Taps Coogan – January 6th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

We’ve seen this movie before. The Fed does too much stimulus for too long, waiting for such overwhelming evidence of economic strength before tightening that the strength has already peaked by the time they pull the trigger.

Each time the routine is more exaggerated: the stimulus is bigger, the Fed’s insistence on waiting to tighten is more intransigent, the evidence that they should have tightened earlier is stronger, and when they finally do tighten, the stock market reaction is worse.

The eponymous taper tantrum of 2013, mostly a treasury market phenomenon, barely hit stocks at all. The S&P 500’s largest drawdown in 2013 was about 7%, less than the long term yearly average. The second taper tantrum, which stuck in 2018 and barely hit the Treasury market, led to an intense ~20% decline in the S&P 500 that started the month that the global central bank balance sheet expansion peaked and bottomed literally days after the Fed officials started to walk back their plans for rate hikes in 2019.

This go-around is the most absurdist of all. The Fed was doing the most QE in its history and keeping rates at the lowest real level on record while inflation was surging to its highest level in a generation and labor shortages were everywhere.

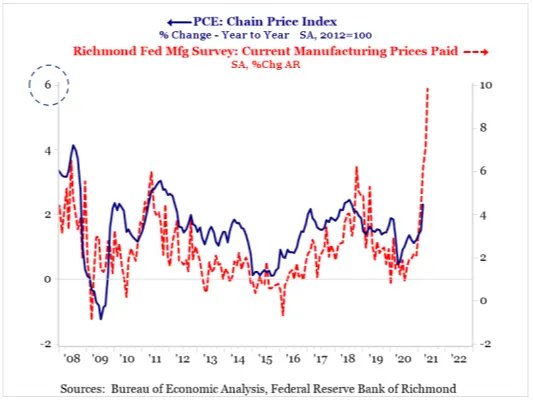

As I keep asking, which part of the endless parade of charts like the following one from the Richmond Fed last April, did the FOMC not understand as they kept QE on full blast all summer?

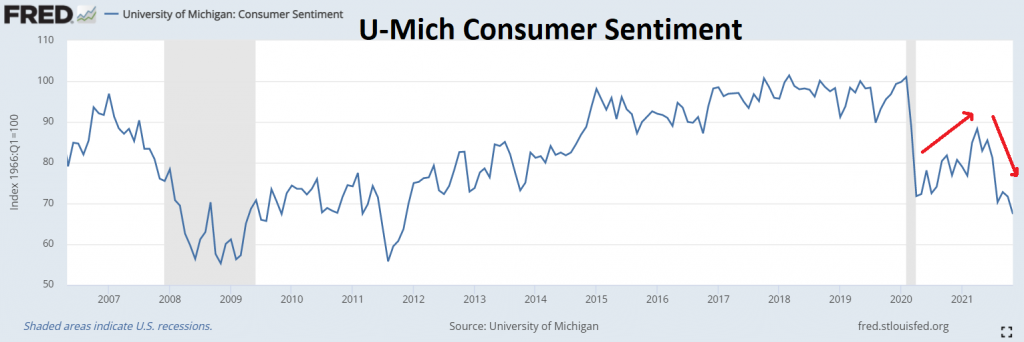

Yesterday’s FOMC meeting minute release shows that the Fed is contemplating interest rate hikes as early as March and balance sheet runoff starting this year. Now that the economy is beginning to shows some signs of weakness, the Fed is ready to slam on the brakes.

For anyone that’s been paying attention, the most liquidity sensitive parts of the market, ultra-high growth IPO names, cryptocurrencies, and momentum funds like ARKK have been correcting ever since the Fed started tapering. Many names are down 70%+.

Strap yourself in because that selling may eventually seep into the broader market as the Fed gets into the business of actual tightening later this year.

But make no mistake, this is a Fed with a savoir complex, no backbone, and most of all, total ideological homogeneity. So where is the Fed Put in a world of high inflation. 10% down from here? 15%? We may find out once the balance sheet starts shrinking.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.