Taps Coogan – June 27th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

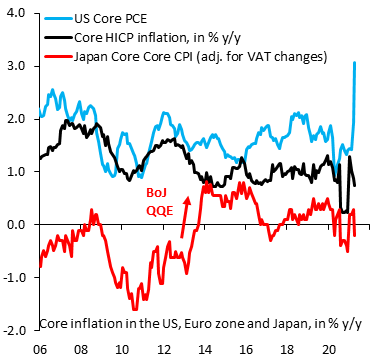

The following chart, from the ever-interesting Robin Brooks, shows the benchmark inflation rate in the US, the Eurozone (HICP), and Japan.

First things first, this chart should put to rest the tedious “base effect” argument as to why inflation is jumping in the US. US inflation measures didn’t drop very much last year. In the places where they did drop (Europe and Japan), the places where you’d expect a large base effect this year, there isn’t one.

Inflation is surging in the US because we sent nearly everyone in the country thousands of dollars of free money, expanded unemployment benefits to such an extent that they exceeded average wages, bailed-out nearly everything in sight, suspended evictions, and put the whole affair on the Federal Reserve’s tab. In the process, we expanded the money supply and the national debt by about 25%.

Inflation may cool off from here, It may not. Either way, it is not a statistical artifact of some year-over-year rate of change calculation. It’s real.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

A trillion here, a trillion there. Who really cares?

Pretty soon we all be the penniless trillion heirs!