Taps Coogan – October 2nd, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

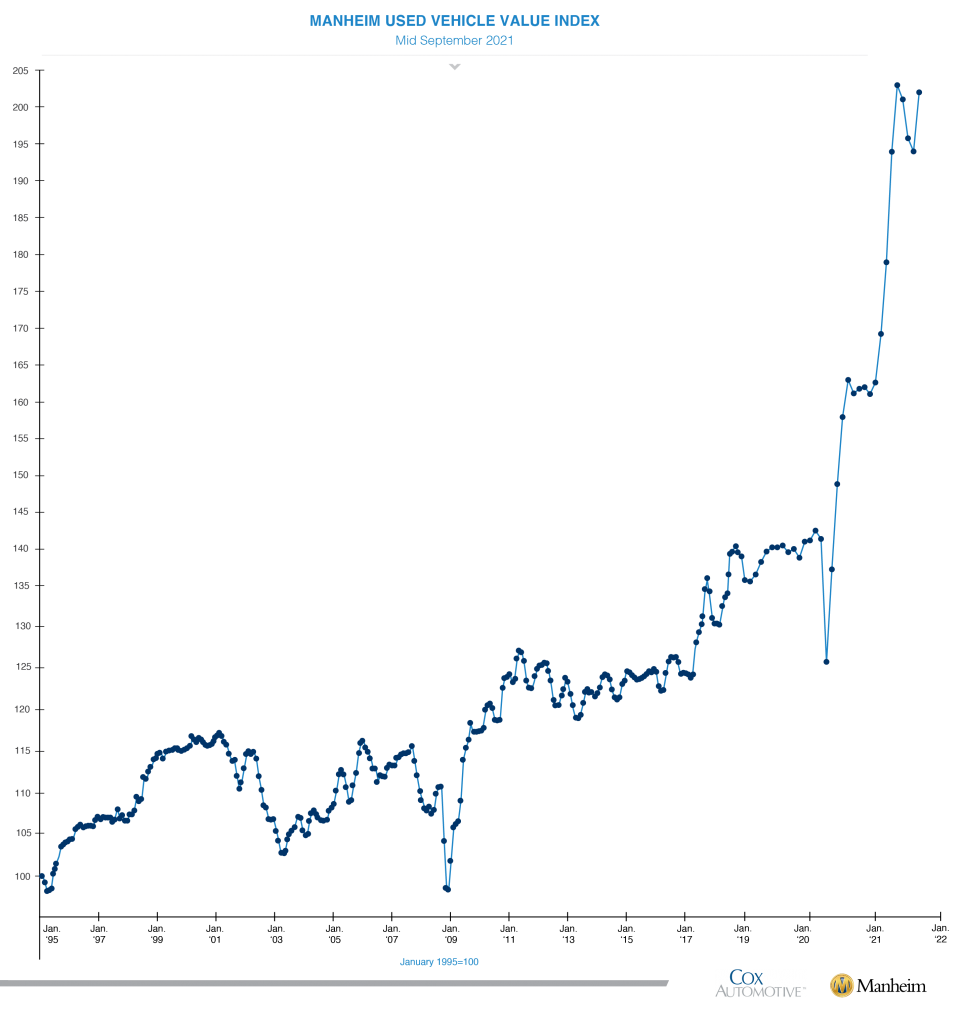

As has been reported here and elsewhere, used car prices witnessed an unprecedented surge last year and this Spring, with the benchmark Manheim Used Vehicle Index hitting nose-bleed highs this May.

The ‘transitory’ inflation camp held that such price increases would prove at least partially temporary, and indeed, used car prices started to back off slightly from their high in the months after this past May. Well, the most recent data from September shows that the ‘transitory’ spike in used car prices is still alive and well, with the index right back near its May high.

There is a good chance that year-over-year headline inflation measures like CPI and PCE are peaking, but if you haven’t noticed, the people who were inexplicably arguing just a handful of months ago that we were going to get back to the Fed’s old 2% target as soon as this winter, people like Janet Yellen, Jerome Powell, and nearly the entire FOMC, are changing their tune fast. Transitory inflation peaking and inflation getting all the way back down to 2% are two very different things.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.