Taps Coogan – November 15th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

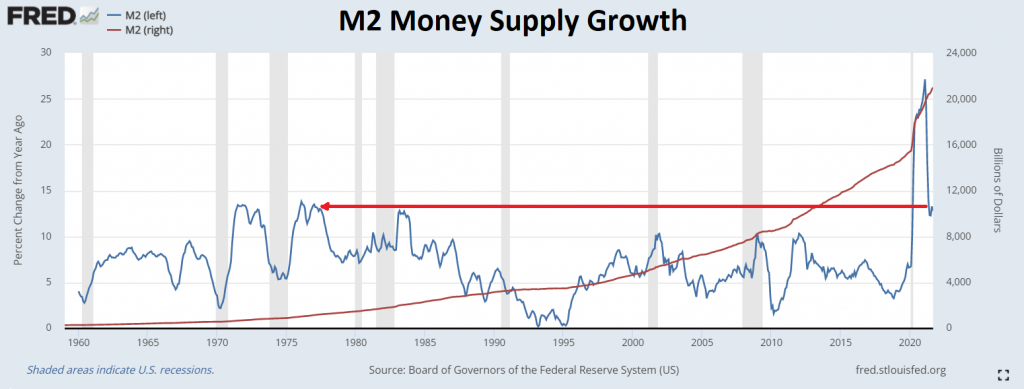

Back in the early days of the Covid pandemic we wrote regularly about the explosion in the US money supply that resulted from the period’s record monetary stimulus and fiscal stimulus, warning that it would lead to more inflation than expected at the time.

Fast forward to today and the broad US money supply is still growing at nearly 13% year-over-year as of September. That means that this September M2 grew nearly 13% compared to last September, after the money supply had already surged by over $3 trillion since the start of the pandemic and the first round of stimulus checks had been spent. In other words, the US money supply is still growing at the fastest pre-Covid rate since 1977.

While monetary policy is actually getting easier relative to inflation despite the Fed’s taper talk, someday increasingly soon, the Fed is going to get serious about fighting inflation, an inevitability that should worry investors much more than it apparently does.

Until then, all signs point to ‘transitory’ inflation persisting for longer.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.