Taps Coogan – September 23rd, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

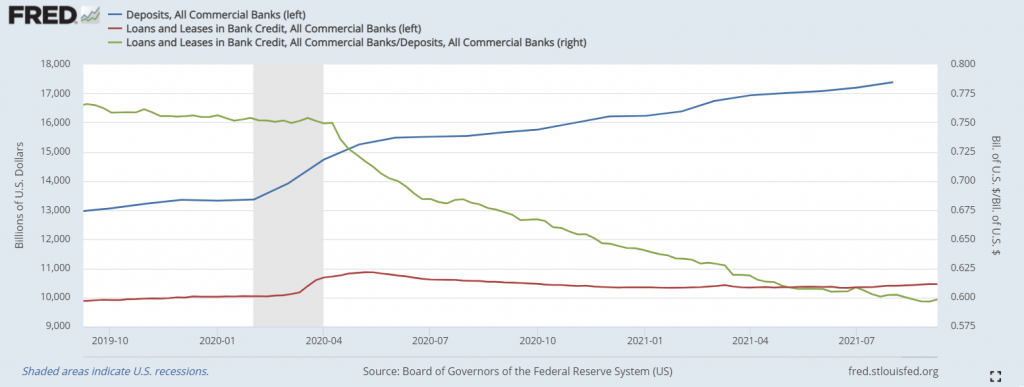

On April 1st, 2020, as the first wave of Covid was cresting, commercial banks in the US had roughly $14.7 trillion of deposits and $10.6 trillion of loans and leases.

Since then, the Fed has done $2.6 trillion of QE, which has led to a $2.6 trillion dollar-for-dollar increase in bank deposits.

Nominally, the Fed did that QE in order to increase bank deposits and push down borrowing costs with the goal of simulating credit growth.

So, how well has the last $2.6 trillion of QE worked? Since last April, the average 30-Year mortgage rate has fallen from 3.5% to 2.86% and BB High-Yield bond yields have fallen from 7.14% to just 3.12%.

So far, so good.

So, how much has bank lending increased?

Negative $230 billion.

As we have pointed out over and over, the limit on bank lending stopped being the availability of deposits or prevailing interest rates back in 2009 when the Fed dropped the Fed Funds rate to ‘0’ and created the ‘Excess bank reserve’ regime that we’ve been stuck in ever since. We are trillions upon trillions of dollars from a place where more QE will have any lasting bearing on bank lending growth.

Despite platitudes about stimulating the economy, QE is actaully about three things: boosting asset prices, keeping the interest on the national debt down, and facilitating corporate bond issuance.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.