Taps Coogan – December 15th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

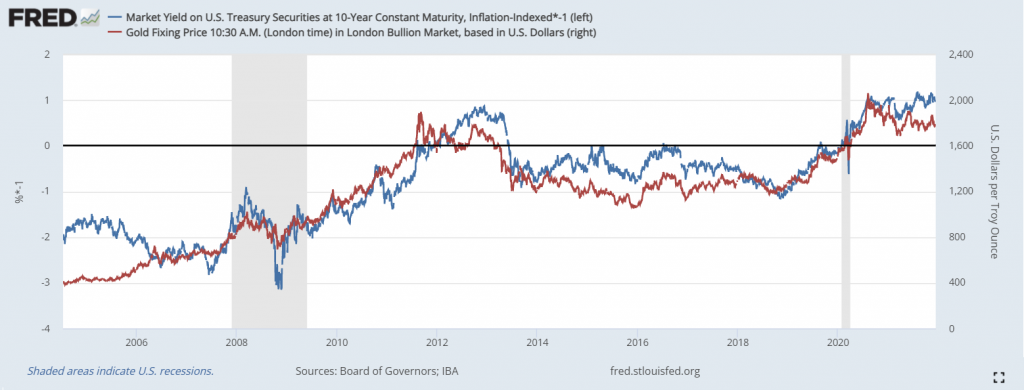

As the chart below highlights, gold and the 10-Tear TIPS (inverted) have been well correlated since 2006.

When the Fed began to talk about tapering QE4 back in 2013, it marked the end of that era’s bull market for gold and most commodities. That caught many commodity investors off-guard as monetary policy remained accommodative and inflation continued to grind away at purchasing power for years, albeit at a slightly slower pace.

Nonetheless, commodities and gold entered into a multi-year bear market around 2013 that only bottomed out a few years ago. When inflation adjusted ‘risk free’ long term yields are rising, gold has not done all that well, even when those yields were low on a nominal basis.

It’s hard to miss the parallels to today. After a recession and a massive push of monetary and fiscal stimulus that sent ‘real’ yields plunging to record lows and gold prices to new record highs, the Fed is now talking about tapering and eventual rate hikes. Gold has softened and many commodities, while still up relative to pre-Covid, have rolled over.

So are we in for a ‘redux’ of the 2013-2018 gold/commodity bear market or is this time different? The problem with the 2013-2018 comparison is that there was large production overcapacity for most commodities after the Global Financial Crisis, a ‘problem’ that does not exist today (unless China implodes).

Many gold and commodity bulls prefer to draw comparisons to the 1970s but remember this, part of what enabled the economy to continue to produce inflation despite radically higher nominal interest rates and repeated recessions in the 1970s and early 1980s was the fact that it was the low point in Post-War debt-to-GDP, the high point in working age population growth and family formation, and the high water mark in manufacturing employment. On all of those points, today represents the polar opposite.

My guess is that we’re in for neither the 2013-2018 redux nor the 1970s but something entirely different, perhaps more like the late 1930s. By that I mean severe bouts of inflation and deflation, driven by the build up to a major global conflict, large fiscal stimulus, rapidly increasing debt, economic disillusionment, industrialization (Yes, I think America is starting to turn the corner on de-industrialization), etc… For what it’s worth, FDR devalued the dollar in 1934, in effect increasing gold prices. Of course, he also confiscated gold, so it wasn’t a particularly good trade…

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

sell gold now, buy the dip?

Sell gold? I guess,…. if you believe the FED will successfully address currency debasement (or even really wants to).