Submitted by Taps Coogan on the 7th of June 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

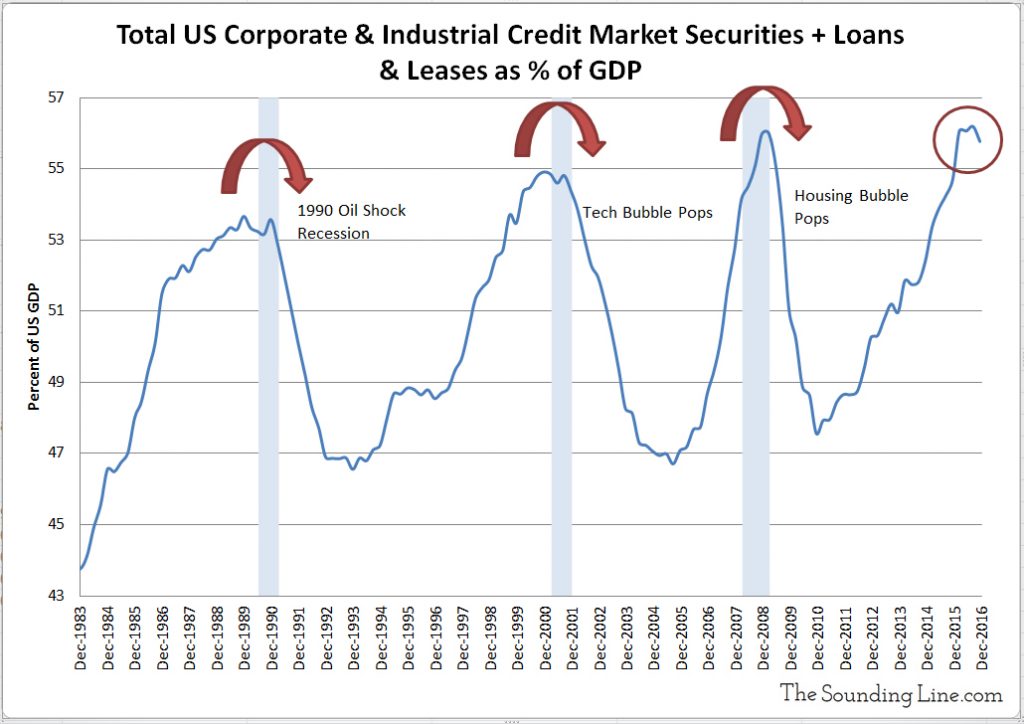

US corporate and industrial borrowing is a critical measure of where the US economy stands relative to cycles of economic growth and contraction. Since at least the early 1980s, total corporate and industrial borrowing has oscillated between about 45% and 56% of the US economy (as measured by GDP). Generally speaking, cycles in corporate borrowing follow a familiar pattern. Corporate borrowing accelerates during periods of economic expansion as companies need money to fund projects and investment. Eventually economic growth stalls, interest rates rise, and corporations begin to slow their borrowing. In this way, corporate borrowing typically peaks just before or during a recession. Companies then attempt to reduce their debt burdens as economic conditions worsen, cash flow problems become acute, and the need for further investment is replaced by the need for cost cutting.

As a continuation of a series of articles here at The Sounding Line which discuss developments in US corporate and industrial borrowing (here and here), we present the following chart which shows the sum of all corporate credit market securities (corporate bonds) plus corporate and industrial bank lending, compared to GDP.

As the chart clearly shows, after several years of rapid expansion in corporate debt, reaching levels higher than during the dot-com and housing bubbles, borrowing is now showing its first signs of peaking. The decline in corporate borrowing in the last quarter on 2016 is the largest to occur outside a recession (or just following a recession) since the 1980s. This is a strong signal that the underlying US economy is at risk of recession.

However, unlike during housing and the dot-com bubbles, interest rates remain exceptionally low and central banks around the world (including the Fed) continue to purchase financial assets at a rate of over $1 trillion a year. So while the underlying US economy looks vulnerable to contraction, it remains unclear if financial assets themselves are equally threatened.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.