Taps Coogan – October 4th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

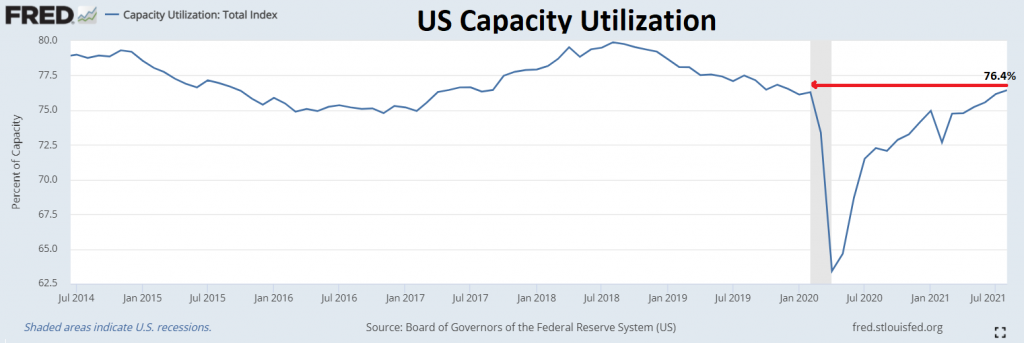

Every month the Federal Reserve publishes the US industrial capacity utilization rate based on the results of a Census Bureau survey of manufacturers across the country. The aim of the survey is to estimate what percentage of the nation’s total industrial production capacity is being utilized at any given moment. The latest numbers, which represent data for August, show that capacity utilization has fully recovered to pre-Covid levels.

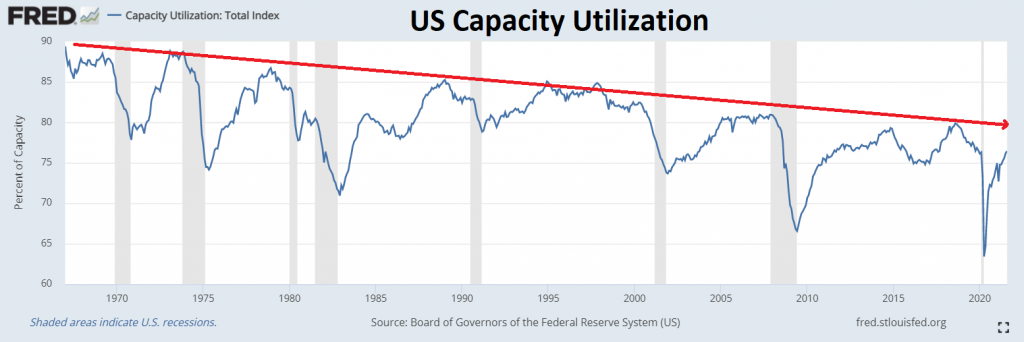

While US Capacity Utilization has now fully recovered to pre-Covid levels, it remains in a longer term downtrend since the beginning of the data series in the late 1960s.

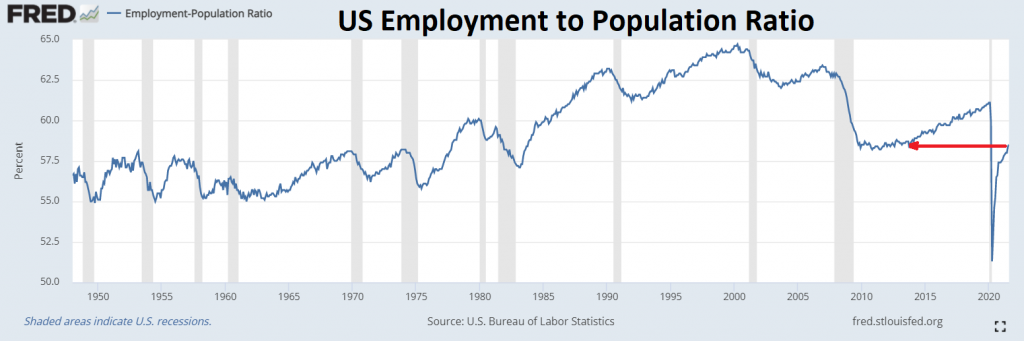

The fact that the US economy is generating such a high level of inflation at these relatively low levels of capacity utilization (and labor participation), should probably raise a few big red flags about the entire Phillips-Curve school of thought that dominates the Fed and also about the prudence of pouring monetary and fiscal stimulus on top of an economy that is recovering as fast as could be hoped for.

Of course, the monetary and fiscal stimulus still on the table has less to do with economics than it does asset prices and politics, so it will presumably happen nonetheless.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.