Taps Coogan – August 13th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The main argument touted by central bankers and some economists to justify seemingly endless periods of very low interest rates is the idea that low interest rates encourage more bank lending which, in turn, is supposed to stimulate the economy.

Critics of endless accommodative policy have long noted that there is little observable evidence that bank lending ratios and loan growth actually have meaningfully increased in the way policy makers have expected.

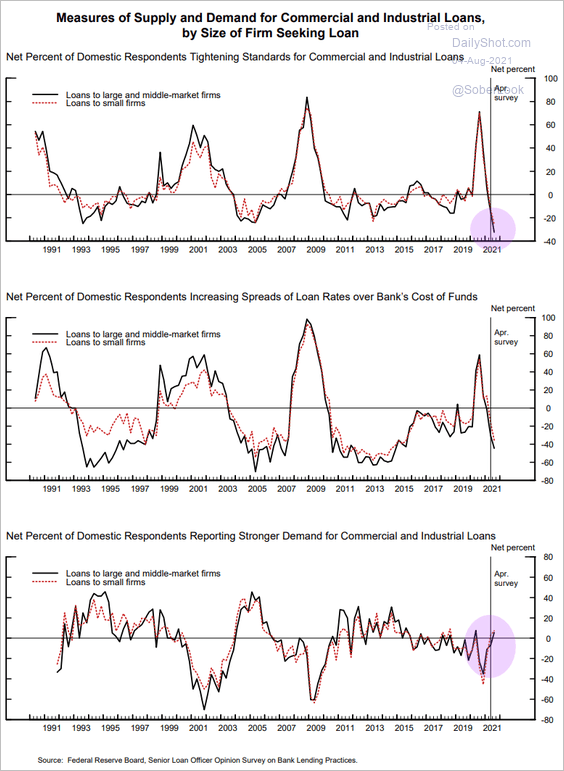

The following three charts, via the The Daily Shot, capture that dynamic.

The first chart shows that a record number of banks are loosening lending standards to small, medium, and large commercial and industrial borrowers.

The second chart shows that bank loan spreads have fallen to their lowest since the last time interest rates were around zero. (the difference between the banks’ funding costs and the interest rates they charge).

The third chart shows that lending demand is barely positive.

In other words, despite easing lending standards to record levels and compressing their margins, banks are still seeing tepid demand for new loans.

Why?

People don’t borrow money just for the fun of it. To get credit growth you need economic opportunities that people want to invest in. The Fed can’t print those.

Taking nearly the lowest interest rates in history and making them a little bit lower, is probably going to keep some bad businesses borrowing longer than they otherwise would have and it will make some bad business ventures seem like good business ventures so long as rates stay artificially low. That may be enough to keep credit growth slightly positive for all the wrong reasons, but it’s weak medicine with bad side effects. In other words, central banks are grossly exaggerating their ability to move the needle on healthy growth despite the most aggressively accommodative monetary and fiscal policy mix on record.

If you want to stimulate actual economic activity you need actual pro-growth economic reform. That’s all that politically hard stuff like reducing taxes on the productive parts of the economy, streamlining regulations, cutting bureaucracy, improving trade deals, addressing the root causes of spiraling healthcare costs, improving education in the sciences, trades, engineering, etc… There is no alternative and never has been.

Monetary policy is a costly distraction.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

People don’t borrow money just for the fun of it. To get credit growth you need economic opportunities that people want to invest in. The Fed can’t print those.

Bingo.

Corollary: Downward manipulation of interest rates and yields forces down the hurdle rate that governs and filters endeavors worth undertaking. In the long run, unnaturally impaired economic endeavors are synonymous with lower economic opportunity. The deliberate debasement of yield is the deliberate debasement of economic activity and economic opportunity.

And somehow people are surprised that we’ve struggled with low productivity growth in an environment where we incentivize low productivity business

An it unnaturally crushes the natural learning curve, which is the heart of capitalism and human progress, not dissimilar to other unnaturally and/or illusory “free” systems of the world….

https://www.youtube.com/watch?v=cidZRD3NzHg&t=990s

That interview should be watched from the start — it’s all about Godel, who even today continues to expose the vast void that exists directly below Google, AGI and even ML (in any open-system application), all of which presently float dizzyingly high above and underlying reality like Wile E. Coyote over the cliff.

I’ll definitely watch that whole video and here’s another one that your video reminded me of. It’s well worth the 5 hours but watch it at 1.25 speed…….John Taylor Gatto is a slow talker.

https://www.youtube.com/watch?v=IZBdv2yznmI