Taps Coogan – May 26th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Taps Coogan: As mentioned yesterday, we’ve had a technical issue here at The Sounding Line. We’ve been able to successfully restore all our articles (sadly without comments after May 16th), expect this one. I can’t find a backup of the original anywhere so I have rewritten it from scratch. As such, it is definitely not the same, though the overarching point will be. Everything should be back to normal from here on out.

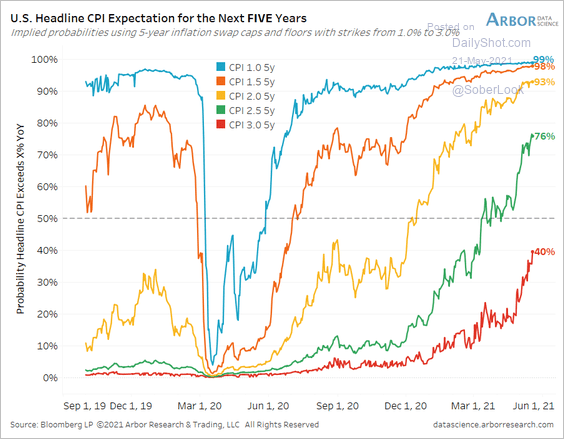

The following chart, from @DataArbor via The Daily Shot, shows that options swaps markets for 5-year TIPS inflation protected treasury securities are implying a 40% chance that CPI inflation averages over 3% for the next five years.

That’s consistent with 5-Year TIPS breakeven inflation rates hovering around 2.6%, the highest rate since 2008. 5-Year breakevens have a somewhat spotty record of predicting month to month trends in CPI inflation but have done a reasonable job forecasting the five-year forward average.

While the Fed has its finger on the scale for implied inflation measures by extension of the fact that they buy TIPS as part of QE-Infinity, these are the closest to market-based forecasts for inflation we’re going to get. The punchline is the market believes that the inflation will overshoot the Fed’s target for five years.

Nobody knows what ‘transitory’ inflation means because the Fed refuses to define it. Presumably it means more than a few months and less than a couple years However, judging by how skittish economists and markets have gotten over a just one solitary month of inflation overshooting, it seems as though they meant ‘no inflation at’ all when they warned repeatedly about ‘transitory’ inflation.

For those keeping track at home, headline CPI inflation is currently 4.2% for March and has averaged 3.4% since the series started in 1948. PCE core inflation, the lowest of all mainstream measures of inflation and therefore the one that the Fed uses to set policy, is currently 1.8% and has averaged 3.2% since its inception in 1960. When the Fed talks about needed to make up for past undershoots in inflation, what they really mean is that 2% is a floor not a target.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.