Taps Coogan – March 23rd, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

During and after the Global Financial Crisis (GFC), bank lending plunged from an annualized growth rate of about 10% in 2007 to negative 5% by 2010, the lowest level on record.

During the Covid pandemic, US bank lending growth surged from 5% to over 10% for the first time since the GFC and remains near 10% today.

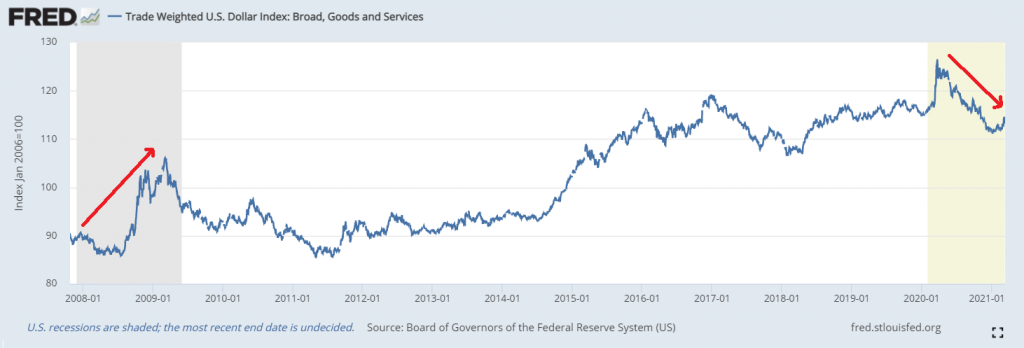

During the GFC the Broad US Dollar Index surged by nearly 20%. During the Covid Pandemic, the Broad US Dollar Index briefly surged by a little over 10% before falling by more than 10%.

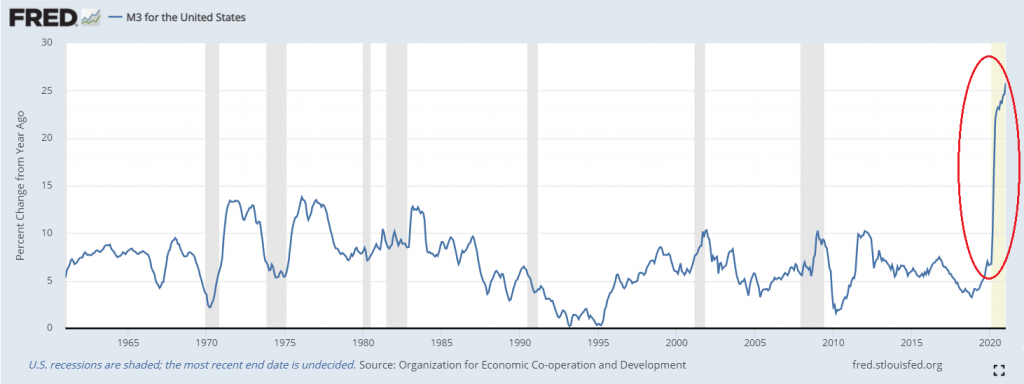

All the quantitative easing deployed by the Fed in the years following the GFC had little observable impact on the broad money supply which remained bound within its historical range.

The helicopter money & stimulus since the Covid pandemic has pushed the broad money supply to the highest level on record by a country mile. Milton Friedman is rolling in his grave.

5-Year breakeven inflation fell to deeply negative levels during the GFC and failed to get back to its pre-GFC level during the recovery years.

5-Year breakeven inflation never turned negative during the Covid pandemic. It is not only 50% higher than it was pre-Covid, it is back to the pre-GFC level for the first time in 13 years.

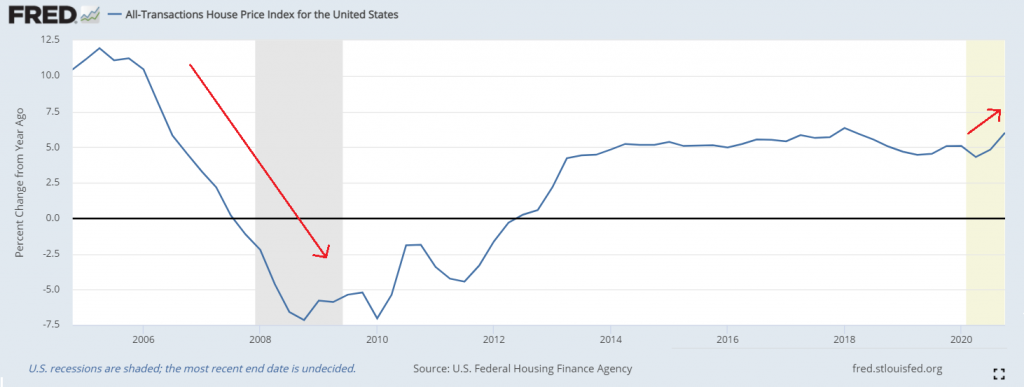

US home prices plunged during the GFC. Home prices have risen slightly since Covid.

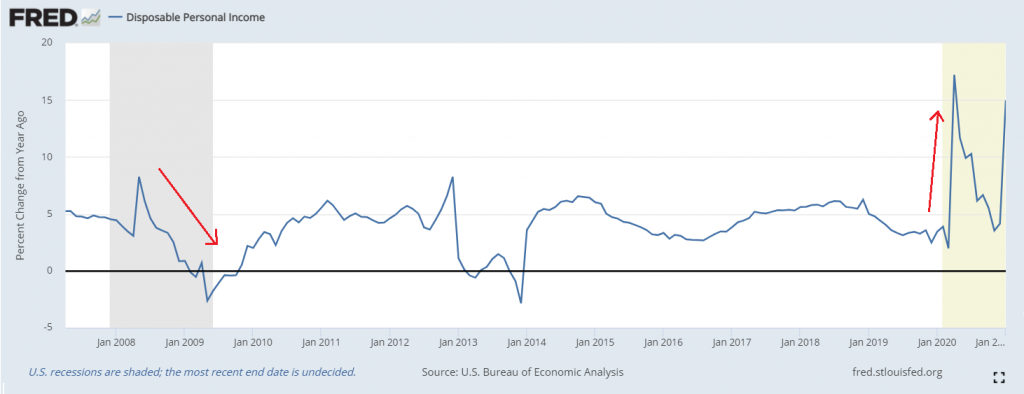

Disposable income plunged during the GFC. Since Covid, disposable income has surged at the fastest rate on record, courtesy of helicopter money & looney-tunes sized stimulus.

The post-GFC era was an unmitigated boon for investors in pretty much everything (other than commodities). That was possible because official inflation metrics kept undershooting expectations, enabling an endless ‘Fed Put’ and perpetually falling interest rates. That dynamic is over.

The Fed is determined to remain excessively simulative for years. I doubt that that determination will make it through 2021.

The post-GFC era is over. The post-Covid era has begun.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.