Taps Coogan – September 12th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

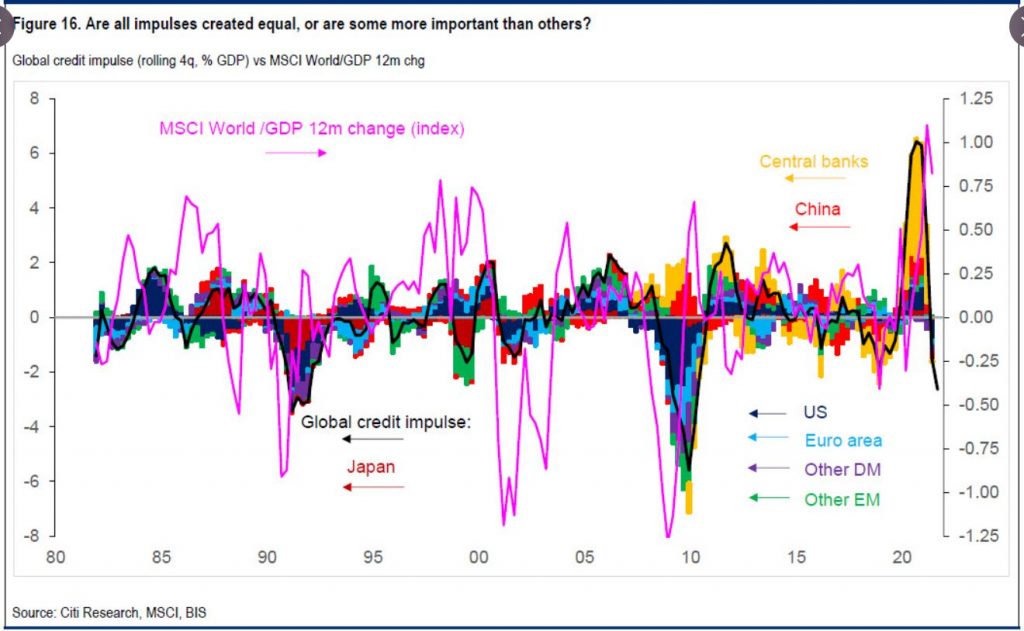

There is a lot going on in the following chart, via Zerohedge, but the punchline is that the global credit impulse is contracting for the first time since early 2020.

The global credit impulse (the black line above), the rate of growth of credit in the world’s major economies, is now negative along with every sub-region. That includes developed and emerging markets, the US, the Eurozone, Japan, China, and even net central bank holdings.

While a negative credit impulse is not an unusual occurrence and doesn’t necessarily represent an insurmountable problem for markets, it does signify that the ‘knee-jerk’ part of the recovery from the depths of last year’s recession is essentially over, along with the biggest credit impulse ever seen.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.