to outpace the national debt is through growth or inflation. However, the national debt is growing by about 20% of GDP a-year post-Covid and was growing at about 6% pre-Covid. The US economy can’t grow at 6% on a sustained basis, let alone 20%. Even China struggles to pretend to grow at 6%. Real US GDP growth during ‘hot’ years like 2017 and 2018 was between 2% and 3%. Yes, there will be a big bounce in growth in 2021, but that will just make up for the shortfall in 2020. On a long term basis, assuming we get back to healthy growth and get the deficit back to pre-Covid levels, there is a 3% to 4% shortfall between the growth in the economy and the national debt.

All that is left to bridge that shortfall is inflation. So, for all intents and purposes, inflation has become the ‘plan.’ Accordingly, the Fed has suspended its 2% inflation limit and constantly reminds everyone that it wants inflation to run hot.

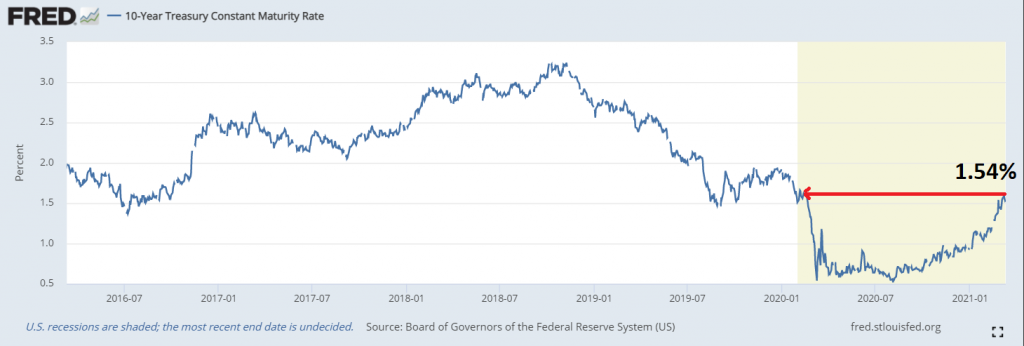

Of course, there are problems with inflation and we are living one of those problems right now. When inflation rises, so do interest rates. While policy makers drone on about taking advantage of low interest rates, interest rates have been busy rising. Right now the 10-year treasury rate is higher than it was when Covid sprang onto the world stage last February. All of the debt that we are hurriedly piling on ourselves is already costing nearly as much as it would have pre-Covid.

What we ‘need’ more than just inflation is interest rates that are lower than the inflation rate. i.e. negative real interest rates. However, negative real rates and rising nominal rates and rising inflation is the absolute worst scenario for the bond investors that are supposed to be financing the ever growing national debt. That mix represents a guaranteed loss of real wealth for bond holders. How are bond holders supposed to lend ever more money to the government while they are busy going broke?

For that reason, negative real interest rates don’t persist for long in a rising nominal rate environment without massive interventions by central banks. The ECB and Bank of Japan have had to buy virtually all debt issuance from their respective governments to enforce negative nominal rates and their bond investors haven’t had to worry about rising nominal yields, at least not until recently.

So, the Fed needs to do much, much more QE. However, inflation is rising in part because the Fed is already doing so much QE. So what will happen to inflation expectations if the Fed were to double or triple their QE program in a bid to keep real rates deeply negative? And how much more upward pressure on rates will all that extra inflation cause? And how much more QE will that extra pressure on rates necessitate?

Before you know it, the Fed would be monetizing the entire deficit on a perpetual basis. But, if the Fed is monetizing the entire deficit at a negative real rate, what would stop Congress from sending everyone $2,000 checks quarterly, or monthly, or sending state and local governments another trillion dollars, or bailout even more insiders? After all, real rates would be negative, people would still be suffering (now from inflation), there would still be carbon in the atmosphere, enemies in the Middle East, etc…

How does all of this end? If Congress cannot get a grip on the extremist deficit spending, very badly. That’s how.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.