Taps Coogan – May 20th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

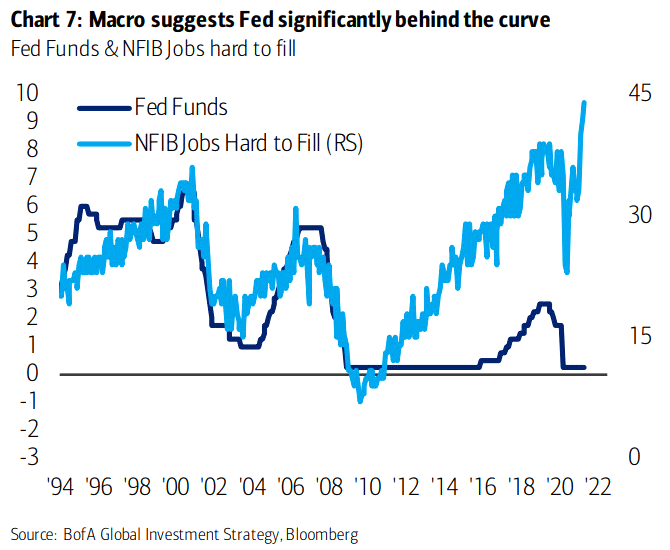

Add the following chart, from Bank of America via ISABELNET, to the pile of charts showing how wildly out of whack monetary policy is.

The Fed should have started tightening policy back in 2012 or 2013. Instead, they delayed until late 2015 and then moved at a snails pace until 2017. That forced them to play catchup in 2017 and 2018 when, in reality, by 2018 they should have been slowing down. It also meant that the economy piled on debt too fast relative to growth for years and financial markets got too disconnected relative to fundamentals, creating an unhealthy sensitivity to rising rates and economic shocks that worsens to this day.

Once again, the Fed is going to be late to tightening policy. They’re insistent that they’ll be late by years, though that seems unlikely given the increasingly high profile of rising inflation. Being late will do nothing more than guarantee that inflation runs too hot for the time being and then, whenever they do get around to tightening, too low because the economy will be that much more over-indebted and over financialized and thus that much more sensitive to rising rates.

The economy doesn’t care whether the Fed under-shot its arbitrary and poorly constructed inflation target in 2015. Bad policy is bad policy.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.