Taps Coogan – October 1st, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

‘Stagflation,’ the economic condition of high inflation despite slowing growth and high unemployment, should not exist according to the Phillips Curve and most of the economic models used by economists and central bankers to set monetary policy.

Of course, stagflation definitely does exists and was witnessed repeatedly in the US during the 1970s and quite often in emerging markets. It looks something like this, via Jesse Felder.

In the world’s five large developed economies (The US, Eurozone, UK, Japan, and Australia), manufacturing input prices are still surging while growth in actual orders cools down substantially.

Why is this happening? Inflation is arising from surging energy prices, surging transportation costs, residual supply chain bottle necks, and endless monetary and fiscal stimulus despite persistently high unemployment.

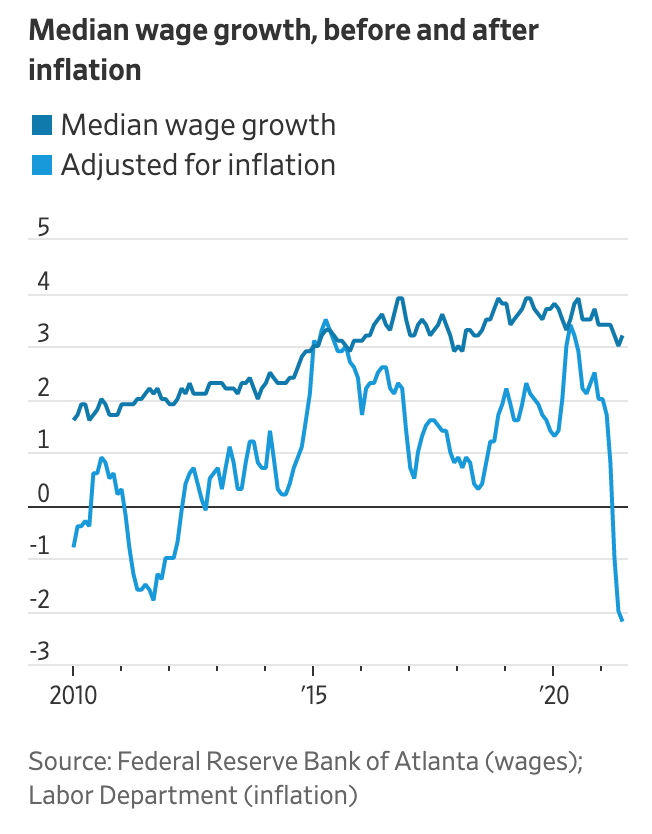

In fact, we are witnessing a bigger decline in inflation adjusted wages than occurred during the Global Financial Crisis. Again, stagflation looks something like this:

Print, spend, tax, and regulate doesn’t work, something we’re going to have to learn the hard way.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.