Taps Coogan – January 21st, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

Back in October, we noted that the market was assigning a very high probability to three rate hikes from the Fed this year, something we described as a “pipedream.” Why? Because while the Fed was inexplicably oblivious to inflation, we still live in a highly interest rate sensitive economy.

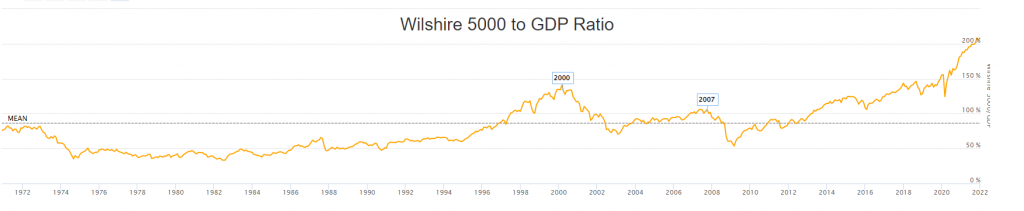

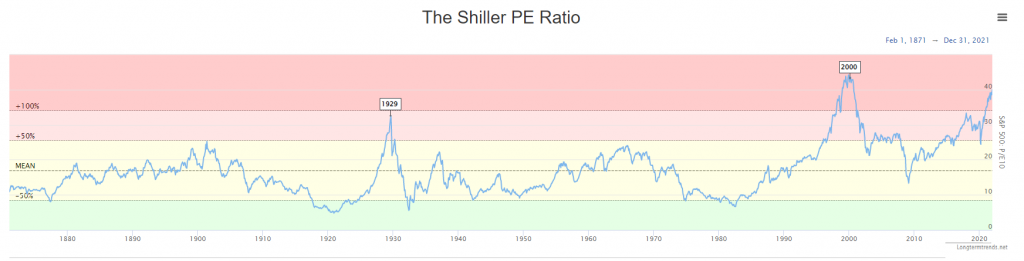

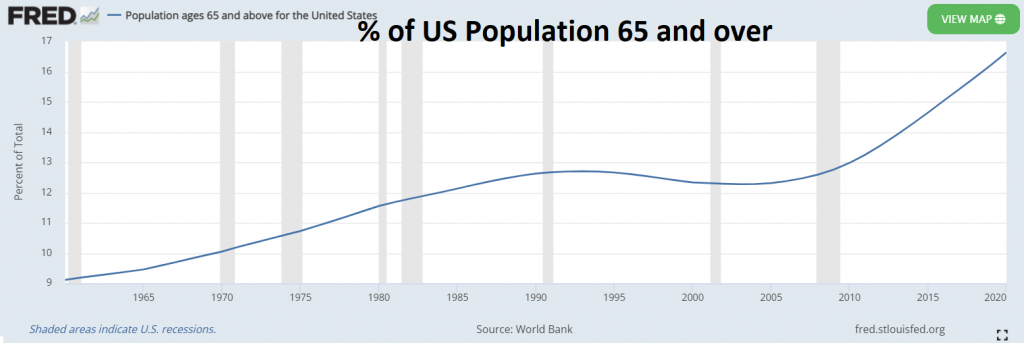

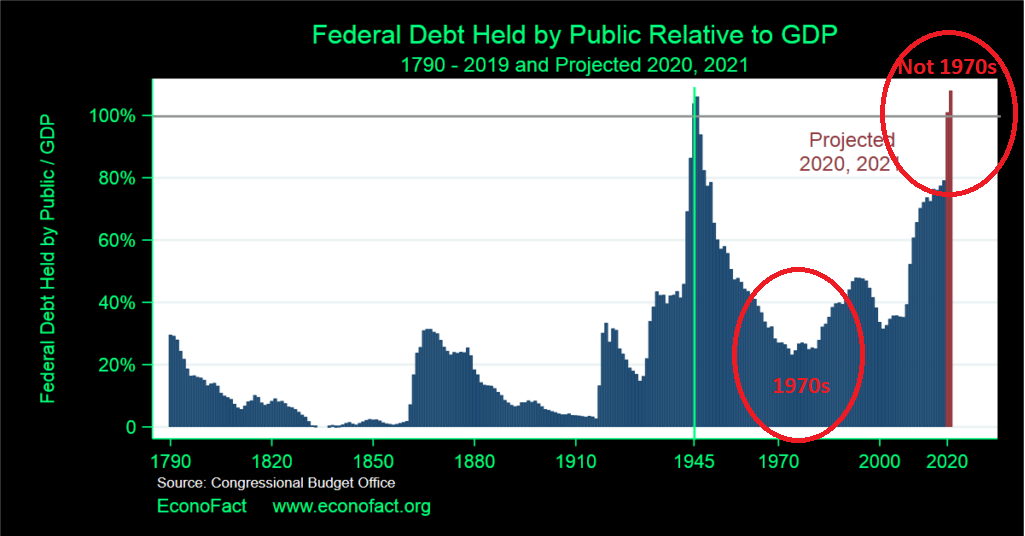

An interest rate sensitive economy is one with high debt levels and large ongoing borrowing requirements. It’s one where financial assets have come to dominate the economy, where valuation multiples are high, and where indexes are dominated by growth companies – the most interest rate sensitive companies. It’s one where transfer payments and financial asset returns represent the majority of disposable income and where retirees, for whom investment income is even more important, make up an increasingly large portion of the demography.

In other words, this is not the 1970s when the US debt to GDP was dropping to its post-war lows, the working age population was surging as Baby Boomers entered the workforce, and financial assets were dirt cheap.

However much we have criticized the Fed for its terrible inflation call this year, that mistake would be surpassed by orders of magnitude if they now think they can slam the brakes on the bubble they just created.

Such a mistake would draw an obvious parallel to their decision to begin a punitive rate hiking campaign in 1929, somehow oblivious to the fragility of the historic financial bubble that they had just incubated and yet intent on snuffing it out.

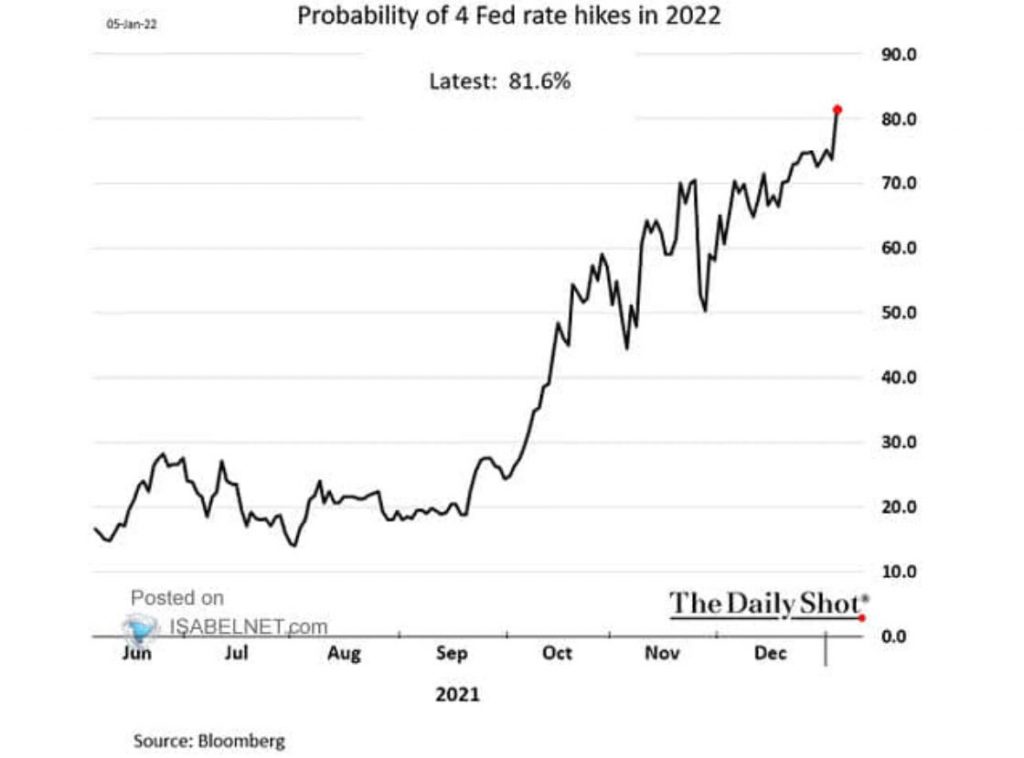

In that light, the following chart via ISABELNET, shows that the market is now pricing in four rate hikes in 2022. On top of that, the Fed FOMC meeting minutes now suggest that balance sheet reductions may start in 2022.

As far as yours truly is concerned, three rate hikes this year are still not going to happen, let alone four or five. However, by attempting, the Fed is about to parlay the mistake of ignoring inflation all year into a much worse mistake.

You can see it from a mile away.

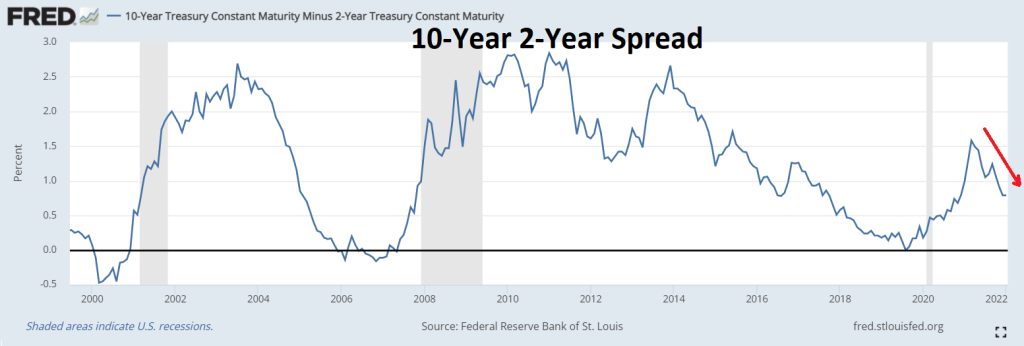

The yield curve is flattening.

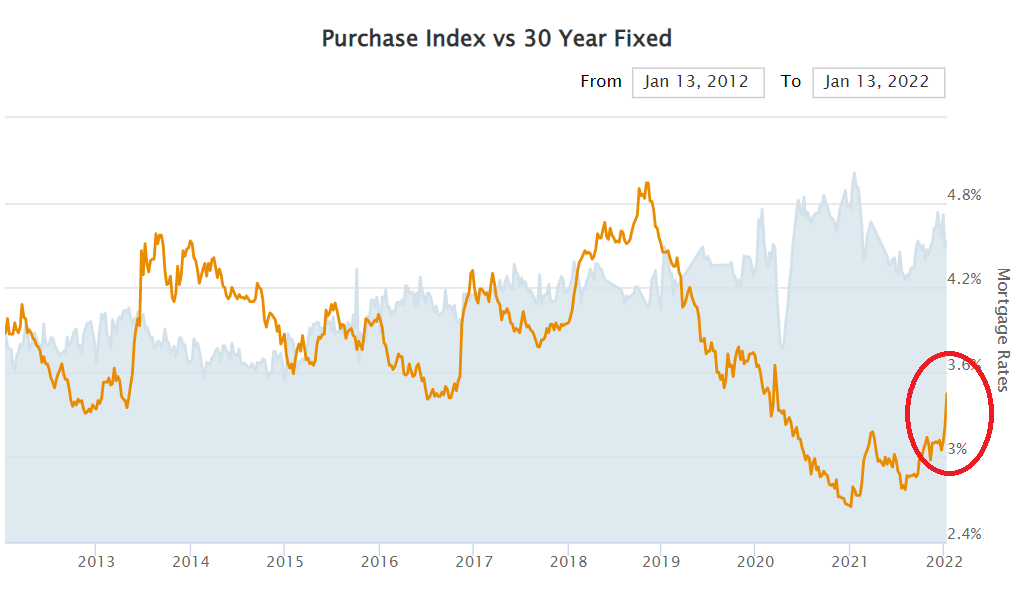

Mortgage rates are jumping.

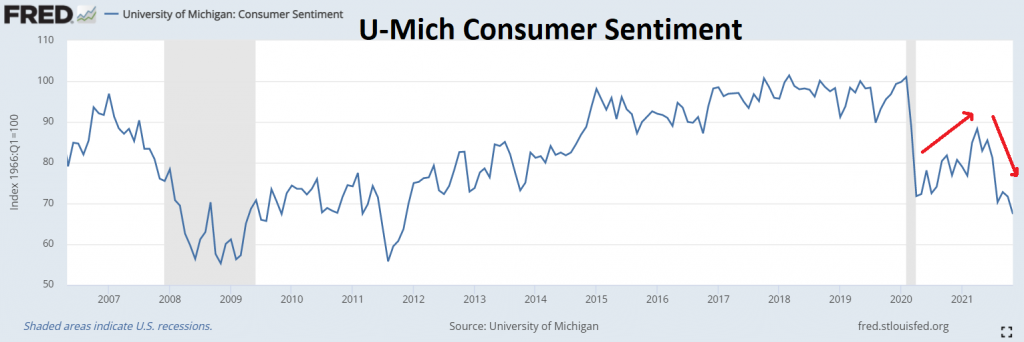

Consumer confidence is double-dipping.

While the broader market indexes are still mostly holding up, the bleeding edge ultra growth stocks are down by Dot-Com-Bubble-Burst percentages. The ‘benchmark’ Ark Fund (ARKK) is down about 52%, with many of its constituent holdings down much more than that. That’s serious.

Simply put, the implosion of growth and momentum stocks can be thought of as exaggerated foreshadowing for the broader market if the Fed persists in meaningfully tightening policy.

Now, everybody knows that the Fed will cave once the selling reaches the broader indexes and their pain threshold is met. That threshold is not down 90% like in 1929-1932. Maybe it’s down 15%. Who knows? This isn’t 1929 any more than it’s 1975.

Nonetheless, this is a terrible setup for investors. However much the downside is capped by a savoir-complex Fed – assuming they can pivot forcefully enough, the upside is capped by inflation, at least for now.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

No policy mistakes. All deliberate. A 109-year track record perfectly demonstrates intent. The fed now operates grotesquely far outside of its charter via special purpose vehicles and via affiliates owned by its shareholders. In 15 minutes the Fed can hyper-inflate or it can hyper-deflate. Citizens march a timeline at gunpoint, bouncing around within the channel of economic extortion defined by those two extremes, toward a single, guaranteed outcome, in which the Fed and its affiliates gut the productive capacity and buy ALL HARD ASSETS, exactly as the WEF marketing campaign has bragged. They buy it using the currency units for… Read more »

The last sentence is not personal opinion or judgement. It is the fact of natural consequence — cause and effect, which most now believe does not exist. Most believe that everything is just opinion, whim, or whatever they decide it is. Subjective madness of slaves marching the fed’s timeline to the guaranteed outcome.

Excellent observation.

Yep. And the effects of those causes will be immense & earth shattering.

Brace for impact.